Table of Contents

Quick Summary for Affordable Housing Buyers (2026)

Key Takeaways:

- Still highly relevant in 2026: Affordable housing schemes remain crucial, especially for EWS/LIG households, despite execution and market challenges.

- PMAY-U 2.0 (launched Sept 2024):

- Offers ₹1.80 lakh interest subsidy

- 4% subsidy on first ₹8 lakh loan

- 12-year tenure

- Eligible for families earning up to ₹9 lakh annually

- Offers ₹1.80 lakh interest subsidy

- Indiramma Housing Scheme (Telangana):

- Provides ₹5 lakh grant per family

- Targets 4.5 lakh homeless families

- Backed by a ₹22,000 crore allocation

- Provides ₹5 lakh grant per family

- Middle-class housing plan delayed:

- Promised affordable housing initiative for middle-income groups is indefinitely postponed

- Promised affordable housing initiative for middle-income groups is indefinitely postponed

- Shift to peripheral locations:

- Rising land prices in Hyderabad are pushing affordable projects to Patancheru, Shamshabad, and Kompally

- These areas are 30–40 km from the city center

- Rising land prices in Hyderabad are pushing affordable projects to Patancheru, Shamshabad, and Kompally

- Key market challenges:

- Developers favor luxury and premium projects over affordable housing

- Limited supply below ₹50 lakh in core urban areas

- Higher regulatory and compliance costs are inflating affordable housing prices

- Developers favor luxury and premium projects over affordable housing

- Strong impact for EWS/LIG groups:

- Families earning ₹3–6 lakh annually benefit the most

- Schemes offer 25–30% effective cost reduction via subsidies and lower interest rates

- Families earning ₹3–6 lakh annually benefit the most

What Defines Affordable Housing in Telangana (2026)?

Affordable housing refers to residential properties priced within reach of low-to-middle-income households, typically costing no more than 30% of gross household income monthly. In Telangana’s regulatory framework, affordable housing specifically targets Economically Weaker Sections (EWS), Low Income Groups (LIG), and Middle Income Groups (MIG) with defined income ceilings and property specifications.

Income Categories and Definitions

| Category | Annual Household Income | Carpet Area Limit | Typical Property Price (Telangana) |

| EWS (Economically Weaker Section) | Up to ₹3 lakh | Up to 60 sqm (645 sq ft) | ₹15-30 lakh |

| LIG (Low Income Group) | ₹3-6 lakh | Up to 60 sqm (645 sq ft) | ₹25-45 lakh |

| MIG-I (Middle Income Group I) | ₹6-12 lakh | Up to 160 sqm (1,722 sq ft) | ₹40-70 lakh |

| MIG-II (Middle Income Group II) | ₹12-18 lakh | Up to 200 sqm (2,153 sq ft) | ₹60-95 lakh |

Carpet Area Clarification: Carpet area measures the usable interior space excluding walls, balconies, and common areas. A 60 sqm (645 sq ft) carpet area EWS/LIG unit typically translates to 750-850 sq ft built-up area including walls and proportionate common area share.

Major Affordable Housing Schemes in Telangana (2026)

1. Pradhan Mantri Awas Yojana-Urban 2.0 (PMAY-U 2.0)

Launch Date: September 1, 2024 (replacing earlier PMAY framework)

Objective: Assist one crore urban families over five years through financial aid across four verticals: Beneficiary-Led Construction (BLC), Affordable Housing in Partnership (AHP), In-Situ Slum Redevelopment (ISSR), and Interest Subsidy Scheme (ISS).

Interest Subsidy Scheme (ISS) – The Primary Benefit:

Eligibility:

- EWS/LIG: Annual income up to ₹3 lakh (EWS) or ₹3-6 lakh (LIG)

- MIG: Annual income ₹6-9 lakh (note: narrower than previous MIG-I/MIG-II brackets)

- Loan value up to ₹25 lakh for property value up to ₹35 lakh

- Carpet area up to 120 sqm (1,292 sq ft)

Subsidy Structure (2026):

- Interest Rate: 4% subsidy on first ₹8 lakh of loan amount

- Maximum Subsidy: ₹1.80 lakh total (₹1.50 lakh NPV at 8.5% discount rate)

- Tenure: Up to 12 years for subsidy calculation

- Disbursement: Five yearly installments through Direct Benefit Transfer (DBT) to loan account, provided loan remains active and 50%+ principal outstanding

Calculation Example:

- Property Price: ₹30 lakh

- Loan Amount: ₹24 lakh (80% LTV)

- Subsidy applies to: First ₹8 lakh

- Interest subsidy: 4% per annum for 12 years

- Total subsidy: ₹1.80 lakh (credited over 5 years)

- Effective Loan Amount: ₹22.20 lakh (₹24 lakh – ₹1.80 lakh)

- Monthly EMI Reduction: Approximately ₹2,500-3,000 over 20-year tenure

Application Process:

- Register on unified PMAY portal (pmaymis.gov.in)

- Submit self-certificate/affidavit proving income eligibility

- Application forwarded to Primary Lending Institution (PLI) – bank/housing finance company

- PLI assesses eligibility, sanctions loan

- Subsidy credited upfront to principal loan amount, reducing EMI burden

- Geo-tagging of property mandatory before installment releases

Extension Timeline: PMAY-U extended until December 31, 2025, providing continued access for eligible beneficiaries in Telangana’s 38 municipalities plus Greater Hyderabad Municipal Corporation (GHMC).

2. Indiramma Housing Scheme (Telangana State Initiative)

Launch Date: March 2024

Objective: Provide permanent housing to 4.5 lakh homeless and inadequate housing families across Telangana through direct financial assistance.

Financial Assistance:

- Grant Amount: ₹5 lakh per family (non-repayable)

- State Budget Allocation: ₹22,000 crore total

- Target Beneficiaries: 4.5 lakh families statewide

Eligibility Criteria:

- Resident of Telangana state

- Belong to EWS/LIG categories

- Currently homeless or living in kutcha/semi-pucca structures

- No ownership of pucca house anywhere in India

- Priority given to Dalits, Scheduled Tribes, minorities, and Telangana movement participants

- Special provisions for widows, differently-abled persons, and single women

Implementation Status (2026):

- Beneficiary surveys completed across districts

- Initial beneficiary lists released for public verification

- First-phase construction commenced in select districts

- Land allocation and infrastructure planning ongoing for urban components

Application Process:

- Online application via official Indiramma Housing portal

- Submit proof of residence, income certificate, caste certificate (if applicable), proof of landlessness

- District-level committees verify eligibility

- Allotment based on priority scoring (most vulnerable first)

Key Features:

- Construction Quality: RCC framed structures with basic amenities (water supply, electricity, sanitation)

- Land Provision: State government providing land in designated areas for urban homeless

- Community Development: Integrated approach including livelihood linkages, skill training, and social infrastructure

Challenges:

- Land acquisition delays in urban areas where land costs prohibit large-scale development

- Construction timelines extending 18-24 months from beneficiary identification to possession

- Coordination between housing, urban development, and revenue departments

3. Double Bedroom Housing Scheme (2BHK Scheme) – Ongoing Initiative

Background: Launched by previous Telangana government, this scheme constructed 2BHK units for urban poor, particularly slum dwellers. While new allocations have slowed under current government priorities (shift to Indiramma), existing projects continue completion and allotment.

Current Status (2026):

- Approximately 1.2 lakh units completed across Telangana

- Pending units under construction (30,000-40,000 units)

- Possession and allotment ongoing in districts

- No new project launches announced; scheme effectively merged into broader affordable housing approach

Target Beneficiaries:

- Urban slum dwellers

- Families displaced by development projects

- Government employees in lower pay scales

Allotment Process:

- Based on beneficiary surveys conducted 2017-2020

- Priority to residents of identified slums

- Minimal contribution (₹20,000-30,000) from beneficiaries for maintenance corpus

- Freehold ownership transferred after 5-10 years occupancy (varies by project)

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Are These Schemes Still Relevant in 2026? Critical Assessment

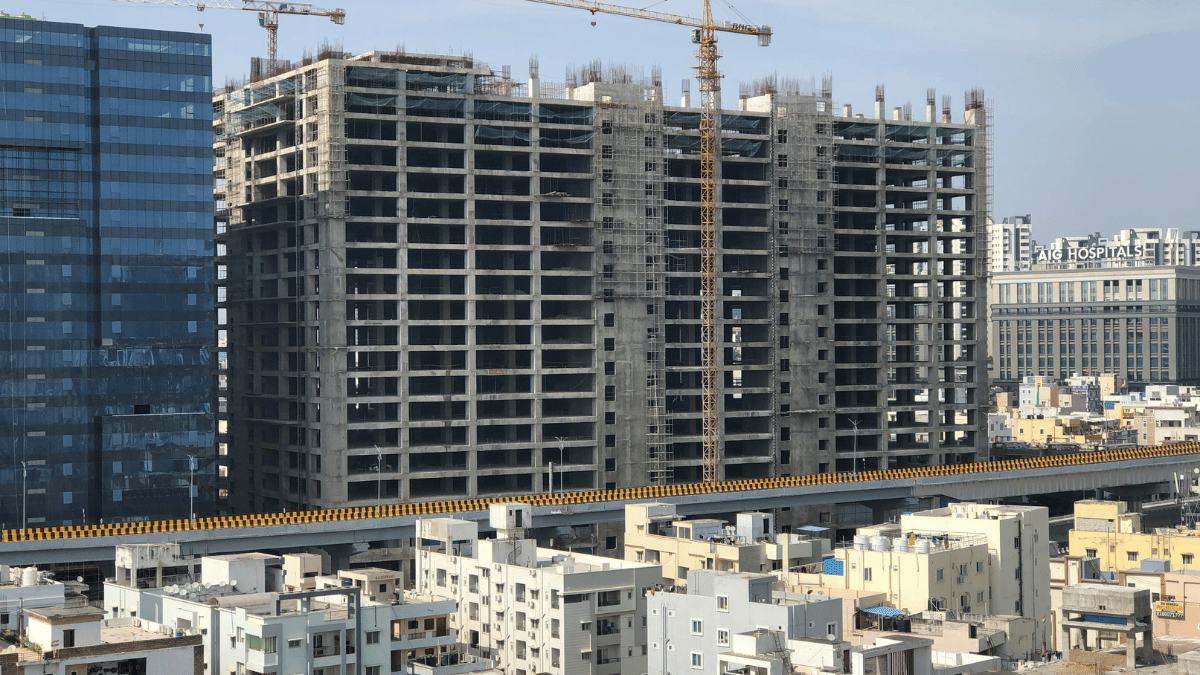

Factor 1: Rising Land and Construction Costs

Challenge: Hyderabad’s land prices have surged 60-80% between 2020-2026 in emerging corridors, making affordable housing projects financially unviable in desirable locations within 20 kilometers of city center.

Impact on Affordability:

- Prime Corridors (Gachibowli, Kondapur, Financial District): Land costs ₹15-25 crore per acre render affordable housing (₹40-60 lakh unit pricing) impossible, developers require ₹1+ crore per unit to break even

- Mid-Range Corridors (Narsingi, Tellapur, Kokapet): Land costs ₹8-12 crore per acre push affordable units to ₹55-75 lakh range, exceeding MIG-II threshold

- Peripheral Corridors (Patancheru, Shamshabad, Kompally): Land costs ₹3-6 crore per acre enable ₹40-65 lakh affordable units, but 30-40 kilometer distances deter buyers

Developer Response: Shift toward luxury and premium segments (₹1-3 crore properties) where margins compensate for high land costs. Affordable housing share of new launches declined from 35-40% (2018-2020) to 15-20% (2023-2026) in GHMC limits.

Government Intervention: PMAY-U 2.0’s increased subsidy (₹1.80 lakh vs. previous ₹2.67 lakh maximum under old CLSS) partially offsets cost inflation but doesn’t fully bridge affordability gap for families earning ₹3-6 lakh annually facing ₹60-80 lakh property prices.

Factor 2: Middle-Class Affordable Housing Plan Delayed

Background: Telangana government announced plans for dedicated middle-class housing scheme targeting families earning ₹8-15 lakh annually who fall between EWS/LIG subsidies and luxury market pricing.

2026 Status: Delayed indefinitely due to budgetary constraints, land acquisition challenges, and prioritization of Indiramma Housing (targeting homeless population first).

Impact: Middle-income families (₹10-15 lakh annual income) seeking ₹60-90 lakh properties receive limited government support beyond PMAY-U interest subsidies. This segment increasingly relies on private developers and market-rate financing, reducing relevance of government schemes for aspir ational middle class.

Workaround: Some middle-income buyers leverage PMAY-U subsidies for properties up to ₹35 lakh value in peripheral locations, then upgrade after 5-7 years. However, this two-step approach involves transaction costs and risks appreciation volatility.

Factor 3: Regulatory Compliance Increasing Costs

RERA Implementation: Telangana’s Real Estate Regulatory Authority (RERA) mandates 70% buyer fund protection through escrow accounts, detailed project disclosures, and completion timeline penalties. While protecting buyers, these regulations increase developer compliance costs by 3-5%, passed to end buyers.

Environmental Clearances: Stricter environmental impact assessments for projects 50+ units add 6-12 months approval timelines and ₹5-10 lakh per acre compliance costs.

Building Code Upgrades: Updated fire safety, earthquake resistance, and green building norms increase construction costs ₹50-150 per sq ft, translating to ₹5-15 lakh per affordable housing unit.

Net Effect: Affordable housing projects targeting ₹40-50 lakh pricing in 2020 now require ₹55-70 lakh to deliver equivalent quality under current regulatory framework, inflating costs 25-40% and reducing developer enthusiasm.

Factor 4: Subsidy Awareness and Uptake Gaps

Survey Data Insight: Only 35-40% of eligible EWS/LIG families in Telangana are aware of PMAY-U subsidies and application processes, per urban development ministry estimates.

Barriers to Access:

- Digital Divide: Online-only application portals exclude families lacking internet access or digital literacy

- Documentation Challenges: Income certificates, land ownership proofs, and Aadhaar linkage requirements deter applicants from informal employment sectors

- Banking Relationship Gaps: Many eligible families lack relationships with Primary Lending Institutions, hindering loan approvals even with subsidies

- Language Barriers: Application portals primarily in English/Hindi with limited Telugu support

Government Response: Awareness campaigns through self-help groups, anganwadi workers, and gram panchayats. However, execution remains inconsistent across districts.

Recommendation: Community facilitators and housing counselors needed at municipal level to guide eligible families through application maze, model successfully deployed in Gujarat and Maharashtra.

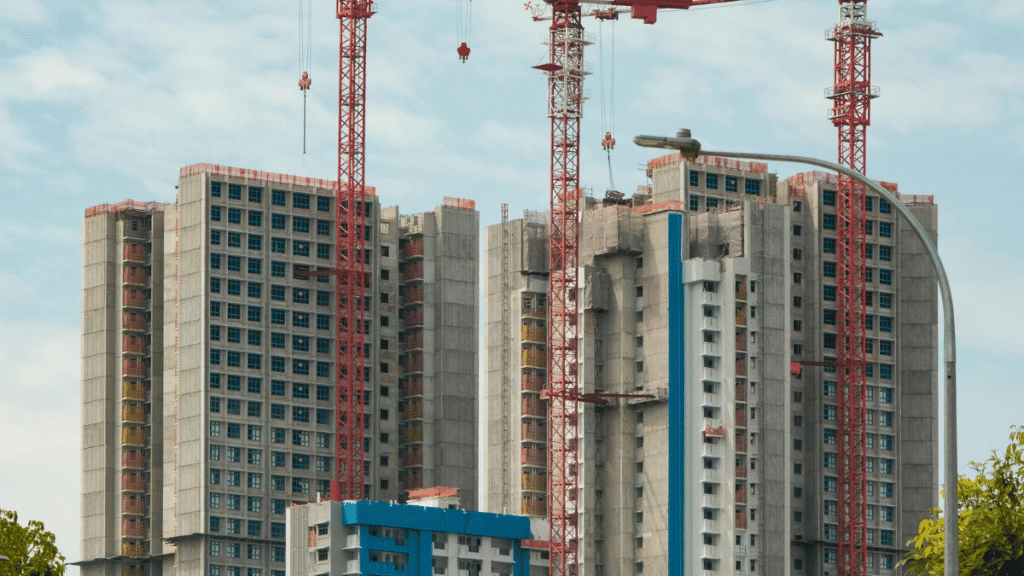

Factor 5: Peripheral Location Compromise

Reality Check: Affordable housing projects cluster in Patancheru (northwest, 35 km from city center), Shamshabad (south, 30 km), Kompally (north, 25 km), and Medchal (northeast, 28 km), locations where land costs enable EWS/LIG pricing.

Buyer Trade-offs:

- Commute Burden: 90-120 minute one-way commutes to Gachibowli/HITEC City employment hubs versus 30-45 minutes from premium locations

- Social Infrastructure Gaps: Limited quality schools (forcing children’s education compromises), hospitals (requiring travel for specialized care), and retail (inadequate shopping options)

- Resale Liquidity: Affordable housing in peripheries takes 6-12 months to resell versus 2-4 months for properties in established corridors

- Appreciation Lag: Peripheral affordable housing appreciates 6-9% annually versus 12-16% in mid-premium corridors, reducing wealth-building potential

Mitigating Factors:

- Metro Phase 2 extensions (operational 2027-2028) will connect Patancheru, Kompally to core employment zones, reducing commute times to 50-70 minutes

- Industrial development (Bharat Future City near Shamshabad, pharma clusters near Patancheru) creating local employment reducing commute necessity for some families

- Affordable housing in these corridors becoming starter homes for young professionals who upgrade to better locations after 7-10 years career progression

Who Benefits Most from Current Affordable Housing Schemes?

Ideal Beneficiary Profile 1: EWS/LIG First-Time Homebuyers

Demographics:

- Annual household income: ₹3-6 lakh

- Currently renting or living in inadequate housing

- Employment in informal sectors, lower government grades, or entry-level private jobs

- Family size: 3-5 members

Scheme Advantage:

- PMAY-U Interest Subsidy: ₹1.80 lakh subsidy reduces ₹25 lakh loan to effective ₹23.20 lakh, saving ₹2,500-3,000 monthly EMI

- Indiramma Housing Grant: ₹5 lakh direct assistance covers 25-35% of total ₹15-20 lakh construction cost, making homeownership feasible on modest incomes

- Combined Impact: For eligible families, government support covers 30-40% of total housing cost through subsidies and grants

Pathway: Apply for Indiramma Housing if homeless/landless, or leverage PMAY-U for purchasing small affordable unit in peripheral areas like Kompally or Patancheru.

Ideal Beneficiary Profile 2: Lower Middle-Income Upgraders

Demographics:

- Annual household income: ₹6-9 lakh

- Currently living in parents’ home or small rented accommodation

- Stable employment (government employees, established private sector roles)

- Planning family expansion requiring own space

Scheme Advantage:

- PMAY-U MIG Subsidy: Even with ₹6-9 lakh income, interest subsidy applies to properties up to ₹35 lakh value

- Loan Eligibility: ₹6-9 lakh income supports ₹45-65 lakh home loans; with ₹10-15 lakh down payment, can purchase ₹55-80 lakh properties

- Strategic Location Choice: Target emerging corridors (Tellapur, Narsingi) where quality 2-3BHK properties price at ₹60-85 lakh with decent social infrastructure and metro connectivity

Pathway: Purchase ready-to-move or under-construction 2-3BHK in emerging corridors, apply PMAY-U subsidy reducing EMI burden, and hold 7-10 years benefiting from appreciation (10-14% annually projected) while building equity.

Ideal Beneficiary Profile 3: Single Women and Senior Citizens

Demographics:

- Widows, divorcees, or single women lacking family housing support

- Senior citizens on fixed incomes (pensions, savings interest)

- Annual income: ₹2-5 lakh

Scheme Advantage:

- PMAY-U Priority: Women ownership encouraged (mandatory for some categories), improving approval rates

- Indiramma Housing: Special provisions for widows and single women ensure priority allocation

- Social Security: Government-constructed housing provides safe, secure accommodation eliminating landlord dependencies and rental insecurity

Pathway: Priority application under Indiramma Housing with documentation of single status and income constraints. Alternatively, if modest income exists, apply for PMAY-U subsidized small 1-2BHK units in cooperative housing societies.

Challenges and Limitations: When Schemes Fall Short

Challenge 1: Inventory Shortage in Desirable Locations

Reality: Affordable housing projects below ₹60 lakh are virtually absent within 15 kilometers of Gachibowli, Banjara Hills, or Jubilee Hills. Families wanting homeownership near employment hubs find no affordable inventory despite subsidy eligibility.

Root Cause: Land economics dictate developers prioritize ₹1-3 crore luxury segments where 25-30% margins are achievable versus 8-12% margins in affordable housing.

Workaround: Families compromise on location (peripheral areas) or configuration (1BHK instead of 2BHK) to stay within subsidy-eligible price ranges. Many eventually abandon government schemes, opting for market-rate properties in better locations through higher home loans.

Challenge 2: Construction Quality and Specification Compromises

Issue: Affordable housing projects, pressured by tight margins, sometimes compromise on finishing quality, amenity provision, and long-term durability to meet price targets.

Common Shortcuts:

- Basic ceramic tiles instead of vitrified tiles

- Standard aluminum windows instead of UPVC

- Minimal common amenities (small clubhouse, basic gym)

- Lower-quality fittings and fixtures requiring frequent replacement

- Thin walls and inadequate soundproofing

Buyer Dilemma: Accept lower quality in exchange for affordability, or stretch budget beyond subsidy-eligible thresholds for better specifications.

Recommendation: Inspect completed projects by same developer before booking affordable housing units. Prioritize developers with established track records over unknown players offering suspiciously low prices.

Challenge 3: Delayed Possession and Cost Overruns

Historical Data: Affordable housing projects average 12-18 month delays beyond promised possession timelines, per RERA authority data. Delays stem from undercapitalization (developers underestimating costs), regulatory approval lags, and funding shortfalls.

Financial Impact on Buyers:

- Extended rent payments during construction delays (₹10,000-15,000 monthly for 12-18 months = ₹1.2-2.7 lakh)

- Pre-EMI interest on sanctioned home loans during delay period

- Inflation eroding purchasing power between booking and possession

- Delayed subsidy disbursement (PMAY-U installments contingent on construction milestones)

Risk Mitigation: Choose projects with RERA registration, verify 30-40% construction completion before booking, and review developer’s delivery track record on previous affordable housing initiatives.

Challenge 4: Resale Market Liquidity Concerns

Market Reality: Affordable housing units in peripheral locations take 8-12 months to resell versus 2-4 months for properties in prime/mid-premium locations. Buyer pools for ₹40-60 lakh properties are narrower, predominantly first-time buyers with limited financing options.

Impact: Families facing job relocations, medical emergencies, or financial needs struggle to liquidate affordable housing investments quickly. This illiquidity risk deters some potential buyers from peripheral affordable projects.

Future Outlook: As metro connectivity improves (2027-2030), Patancheru, Kompally, and Shamshabad will gain liquidity through better accessibility. Early buyers accepting current illiquidity may benefit from enhanced resale markets within 3-5 years.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Verdict: Relevance Depends on Buyer Circumstances

Highly Relevant For:

1. EWS/LIG Families (₹3-6 Lakh Annual Income): Government schemes remain the only realistic pathway to homeownership. Without PMAY-U subsidies or Indiramma grants, purchasing even peripheral ₹40-50 lakh properties is financially impossible on ₹25,000-50,000 monthly household incomes.

Quantified Benefit: ₹1.80 lakh PMAY-U subsidy + ₹5 lakh Indiramma grant (if eligible) = ₹6.80 lakh total assistance, covering 35-45% of ₹15-20 lakh small unit cost. This makes 25-year homeownership journey manageable versus lifelong renting.

2. Single Women, Widows, Senior Citizens: Priority provisions and gender-sensitive implementation make government schemes particularly relevant for vulnerable demographics facing housing insecurity. Schemes offer safety nets that private market doesn’t provide.

3. First-Generation Urban Migrants: Rural families migrating to Hyderabad for employment lack generational wealth or property. Affordable housing schemes provide entry into urban property ownership, building intergenerational wealth foundations.

Moderately Relevant For:

Lower Middle-Income Families (₹6-10 Lakh Annual Income): PMAY-U subsidies provide meaningful EMI relief (₹2,500-3,000 monthly), but inventory shortage in desirable locations forces location compromises. Relevance depends on willingness to accept peripheral areas and commute burdens.

Strategic Approach: Use schemes for starter homes, build equity over 7-10 years, then upgrade to better locations using accumulated equity as down payment. This two-step approach requires patience but enables homeownership sooner than waiting to afford premium locations outright.

Limited Relevance For:

Middle-to-Upper Middle-Income Families (₹10-18 Lakh+ Annual Income): Affordability isn’t primary constraint, location, quality, and lifestyle preferences dominate decisions. These families can afford ₹80 lakh-1.5 crore properties in established corridors (Narsingi, Kondapur, Manikonda) without subsidies.

Subsidy Availability: PMAY-U 2.0 narrows MIG eligibility to ₹6-9 lakh income (down from previous ₹12-18 lakh), excluding most middle-class families from benefits. Delayed middle-class housing scheme means no targeted government support for this demographic.

Frequently Asked Questions (FAQs)

Can I apply for both schemes?

No. You can avail only one government housing scheme. PMAY-U (interest subsidy) and Indiramma Housing (₹5 lakh grant) are mutually exclusive and cross-verified.

Which should I choose?

- Homeless/landless: Choose Indiramma Housing (higher upfront benefit).

- Buying a home with loan: Choose PMAY-U (flexibility in property choice under ₹35 lakh).

When does PMAY-U subsidy reflect in loan?

- Credited in 5 yearly installments (₹36,000/year).

- First credit: 3–6 months after loan disbursement & geo-tagging.

- EMI reduces immediately, but government releases funds annually.

- Heavy prepayment (below 50% outstanding) can stop future installments.

What if property value crosses ₹35 lakh later?

You become fully ineligible for PMAY-U. No partial subsidy.

Any subsidy already taken must be refunded, with possible legal action.

Is the middle-class housing scheme coming?

Delayed indefinitely as of 2026. Possible revival only after 2026–27.

Better to explore PMAY-U-eligible or private affordable projects now.

Do affordable homes appreciate well?

They appreciate 30–40% slower than mid-premium homes.

Peripheral Hyderabad areas saw 6–9% annual growth vs 12–16% in prime zones.

Infrastructure improvements may narrow this gap post-2027.

Can NRIs use PMAY-U?

No. Only resident Indians are eligible.

A resident co-applicant (spouse/parent) can claim subsidy if they are the primary borrower.

What documents prove EWS/LIG income?

Self-declaration affidavit + income proof (salary slips, ITR, bank statements).

False declaration leads to refund + legal action.

Are affordable homes available inside GHMC?

Very limited. Core GHMC has almost no homes below ₹60 lakh.

Most affordable options are 20–40 km from city center (Patancheru, Shamshabad, Kompally, Medchal).

Conclusion: Schemes Remain Relevant with Realistic Expectations

Affordable housing schemes in Telangana in 2026 are unquestionably relevant for economically weaker and low-income families for whom government subsidies represent the difference between homeownership and lifelong renting. The ₹1.80 lakh PMAY-U interest subsidy and ₹5 lakh Indiramma Housing grant provide meaningful financial assistance, covering 25-40% of total housing costs for eligible families.

However, relevance diminishes as income rises. Middle-income families find limited inventory in desirable locations, and the delayed middle-class scheme leaves a policy gap. Market realities, rising land costs, developer preferences for luxury segments, and peripheral location compromises, constrain affordable housing supply exactly where demand concentrates.

For eligible buyers, the verdict is clear: Leverage schemes strategically. Accept peripheral locations as temporary compromises, knowing infrastructure improvements (metro, roads, employment zones) will enhance livability and property values over 5-10 years. Use affordable housing as wealth-building foundation, then upgrade when financial circumstances improve.

For policymakers, the challenge is equally clear: Address land cost barriers through innovative models (land pooling, transferable development rights, vacant land taxation), simplify application processes for digitally disadvantaged populations, and revive middle-class housing initiatives filling the policy void between subsidized EWS/LIG housing and unaffordable luxury market.

Affordable housing schemes aren’t failing, but they’re straining under market pressures and implementation challenges. Their continued relevance depends on adaptive policy responses ensuring government support reaches intended beneficiaries without bureaucratic barriers or inventory shortages nullifying benefits.