Table of Contents

Quick Summary for Mid-Income Hyderabad Homebuyers (2026)

Key Takeaways: High-Rise vs Low-Rise Apartments in Hyderabad

- Decision driver = lifestyle + location, not just price

- High-rises suit amenity-focused, urban lifestyles

- Low-rises suit space, ventilation, and community-oriented living

- High-rises suit amenity-focused, urban lifestyles

- High-rise apartments (10+ floors):

- Concentrated in IT corridors like Gachibowli and Financial District

- Price range: ₹75 lakh – ₹1.3 crore (2–3 BHK)

- Offer premium amenities: swimming pools, gyms, clubhouses, 24/7 security

- Higher maintenance costs: ₹4–6 per sq ft

- Appeal to professionals prioritizing convenience, security, and status

- Concentrated in IT corridors like Gachibowli and Financial District

- Low-rise apartments (4–5 floors):

- Emphasize natural ventilation, privacy, and community living

- 15–20% cheaper than comparable high-rise units in similar locations

- Lower maintenance costs: ₹2–3 per sq ft

- Typically offer larger carpet areas and fewer shared facilities

- Emphasize natural ventilation, privacy, and community living

- Post-COVID buyer preference shift:

- 35% of mid-income buyers now prefer low-density living

- Demand has moved toward spacious homes over amenity-heavy towers

- 35% of mid-income buyers now prefer low-density living

- Emerging low-rise hotspots:

- Tellapur

- Kompally

- Narsingi

- Low-rise projects here offer 20–30% larger carpet area at comparable pricing

- Tellapur

- Overall takeaway:

- High-rise = amenities, urban access, vertical living

- Low-rise = space, airflow, lower costs, quieter lifestyle

- Buyer choice increasingly reflects post-pandemic lifestyle priorities, not just budget

- High-rise = amenities, urban access, vertical living

Understanding the Definitions

High-Rise Apartments: Buildings with 10 or more floors (some definitions use 7+ floors), typically featuring elevators, extensive common amenities, and higher population density. In Hyderabad, high-rises concentrate in western corridors (Gachibowli, Kondapur, Financial District) and emerging zones (Kokapet, Narsingi).

Low-Rise Apartments: Structures with 4-5 floors maximum, often standalone buildings or small gated communities. These buildings may have elevators but can function without them, offering ground-floor accessibility advantages. Common in established residential neighborhoods (Sainikpuri, Yapral, Kompally) and emerging peripheral areas.

Mid-Income Buyer Profile: Households with annual incomes of ₹8-20 lakh, typically young professionals, small families, and dual-income couples seeking 2-3BHK apartments priced ₹60 lakh-1.3 crore. This segment represents 55-60% of Hyderabad’s homebuyer market.

Comprehensive Comparison: High-Rise vs Low-Rise

| Factor | High-Rise Apartments | Low-Rise Apartments | Winner for Mid-Income |

| Price Range (2BHK) | ₹70-95 lakh | ₹60-80 lakh | Low-Rise (15-20% cheaper) |

| Price Range (3BHK) | ₹1-1.5 crore | ₹85 lakh-1.2 crore | Low-Rise (15-20% cheaper) |

| Maintenance Cost | ₹4-6 per sq ft/month | ₹2-3 per sq ft/month | Low-Rise (40-50% lower) |

| Amenities | Extensive (pool, gym, club) | Basic (parking, elevator, park) | High-Rise (if utilized) |

| Community Size | 200-500+ families | 20-80 families | Depends on preference |

| Privacy | Lower (shared facilities) | Higher (fewer neighbors) | Low-Rise |

| Natural Ventilation | Limited (central AC common) | Excellent (cross-ventilation) | Low-Rise |

| Elevator Dependency | High (power cuts problematic) | Low-Moderate | Low-Rise |

| Resale Liquidity | Higher (broader buyer pool) | Moderate (specific buyers) | High-Rise |

| Rental Yield | 4-5% (corporate tenants) | 3.5-4.5% (families) | High-Rise (marginally) |

| Carpet Area | 65-70% of built-up | 75-80% of built-up | Low-Rise (more usable space) |

Mid-Income Buyer Dilemma: Real-World Scenarios

Scenario 1: IT Professional Couple, ₹18 Lakh Annual Income

Profile: 28 and 30 years old, working in Gachibowli IT corridor, no children yet, budget ₹90 lakh-1.1 crore for 2-3BHK.

High-Rise Option: 3BHK (1,650 sq ft) in Gachibowli high-rise tower, 18th floor, ₹1.05 crore

- Pros: 15-minute commute, gym and pool access, 24/7 security, corporate tenant pool if renting later

- Cons: ₹8,000 monthly maintenance (₹4.8 per sq ft), restricted natural ventilation, elevator wait times during peak hours

Low-Rise Alternative: 3BHK (1,850 sq ft) in Narsingi standalone building, 3rd floor, ₹95 lakh

- Pros: 200 sq ft more space, ₹4,500 monthly maintenance, excellent cross-ventilation, peaceful environment

- Cons: 30-minute commute to Gachibowli, basic amenities (no pool/gym), limited rental demand from corporates

Recommendation: High-rise suits this profile better, short commute saves 2-3 hours weekly, amenities align with young professional lifestyle, and future rental potential to corporate tenants ensures exit strategy flexibility.

Scenario 2: Young Family with Children, ₹12 Lakh Annual Income

Profile: 32 and 34 years old, 5-year-old child, IT employee + teacher, budget ₹75-85 lakh for 2-3BHK.

High-Rise Option: 2BHK (1,250 sq ft) in Kompally high-rise, 12th floor, ₹80 lakh

- Pros: Children’s play area, clubhouse activities, secure gated community, modern amenities

- Cons: ₹5,000 monthly maintenance, elevator dependency with young child, limited outdoor space

Low-Rise Alternative: 3BHK (1,450 sq ft) in Kompally low-rise, ground floor, ₹78 lakh

- Pros: Direct garden access, child-friendly (no elevator risks), ₹3,000 maintenance, spacious for growing family

- Cons: Fewer organized activities for children, basic security, no swimming pool

Recommendation: Low-rise offers better value, ground floor eliminates elevator concerns with young children, larger space accommodates family growth, lower maintenance preserves disposable income for education expenses, and garden access provides supervised outdoor play.

Scenario 3: Established Professional Seeking Investment, ₹25 Lakh Annual Income

Profile: 42 years old, single investor, owns primary residence, budget ₹90 lakh-1.1 crore for rental income property.

High-Rise Option: 2BHK (1,180 sq ft) in Financial District high-rise, 22nd floor, ₹95 lakh

- Pros: Strong corporate rental demand (₹32,000-38,000/month), 4-4.5% rental yield, faster appreciation (12-14% annually)

- Cons: Higher purchase price, ₹5,500 maintenance eats into rental profit

Low-Rise Alternative: 3BHK (1,550 sq ft) in Tellapur low-rise, 2nd floor, ₹90 lakh

- Pros: Lower entry price, family tenant preference, ₹3,500 maintenance improves net rental yield

- Cons: Lower rental rates (₹26,000-30,000/month), family tenants longer lease negotiations, slower appreciation (9-11% annually)

Recommendation: High-rise optimizes investment returns, corporate tenants provide stable, premium rents with shorter vacancy periods, absolute appreciation higher despite lower percentage due to price base, and Financial District’s established status reduces location risk.

Lifestyle Factors: Beyond Price and Amenities

Community and Social Fabric

High-Rise Experience:

- Transient population (30-40% tenants in IT corridor projects)

- Formal interactions through organized events

- Diverse demographics (ages 25-65, various backgrounds)

- Challenges building lasting relationships due to turnover

Low-Rise Experience:

- Stable, owner-occupied majority (70-80% ownership)

- Organic community formation through daily interactions

- Homogeneous demographics (similar life stages)

- Children develop lasting friendships within complex

Mid-Income Consideration: Families with young children and those prioritizing social roots favor low-rise community dynamics. Young professionals valuing privacy and independence prefer high-rise anonymity.

Health and Wellness Considerations

Air Quality and Ventilation:

High-rise apartments, especially on upper floors, experience better air quality due to reduced ground-level pollution and dust. However, reliance on central AC systems can compromise indoor air circulation, potentially accumulating allergens and pollutants without proper maintenance.

Low-rise buildings with cross-ventilation (windows on opposite walls) facilitate natural air circulation, reducing dependency on artificial cooling and improving indoor air quality. Ground and lower floors may experience higher dust accumulation requiring frequent cleaning.

Sunlight and Vitamin D:

High-rise upper floors (12+) receive unobstructed sunlight throughout the day, beneficial for vitamin D synthesis and mood regulation. However, excessive exposure can increase cooling costs and UV damage to furnishings.

Low-rise buildings with tree-lined surroundings offer dappled sunlight, adequate for health benefits without harsh afternoon glare. Ground floors may experience limited direct sunlight in dense developments.

Physical Activity:

High-rise gym facilities encourage regular exercise with zero commute. However, elevator dependency reduces daily physical activity (climbing stairs).

Low-rise buildings with 4-5 floors encourage stair usage, providing incidental exercise (burning 100-150 calories per day for 3rd-floor residents). However, lack of equipped gyms may require external memberships (₹2,000-4,000 monthly).

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Post-COVID Shifts in Mid-Income Preferences

The pandemic fundamentally altered homebuyer priorities, with lasting effects on high-rise versus low-rise preferences:

The “Pandemic-Ready Home” Concept

Factors Driving Low-Rise Preference (35% of Mid-Income Buyers):

Sustained High-Rise Appeal (65% of Mid-Income Buyers):

- Space Prioritization: Work-from-home requirements necessitate dedicated home offices, low-rise projects offer 20-30% larger carpet areas enabling 3BHK configurations with study rooms versus cramped 2BHK high-rises.

- Amenity Skepticism: Clubhouses, gyms, and pools remained closed for 12-18 months during COVID waves, causing buyers to question high maintenance costs for intermittently accessible facilities.

- Health Security: Lower population density in low-rise buildings reduced disease transmission risks, creating perception of safer living environments during health crises.

- Green Space Access: Private balconies with plant space and ground-floor garden access became wellness priorities over shared but restricted common areas.

- Security Infrastructure: 24/7 surveillance, controlled entry, and professional security staff provided peace of mind during lockdowns and continues attracting families concerned about safety.

- Proximity to Employment: IT corridor high-rises maintain advantage as companies implement hybrid work (3-4 days office), making 15-20 minute commutes valuable time savings.

- Modern Infrastructure: Uninterrupted power backup, reliable water supply, and maintained lifts proved crucial during crises, benefits more commonly found in high-rise projects.

- Investment Resilience: High-rise apartments in established corridors experienced minimal price corrections (2-3%) versus suburban low-rise projects (5-8%), reassuring investment-conscious buyers.

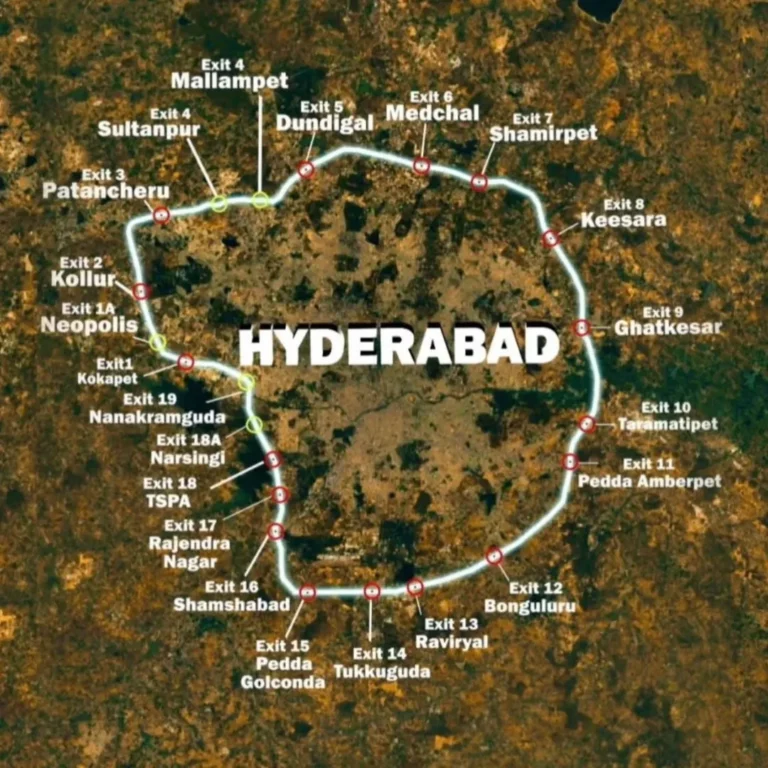

Location-Specific Recommendations for Mid-Income Buyers

Western IT Corridor (Gachibowli, Kondapur, Financial District)

Recommendation: High-Rise Apartments

Rationale: Land scarcity makes low-rise projects rare and expensive. High-rise living offers best value-to-location ratio, with amenities justifying premiums. Established infrastructure (metro connectivity, social amenities) maximizes convenience.

Price Range: 2BHK ₹85 lakh-1.1 crore | 3BHK ₹1.2-1.6 crore

Target Buyers: Young IT professionals, dual-income couples, investors seeking rental income

Emerging Corridors (Tellapur, Kokapet, Narsingi)

Recommendation: Low-Rise Apartments

Rationale: Lower land costs enable spacious low-rise projects at competitive pricing. Quieter neighborhoods suit families seeking work-life balance. 20-30% larger apartments than IT corridor equivalents.

Price Range: 2BHK ₹65-85 lakh | 3BHK ₹90 lakh-1.2 crore

Target Buyers: Families with children, buyers prioritizing space over proximity, long-term end-users

Peripheral Development Zones (Kompally, Uppal, Shamshabad)

Recommendation: Mixed (Evaluate Case-by-Case)

Rationale: Both formats coexist with distinct advantages. High-rises offer modern amenities compensating for peripheral location, while low-rises provide affordability and space. Infrastructure development phase determines optimal choice.

Price Range: 2BHK ₹55-75 lakh | 3BHK ₹75-95 lakh

Target Buyers: First-time homebuyers, budget-conscious families, investors targeting long-term appreciation

Established Residential Areas (Sainikpuri, Yapral, Manikonda)

Recommendation: Low-Rise Apartments

Rationale: These neighborhoods evolved with low-rise character, mature trees, wide streets, community familiarity. New high-rise projects disrupt established ambiance, while low-rise developments integrate seamlessly.

Price Range: 2BHK ₹70-90 lakh | 3BHK ₹1-1.25 crore

Target Buyers: Families valuing established infrastructure, buyers seeking residential tranquility, those prioritizing schools/hospitals proximity

Financial Analysis: Total Cost of Ownership (10 Years)

High-Rise Example: 3BHK (1,600 sq ft) Gachibowli, ₹1.2 Crore

Initial Costs:

- Property Price: ₹1.20 crore

- Registration & Stamp Duty: ₹9.6 lakh

- Furnishing: ₹12 lakh

- Total Initial: ₹1.42 crore

Recurring Costs (10 Years):

- Maintenance (₹5/sq ft): ₹9.6 lakh

- Property Tax: ₹1.5 lakh

- Repairs/Upkeep: ₹3 lakh

- Total Recurring: ₹14.1 lakh

Total Cost: ₹1.56 crore

Expected Value (10 Years): ₹2.3 crore (12% annual appreciation)

Net Gain: ₹74 lakh

Low-Rise Example: 3BHK (1,850 sq ft) Narsingi, ₹1 Crore

Initial Costs:

- Property Price: ₹1.00 crore

- Registration & Stamp Duty: ₹8 lakh

- Furnishing: ₹10 lakh

- Total Initial: ₹1.18 crore

Recurring Costs (10 Years):

- Maintenance (₹2.5/sq ft): ₹5.6 lakh

- Property Tax: ₹1.2 lakh

- Repairs/Upkeep: ₹2.5 lakh

- Total Recurring: ₹9.3 lakh

Total Cost: ₹1.27 crore

Expected Value (10 Years): ₹1.85 crore (10.5% annual appreciation)

Net Gain: ₹58 lakh

Analysis: High-rise generates ₹16 lakh higher absolute returns despite ₹20 lakh higher initial investment, delivering superior ROI. However, low-rise’s lower total cost of ownership (₹29 lakh less over 10 years) provides better cash flow management for mid-income buyers with limited surplus.

Decision Framework: Choosing What’s Right for You

Choose High-Rise If You:

- Work in western IT corridors with daily office commutes

- Value extensive amenities (gym, pool, clubhouse) and utilize them regularly (2+ times weekly)

- Prioritize security infrastructure and 24/7 professional management

- Plan to rent property in future (corporate tenant demand)

- Prefer modern, turnkey living with minimal maintenance involvement

- Have higher disposable income accommodating ₹5,000-8,000 monthly maintenance

- Prioritize investment appreciation over operational cost savings

- Value diverse community interactions and organized social events

Choose Low-Rise If You:

- Work in hybrid/remote arrangements with 2-3 days office presence

- Prioritize living space and carpet area over shared amenities

- Seek close-knit community environment with lasting neighbor relationships

- Have young children requiring ground-floor accessibility and outdoor play

- Prefer natural ventilation and cross-breeze over central AC dependency

- Budget conscious with preference for lower recurring costs

- Long-term end-user planning 15+ year ownership

- Value privacy and quieter living environment

Frequently Asked Questions (FAQs)

Are high-rise apartments safer than low-rise buildings?

High-rises offer stronger security systems (guards, CCTV, access control), while low-rises are safer during emergencies due to easier evacuation. Choose based on priority: security vs. evacuation simplicity.

Do low-rise apartments appreciate slower than high-rise properties?

Not necessarily. Location matters more than height. High-rises see faster appreciation in prime IT areas, while quality low-rises in growth corridors can deliver similar long-term returns.

Which option offers better rental income for mid-income investors?

High-rises earn 10–15% higher rents and rent out faster, but have higher costs. Low-rises offer more stable tenants and comparable net yields over time.

How much do amenities matter for resale value?

Amenities add 8–12% resale premium if well-maintained. However, many buyers prefer lower maintenance and more space over luxury amenities.

What hidden costs exist in high-rise living?

Extra costs include corpus funds, special repairs, club fees, higher insurance, parking charges, and electricity usage, typically ₹30,000–60,000/year extra.

Can low-rise apartments support remote work?

Yes. Low-rises often offer larger carpet areas, better ventilation, and dedicated study spaces, ideal for work-from-home lifestyles.

Which format has better resale liquidity in Hyderabad?

High-rises sell 15–25% faster, especially in IT corridors. Low-rises sell slower but attract committed end-users. For short-term exits, high-rises perform better.

How does building height affect children’s safety and lifestyle?

High-rises offer structured, supervised activities but need childproofing. Low-rises allow safer outdoor play and community bonding. Choice depends on parenting style.

Conclusion: No Universal Answer, But Clear Personal Solutions

The high-rise versus low-rise decision for mid-income buyers has no objectively correct answer, only personally optimal solutions based on life stage, work patterns, family structure, and financial priorities.

High-rise apartments excel for: Young professionals prioritizing work proximity and amenities, investors targeting rental income, buyers valuing security infrastructure and modern conveniences, those comfortable with higher recurring costs for comprehensive facilities.

Low-rise apartments excel for: Families with children seeking space and community, buyers prioritizing lower operating costs and natural living, long-term residents valuing stability and privacy, those in emerging corridors where low-rise offers better value.

The Critical Insight: Don’t let societal narratives about “prestigious high-rise living” or “peaceful low-rise lifestyle” override personal circumstances. A 3BHK low-rise apartment in Tellapur offering 1,850 sq ft at ₹95 lakh delivers superior quality of life for a young family than a cramped 2BHK high-rise in Gachibowli at ₹90 lakh, despite the latter’s proximity to IT hubs. Conversely, a single professional working 50+ hours weekly in Financial District gains negligible benefit from a spacious low-rise 30 minutes away versus a compact high-rise walking distance from office.

Decision Process:

- Assess commute reality: Calculate weekly hours spent traveling, if exceeding 10 hours, proximity trumps space.

- Evaluate amenity usage: Honestly project gym/pool utilization, if less than twice weekly, don’t pay premium maintenance.

- Financial stress-test: Ensure maintenance costs don’t exceed 5-7% of monthly household income for comfortable lifestyle.

- Future-proof choice: Consider 5-7 year life stage evolution, growing families need space, career changes may relocate you.

- Visit both formats: Spend time in high-rise and low-rise buildings during different times, experience daily realities before committing.

Hyderabad’s diverse real estate landscape accommodates both formats successfully. Your ideal home exists within your budget, it’s simply a matter of aligning building format with authentic lifestyle needs rather than aspirational narratives.

Build Your Future in Homes That Understand Your Journey

Kura Homes brings nearly five decades of Hyderabad real estate expertise to understand that the right home balances present needs with future evolution. Our legacy-driven approach crafts both high-rise and low-rise developments that prioritize quality construction, timely delivery, and thoughtful design, ensuring your investment serves your family across life stages.

Explore housing options that align with your lifestyle and financial goals. Connect with Kura Homes today.

Discover Your Ideal Home Format →

Disclaimer: Pricing, maintenance costs, and appreciation rates mentioned reflect 2025-2026 Hyderabad market analysis and may vary based on specific locations, developer reputations, project amenities, and market conditions. Prospective buyers should conduct independent property visits, verify actual maintenance charges with residents, consult financial advisors regarding affordability, and assess personal lifestyle needs before purchase decisions. Comparison scenarios represent typical situations and may not reflect individual circumstances.