Table of Contents

Executive Summary for Homebuyers & Investors (2026)

Key Takeaways:

- Metro Phase II expansions are driving 15-25% property appreciation in suburban corridors over 3-5 years

- Properties within 1 km of metro stations command 20-30% price premiums

- Suburban rental yields (4-6%) now exceed central city returns (2.5-3.5%)

- ORR developments create dual connectivity advantages for private vehicle users

- Optimal investment window: between route announcement and construction completion

- Major cities investing ₹2.75+ lakh crore in metro infrastructure through 2030

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

What is Infrastructure-Led Real Estate Transformation?

Infrastructure-led real estate transformation occurs when major transportation projects specifically Metro Phase II expansions and Outer Ring Road (ORR) developments fundamentally reshape property values, investment patterns, and residential preferences in suburban markets. These projects convert previously distant suburbs into well-connected urban ecosystems with complete infrastructure support.

This transformation goes beyond simple transportation upgrades. It represents a reimagining of urban geography where suburbs transition from affordable alternatives into destination residential markets offering superior quality of life, competitive connectivity, and attractive investment returns.

How Metro Phase II & ORR Projects Are Reshaping Indian Cities?

Metropolitan cities across India are witnessing massive infrastructure overhauls. Metro expansions are extending into peripheral and suburban areas, bringing locations previously considered distant into the urban connectivity network. Simultaneously, ORR expansions are creating comprehensive transportation corridors that connect suburbs directly to employment hubs, airports, and commercial centers.

The convergence of metro rail and ring road networks represents more than transportation upgrades it signifies a fundamental reimagining of urban geography. Areas once characterized by poor accessibility and limited amenities are transforming into integrated urban ecosystems with complete infrastructure support.

The upcoming expansion of metro connectivity to suburban regions is significantly increasing real estate interest in these localities. This trend is particularly evident in cities like Hyderabad, Bangalore, Chennai, and Nagpur, where Phase II metro projects are specifically designed to reach previously underserved suburban zones.

Metro Phase II Investment Details: Major Indian Cities

| City | Phase II Length | Total Investment | Key Suburban Corridors Covered |

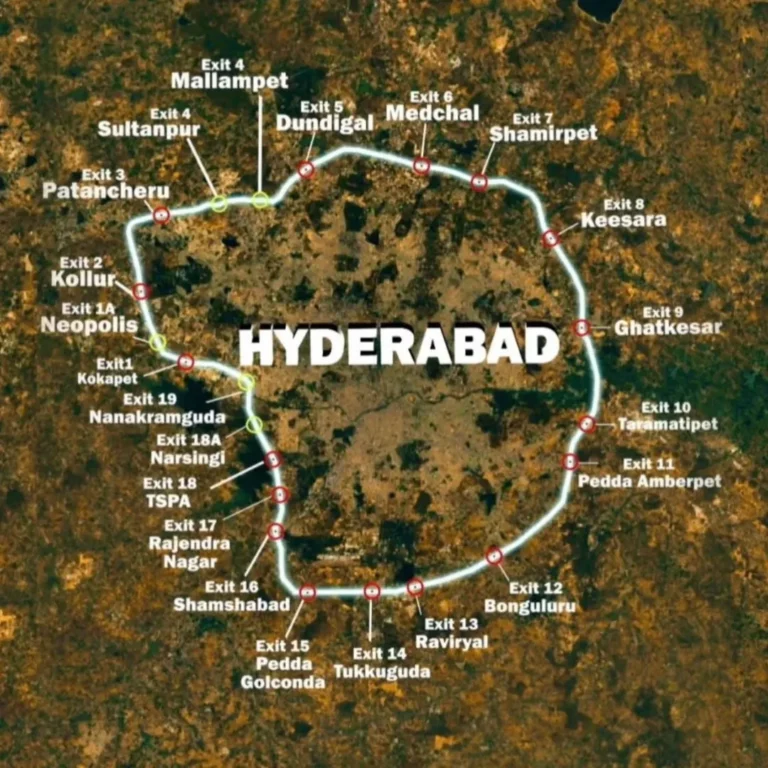

| Hyderabad | 116.2 km | ₹32,237 crore | Patancheru, Medchal, Shamirpet, Airport-ORR corridor |

| Bangalore | 74 km | ₹24,000 crore | Sarjapur, Hoskote, Attibele, Hosakerehalli-ORR |

| Chennai | 118.9 km | ₹61,843 crore | OMR, Poonamallee, Porur, Madhavaram, Airport connectivity |

| Nagpur | 43.8 km | ₹6,708 crore | Butibori MIDC, Hingna, Transport Nagar, Kanhan River |

| Mumbai | 337 km (ongoing) | ₹1,50,000 crore | Thane, Navi Mumbai, Dahisar, Kalyan corridors |

These investments represent unprecedented infrastructure spending designed to fundamentally reshape urban geography and economic activity distribution across metropolitan regions.

Central City vs. Suburban Corridors: Complete Comparison (2026)

| Parameter | Central City Areas | Suburban Corridors with Metro/ORR |

| Average Price per sq ft | ₹8,000-₹15,000 | ₹4,000-₹7,000 |

| Typical Property Size | 2 BHK (800-1,000 sq ft) | 3 BHK (1,200-1,500 sq ft) |

| Price Appreciation (3-5 years) | 8-12% | 15-25% |

| Rental Yield | 2.5-3.5% | 4-6% |

| Commute Time to Business Districts | Minimal but congested | 30-45 mins via metro/expressway |

| Air Quality & Living Environment | Moderate to poor | Good to excellent |

| Infrastructure Development | Saturated | Rapidly expanding |

| Investment Entry Barrier | High | Moderate to low |

| Future Growth Potential | Limited | High |

Key Insight: This comparison reveals why homebuyers and investors are increasingly prioritizing suburban corridors over traditional central city locations. The value proposition extends beyond mere affordability to encompass quality of life, investment returns, and future-readiness.

How Infrastructure Connectivity Drives Property Values

Price Premium Near Transit Nodes

Properties within 500 meters to 1 kilometer of metro stations typically command a 20-30% premium over properties located farther away. This proximity premium reflects the tangible value buyers place on convenient transportation access.

The price differential becomes even more pronounced when comparing suburbs with confirmed metro connectivity against those without such infrastructure. Early movers in areas with announced metro routes have witnessed substantial appreciation even before construction completion.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Rental Demand Surge

Connectivity doesn’t just drive sale prices it fundamentally transforms rental markets. Metro access boosts rental demand from IT professionals, industrial workforce, and business travelers. This creates sustainable income opportunities for real estate investors.

Suburban properties near metro stations are particularly attractive to young professionals and families seeking affordable accommodation with convenient commute options. The rental yield in these emerging corridors often exceeds that of established central city locations, making them compelling investment propositions.

Emerging Growth Corridors by City

- Bangalore: Locations like Sarjapur, Hoskote, Attibele, and Bidadi are gaining attention from developers and buyers as metro access expands to these areas.

- Hyderabad: Suburbs such as Patancheru, Shankarpally, Kandlakoya, Shamirpet, and Medchal are experiencing significant spikes in real estate demand due to their proximity to the Outer Ring Road.

- Chennai: Corridors along OMR, Poonamallee, Porur, and Siruseri are transforming from purely residential areas into mixed-use urban centers.

- Nagpur: Extension plans targeting Butibori MIDC, Kanhan River, Hingna, and Transport Nagar are opening new suburban investment opportunities.

How Developers Are Responding to Infrastructure Growth

Real estate developers are rapidly responding to infrastructure-driven demand shifts. The metro expansion is encouraging developers to launch townships, plotted developments, and integrated communities in suburban regions, offering a blend of affordability and convenience.

Key Development Types

- Integrated Townships: Comprehensive residential communities with internal amenities including schools, hospitals, shopping centers, and recreational facilities, reducing dependency on external infrastructure.

- Transit-Oriented Developments: Metro corridors are fueling a surge in transit-oriented developments, transforming station zones into vibrant commercial ecosystems with malls, high-street retail, entertainment zones, and co-working spaces.

- Mixed-Use Projects: Combining residential, commercial, and retail spaces to create self-sustaining micro-cities that leverage metro and ORR connectivity.

- Premium Gated Communities: Offering villa plots and independent houses for buyers seeking spacious accommodation with urban connectivity benefits.

Investment Strategy Checklist for Metro Corridor Properties

Timing Your Entry

- Target the window between route announcement and construction completion

- Verify confirmed projects with allocated funding vs. speculative proposals

- Check government notifications, environmental clearances, and preliminary construction activity

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Location Selection Criteria

- Distance from Metro Station: Aim for properties within 1 kilometer walking distance

- Last-Mile Connectivity: Evaluate feeder road quality, auto-rickshaw availability, and bus connectivity

- ORR Proximity: Look for properties near ORR junctions for dual connectivity benefits

- Employment Hub Access: Prioritize convenient metro/ORR access to IT parks, industrial zones, and business districts

- Social Infrastructure: Assess schools, hospitals, shopping centers, and recreational facilities

Risk Mitigation Steps

- Project Delays: Build buffer time into investment horizon; avoid heavy leveraging

- Route Changes: Verify location remains on confirmed route alignment

- Builder Credibility: Research developer track records, financial stability, and RERA compliance

- Market Overcorrection: Evaluate whether pricing reflects genuine demand vs. speculative bubble

- Due Diligence: Consult official metropolitan transport authority websites for project reports

Demographic Shift: Understanding New Suburban Residents

Who Is Moving to Suburban Corridors?

The metro and ORR expansion is facilitating significant demographic shifts. Increasing traffic congestion, air and noise pollution in central city regions are driving residents toward quieter, less crowded suburban outskirts.

Key Demographic Segments

- IT Professionals: Seeking better work-life balance with spacious homes, cleaner environments, and reasonable commutes via metro to tech parks.

- Young Families: Prioritizing child-friendly environments with quality schools, safe neighborhoods, and outdoor spaces while maintaining career connectivity.

- Retirement Planners: Pre-retirees investing in suburban properties offering peaceful living with healthcare access and occasional city connectivity.

- Rental Investors: Targeting the growing rental demand from professionals preferring suburban accommodation with metro convenience.

Understanding these demographic patterns helps investors align property selection with end-user requirements, ensuring sustained demand and rental income.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Future Infrastructure Outlook: Phase III and Beyond

Phase III Expansions

The completion of Phase 2 and proposed Phase 3 and 4 metro expansions will further strengthen metropolitan real estate markets. Future corridors will create additional connectivity layers, potentially triggering new waves of suburban appreciation.

Investors with 7-10 year horizons should monitor master plan announcements for Phase III routes, identifying tomorrow’s growth corridors before they enter public consciousness.

Integrated Multimodal Networks

The ultimate vision extends beyond standalone metro lines or ring roads. Plans for fully circular metro networks around outer ring roads would allow effortless travel between outer suburbs while improving interconnectivity inside the city.

Such comprehensive networks eliminate the traditional core-periphery hierarchy, creating multiple centers of economic activity distributed across the metropolitan region.

Sustainable Urban Development

Modern metro and ORR projects increasingly incorporate environmental sustainability principles. From energy-efficient rolling stock to green building requirements for developments near stations, infrastructure expansion is aligning with broader ecological goals.

Properties in eco-sensitive developments near metro corridors may command premium positioning as environmental consciousness grows among homebuyers.

Frequently Asked Questions (FAQ)

How much price appreciation can I expect from metro connectivity?

In areas with confirmed metro routes and solid infrastructure, price growth of 15-25% over 3-5 years is a reasonable expectation. However, actual appreciation depends on multiple factors including construction timeline adherence, last-mile connectivity quality, overall market conditions, and specific location attributes. Properties purchased before construction commencement typically experience higher appreciation than those acquired post-launch.

Should I invest in suburbs before or after metro construction begins?

The optimal entry point is typically after route confirmation but before major construction activity begins. This phase offers reasonable pricing with minimized uncertainty. Investing during preliminary announcements carries higher risk from potential route changes or project abandonment. Waiting until construction completion reduces investment risk but also limits appreciation potential significantly.

What is the ideal distance from a metro station?

Properties within 500 meters to 1 kilometer of metro stations are considered ideal, with closer locations commanding better premiums. Beyond 1.5 kilometers, the connectivity advantage diminishes substantially unless excellent feeder connectivity exists. However, balance proximity benefits against potential noise and congestion concerns for properties immediately adjacent to stations.

How does ORR connectivity compare to metro access?

ORR connectivity primarily benefits private vehicle users, offering faster point-to-point travel between suburbs without entering congested city centers. Metro access serves public transport commuters with predictable, affordable, and environmentally sustainable options. Properties offering both metro and ORR proximity provide maximum flexibility and command the highest premiums, catering to diverse transportation preferences.

Are suburban properties near metro suitable for rental investment?

Yes, suburban properties near metro stations typically generate attractive rental yields, often 4-6% compared to 2.5-3.5% in central locations. These properties attract strong rental demand from IT professionals, industrial workforce, and those seeking affordable accommodation with good connectivity. Ensure your property targets the appropriate demographic segment and offers competitive amenities relative to the rental positioning.

What are the main risks in metro-corridor investments?

Primary risks include project delays extending beyond anticipated timelines, route modifications during detailed planning phases, poor last-mile connectivity limiting practical metro usage, and builder quality issues affecting property delivery and maintenance. Additionally, speculative price inflation during announcement phases can create bubble conditions. Thorough due diligence on government approvals, developer credibility, and realistic timeline assessments can mitigate these risks substantially.

How do I verify metro route authenticity?

Consult official metropolitan transport authority websites for detailed project reports (DPRs), tender notifications, and environmental clearance documents. Government press releases and gazette notifications provide authoritative confirmation. Be cautious of speculative route maps circulated by brokers or developers without official backing. Verify that land acquisition and preliminary construction activities have commenced for routes claimed as confirmed.

Will metro access reduce property prices in central city areas?

While metro expansion redistributes demand toward suburbs, quality properties in central locations typically maintain their value due to continued scarcity, heritage value, and certain lifestyle preferences. Some central city areas are witnessing declining property interest even with price reductions, as buyers shift preferences toward suburbs offering better value and living conditions. The trend suggests gradual convergence rather than dramatic central city depreciation.

How long does property appreciation take after metro launch?

Appreciation occurs in phases: initial speculation during announcement (12-18 months), construction period stabilization (24-48 months), and post-launch acceleration (12-36 months after operational commencement). Maximum appreciation typically occurs 18-36 months post-launch as commuter patterns stabilize and word-of-mouth drives demand. Patient investors holding through these phases typically realize optimal returns.

Should I choose property near metro or ORR?

If possible, prioritize properties offering both metro and ORR proximity. If choosing between them, consider your target user: metro proximity suits public transport commuters including IT professionals and students, while ORR access appeals to private vehicle users including business owners and senior executives. Mixed-use developments near metro-ORR junctions offer maximum market appeal and appreciation potential.

Conclusion: The New Suburban Real Estate Paradigm

Metro Phase II expansions and ORR developments are creating a fundamentally new suburban real estate paradigm. No longer are suburbs merely affordable alternatives to central city locations they are becoming destination residential markets offering superior quality of life, competitive connectivity, and attractive investment returns.

Affordable housing, better connectivity, and modern infrastructure have made suburban living increasingly attractive. This trend represents a sustainable, long-term shift rather than a temporary market aberration.

For homebuyers, these infrastructure developments offer opportunities to acquire spacious, well-connected properties at reasonable prices. For investors, they represent emerging growth corridors with significant appreciation potential and attractive rental yields.

Frequently Asked Questions (FAQ)

How much appreciation can metro connectivity deliver?

Well-connected metro corridors can see 15–25% appreciation over 3–5 years, depending on timelines, last-mile access, and overall market conditions. Early-stage investments usually perform better.

When is the best time to invest before or after construction?

The sweet spot is after route confirmation but before major construction. Early announcements carry risk; post-completion offers safety but limited upside.

What’s the ideal distance from a metro station?

500 m–1 km is optimal. Beyond 1.5 km, the metro advantage weakens unless feeder connectivity is strong.

Metro vs ORR what’s better?

Metro favors daily commuters and rentals; ORR suits private vehicle users. Properties near both command the highest premiums.

Are metro-adjacent suburbs good for rentals?

Yes. They typically deliver 4–6% rental yields, outperforming central areas due to demand from IT and working professionals.

What are the key risks?

Project delays, route changes, poor last-mile connectivity, and speculative price bubbles. Mitigate through verified approvals and credible developers.

How do I verify metro routes?

Rely only on official transport authority DPRs, tenders, and gazette notifications—not broker maps or marketing claims.

Do metros reduce central city property prices?

Not significantly. Demand is shifting toward suburbs, but prime central locations largely retain value due to scarcity.

How long after metro launch does appreciation peak?

Strong gains usually appear 18–36 months post-operation, once commuter patterns stabilize.

Metro or ORR what should I choose?

Choose both if possible. Otherwise, align with your target buyer or tenant profile.

Conclusion: A New Suburban Reality

Metro expansions and ORR corridors are transforming suburbs into self-sustaining, high-demand residential hubs. This is a structural shift driven by better connectivity, affordability, and quality of life.

For buyers and investors alike, success lies in timing, location precision, infrastructure verification, and long-term thinking. Connectivity—not city-center proximity is now the true driver of real estate value.

Disclaimer: This content is for informational purposes only. Always verify infrastructure status through official sources and consult financial professionals before investing.