Table of Contents

Quick Summary for Hyderabad Investors (2026)

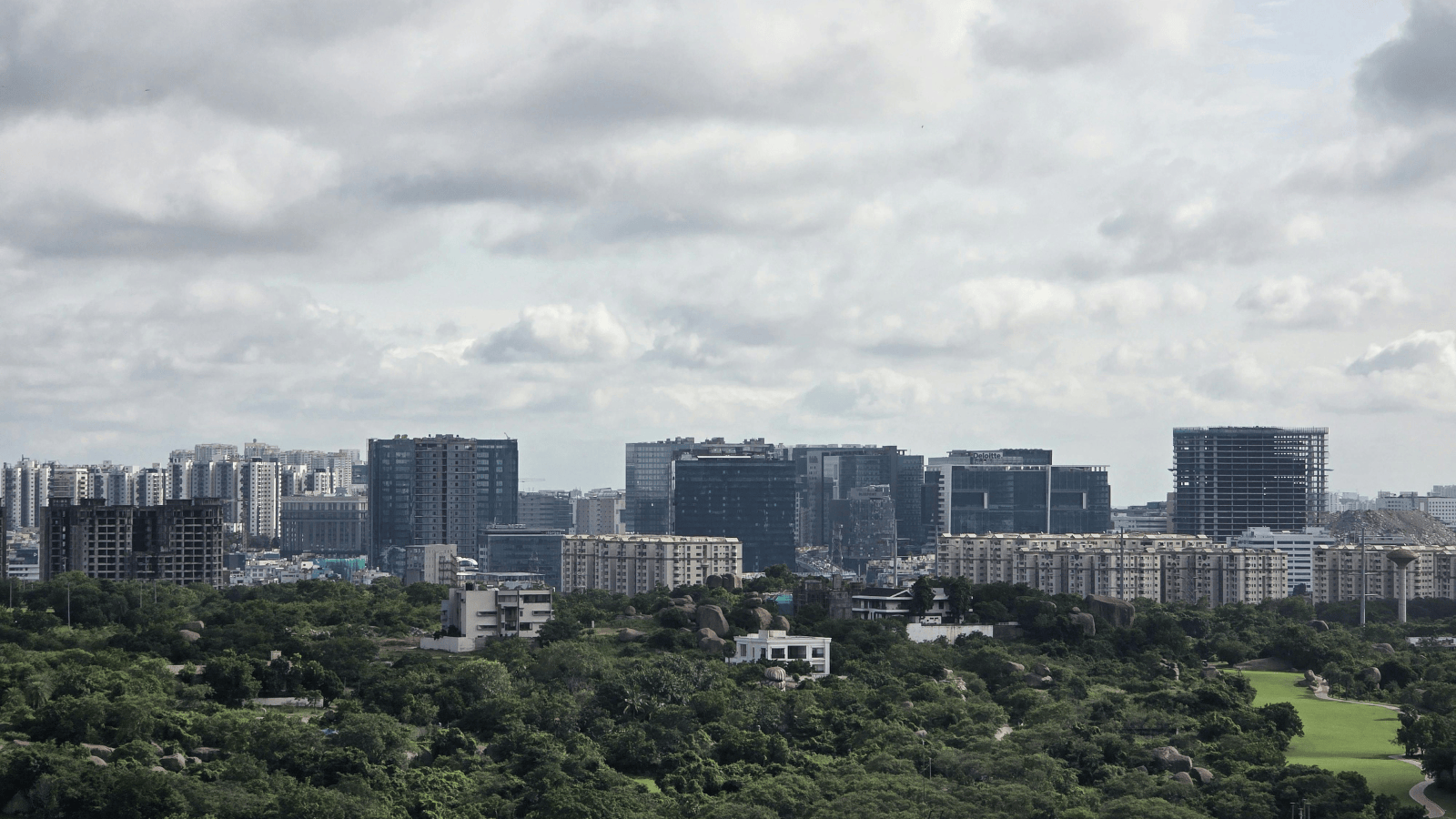

HITEC City and surrounding areas deliver 3-5% rental yields in 2026, making them among India’s most profitable real estate investments. Key factors driving returns include steady IT sector growth, metro connectivity expansion, and consistent tenant demand from high-income professionals. Prime corridors like Gachibowli and Financial District offer even higher yields of 4-6%, while emerging localities provide affordable entry points with strong appreciation potential.

What is Rental Yield and Why Does It Matter?

Rental yield measures the annual income a property generates relative to its purchase price, expressed as a percentage. It helps investors evaluate profitability and compare investment opportunities.

Formula:

Rental Yield (%) = (Annual Rental Income ÷ Property Purchase Price) × 100

Example: A ₹1 crore apartment renting for ₹35,000 per month generates ₹4.2 lakh annually, delivering a 4.2% rental yield.

Higher yields indicate better cash flow and faster investment recovery, making rental yield a critical metric for property investors seeking stable, long-term returns.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

HITEC City Rental Market: 2026 Overview

HITEC City maintains rental yields between 3-5%, supported by premium IT parks, luxury apartments, and sustained demand from corporate tenants. Between 2021 and 2024, HITEC City experienced 54% rental value growth and 62% capital appreciation, establishing it as one of Hyderabad’s most resilient investment zones.

The area’s commercial ecosystem creates consistent rental demand. Office rentals in HITEC City increased 9% in early 2026, reflecting corporate expansion that directly fuels residential demand as employees seek nearby housing.

Why HITEC City Commands Premium Yields

Concentrated Employment: Major IT campuses including Microsoft, Google, and Amazon headquarters create a captive tenant pool of high-earning professionals willing to pay premium rents for proximity to work.

Infrastructure Maturity: Established metro connectivity, commercial infrastructure, and social amenities reduce location risk and ensure stable occupancy rates year-round.

Limited Supply: Land scarcity in core HITEC City restricts new inventory, supporting rental rate stability even during market corrections.

Top Locations Around HITEC City for Rental Returns (2026)

| Location | Rental Yield | Property Price Range | Key Advantages | Tenant Profile |

| HITEC City Core | 3-5% | ₹8,000-12,000/sq ft | Immediate office proximity, premium amenities | Senior IT professionals, expats |

| Gachibowli | 4-6% | ₹7,000-10,000/sq ft | Tech parks, metro access, established infrastructure | IT employees, young professionals |

| Financial District | 3-4% | ₹8,500-11,000/sq ft | SEZ zones, global companies, future growth | Banking professionals, corporate executives |

| Kokapet | 4-6% | ₹6,500-9,000/sq ft | Outer Ring Road access, upcoming developments | IT workforce, mid-level managers |

| Narsingi | 4-4.5% | ₹5,500-7,500/sq ft | Greenery, proximity to employment zones | Families, established professionals |

| Tellapur | 3.8-4% | ₹5,000-7,000/sq ft | Metro extension, peaceful environment | IT employees seeking quieter areas |

Location-by-Location Investment Analysis

1. Gachibowli: The Balanced Investment Choice

Gachibowli recorded 62% rental value growth and 78% capital appreciation between 2021-2024, outperforming most Hyderabad micro-markets. The locality combines established infrastructure with continued development, creating ideal conditions for rental income and property appreciation.

Investment Highlights:

- Major tech campuses (TCS, Infosys, Wipro) drive consistent tenant demand

- Metro Phase 1 operational, Phase 2 expansion planned

- Mix of luxury and mid-range properties accommodates diverse budgets

- Educational institutions and hospitals support family-oriented tenants

Rental Income Expectations: 3BHK apartments (1,800-2,200 sq ft) command ₹40,000-60,000 monthly, while 2BHK units rent for ₹25,000-35,000.

2. Financial District: Corporate Rental Powerhouse

The Financial District yields 3-3.7% annually, driven by SEZ zones and global company presence. While property prices are premium, rental stability and corporate lease agreements reduce vacancy risks.

Investment Highlights:

- Concentration of banking, finance, and consulting firms

- High-quality infrastructure including TSPA layout

- Premium gated communities with world-class amenities

- Rental agreements often longer-term (2-3 years) with corporate backing

Ideal For: Investors prioritizing stable, corporate-backed rental income over maximum yield percentage.

3. Kokapet: High Growth, Emerging Value

Kokapet delivers 4-6% yields thanks to Outer Ring Road proximity and upcoming tech parks. Lower entry prices compared to HITEC City core make it attractive for investors seeking both rental income and capital appreciation.

Investment Highlights:

- Outer Ring Road connectivity to multiple employment zones

- Significant under-construction luxury projects

- Growing social infrastructure (schools, hospitals, retail)

- Future-proofed with planned metro extension

Investment Strategy: Buy pre-launch or under-construction properties for 15-20% price advantage, then capture rental demand as projects complete.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

4. Narsingi: The Family-Friendly Option

Narsingi achieves 4-4.5% yields, attracting mid-to-premium housing demand from families. Its scenic environment and proximity to multiple employment corridors create year-round rental stability.

Investment Highlights:

- Balanced lifestyle location between HITEC City and Financial District

- Lower density, green surroundings appeal to families

- Established social infrastructure reduces settling-in concerns

- Slightly lower property prices than prime zones

Tenant Profile: Married IT professionals with children seeking community-oriented living with manageable commutes.

5. Tellapur: The Quieter Alternative

Tellapur generates 3.8-4% yields, popular among IT employees preferring peaceful areas. The upcoming metro extension significantly enhances its investment case.

Investment Highlights:

- Metro Rail Phase 2 extension will connect to core employment zones

- Greenfield development allows modern, well-planned communities

- More affordable than central locations without sacrificing connectivity

- Growing retail and social infrastructure

Best For: Investors targeting tenants who prioritize lifestyle quality and are willing to commute 30-40 minutes for better living environments.

Investment Strategy: Maximizing Rental Returns Around HITEC City

1. Property Selection Criteria

Optimal Configurations:

- 2BHK (1,000-1,300 sq ft): Highest demand from single professionals and young couples. Easiest to rent, shortest vacancy periods.

- 3BHK (1,600-2,000 sq ft): Premium rents from families and senior professionals. Slightly longer vacancy cycles but higher absolute rental income.

- Avoid 1BHK: Limited tenant pool, difficult resale, lower appreciation potential in premium zones.

Must-Have Features for Maximum Rentability:

- Proximity to metro stations (within 1-2 km)

- Established gated communities with full amenities

- Covered parking (minimum 1 spot, preferably 2 for 3BHK)

- Modern fixtures, modular kitchen, quality fittings

- 24/7 power backup and water supply

2. Furnishing Strategy

Semi-Furnished Approach: Install kitchen cabinets, wardrobes, light fixtures, and basic appliances. This strikes the optimal balance between investment and rental premium.

Expected Rental Premium:

- Unfurnished: Base rental rate

- Semi-furnished: 15-20% premium

- Fully furnished: 25-35% premium (but higher maintenance, faster depreciation)

Key Insight: IT professionals prefer semi-furnished properties they can personalize without starting from scratch.

3. Tenant Selection

Profile Characteristics:

- Employed with reputable companies (verifiable income)

- Long-term intent (minimum 11-month agreements)

- Non-smoking, no pets (unless property allows)

- Credit history verification through employment background

Corporate Leases: Target companies offering employee housing allowances. These provide stable, long-term rental agreements with institutional backing.

4. Pricing Strategy

Market-Rate Positioning: Research comparable properties within 500m radius. Price 5-10% below market for quick rentals, at-market for premium properties with superior amenities.

Annual Escalation: Build in 5-8% annual rent increases into agreements. This protects against inflation and mirrors market appreciation.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Financial Analysis: HITEC City Rental Investment

Sample Investment Calculation

Property Details:

- Location: Gachibowli

- Type: 3BHK, 1,800 sq ft

- Purchase Price: ₹1.35 crore (₹7,500/sq ft)

- Semi-furnished Cost: ₹10 lakh

- Total Investment: ₹1.45 crore

Rental Income:

- Monthly Rent: ₹50,000

- Annual Income: ₹6,00,000

- Rental Yield: 4.14%

Additional Considerations:

- Property Tax: ₹15,000/year

- Maintenance (if non-occupied): ₹24,000/year

- Repairs/Upkeep: ₹20,000/year

- Net Annual Return: ₹5,41,000 (3.73% net yield)

5-Year Projection:

- Rental Income Growth (6% annual): ₹33.84 lakh (cumulative)

- Expected Appreciation (8% annual): Property value ₹1.98 crore

- Total Returns: ₹86.84 lakh (59.9% total return)

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Beyond Rental Yield: Complete Investment Picture

Liquidity Advantage:

Properties near HITEC City also benefit from faster resale liquidity due to consistent end-user demand from IT professionals, corporate executives, and relocating families.

Capital Appreciation Potential

Hyderabad’s rental yield averaged 4.24% in 2026, while properties can recover this proportion of market value annually through rent. However, capital appreciation often outpaces rental yields in prime locations.

Historical Performance:

HITEC City corridor properties appreciated 60-80% between 2021-2024, meaning capital gains frequently exceed cumulative rental income for medium-term holdings.

Investment Horizon Strategy:

- 3-5 Years: Focus on rental yield and stable cash flow

- 7-10 Years: Balanced approach capturing both rental income and appreciation

- 10+ Years: Appreciation becomes primary return driver

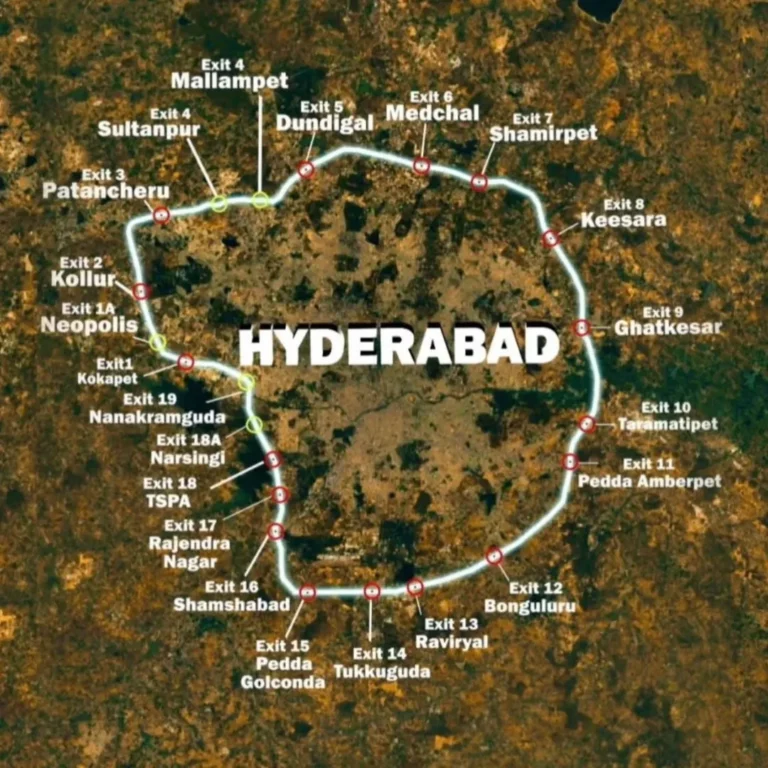

Infrastructure Catalysts Driving Future Returns

Metro Rail Phase 2 (Completion: 2027):

70 km of new metro lines will connect Kokapet, LB Nagar, and airport, potentially driving 22% property appreciation in connected zones.

Regional Ring Road (Completion: 2026):

Will unlock suburban connectivity, reducing commute times from emerging areas to HITEC City from 60+ minutes to 30-40 minutes.

Commercial Expansion:

Hyderabad’s office stock expected to grow 1.5x by 2030, ensuring sustained employment growth that fuels residential demand.

Developer and Project Due Diligence

Choosing the Right Developer

Established Track Record: Prioritize developers with 15+ years in Hyderabad market and history of timely delivery. Delays significantly impact rental commencement and overall returns.

Financial Stability: Verify project funding through bank partnerships and construction milestones. Financially distressed projects risk extended delays or non-completion.

Quality Benchmarks: Visit completed projects to assess construction quality, amenity functionality, and resident satisfaction. Poor quality leads to higher maintenance costs and tenant complaints.

Example: Kura Homes, with nearly five decades of experience in Hyderabad, represents the type of legacy builder whose projects typically deliver reliable construction quality and timely completion—critical factors for investors planning rental income.

RERA Compliance Verification

Mandatory Checks:

- Verify TS-RERA registration on official portal

- Confirm project approval documents available online

- Check completion timelines and delivery track record

- Review escrow account compliance (70% funds protected)

- Understand defect liability period (5 years post-possession)

Red Flags:

- Unregistered projects (avoid completely)

- Vague possession timelines

- Developer unwilling to share approval documents

- History of project delays or legal disputes

Tax Implications for Rental Income

Income Tax on Rental Earnings

Taxation Structure:

- Rental income taxed as “Income from House Property”

- 30% standard deduction allowed on rental income

- Home loan interest fully deductible (no ₹2 lakh cap for rental properties)

- Property tax paid is deductible

Sample Calculation:

- Annual Rent: ₹6,00,000

- Less: Standard Deduction (30%): ₹1,80,000

- Less: Home Loan Interest: ₹4,00,000

- Less: Property Tax: ₹15,000

- Taxable Income: ₹5,000 (minimal tax liability)

Optimization Strategy: Leverage home loan interest deduction to minimize tax on rental income during loan repayment period.

Capital Gains on Sale

Holding Period Classification:

- Less than 24 months: Short-Term Capital Gains (taxed per income slab)

- More than 24 months: Long-Term Capital Gains (20% with indexation benefit)

Tax-Saving Options:

- Invest sale proceeds in residential property (Section 54)

- Invest in capital gains bonds (Section 54EC)

- Claim indexation benefit to reduce taxable gains

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Risk Factors and Mitigation Strategies

Market Risks

Oversupply Concerns:

Rapid construction in some micro-markets could temporarily suppress rental rates. Mitigate by choosing locations with established demand and limited new supply.

Economic Downturns:

IT sector slowdowns can impact tenant availability and rental rates. Diversify tenant base beyond single-sector employees when possible.

Rental Vacancy:

Budget for 1-2 months vacancy per year. Maintain property competitively to minimize downtime between tenants.

Operational Risks

Tenant Disputes:

Clear rental agreements, proper documentation, and advance deposits minimize conflicts. Consider legal rental agreement registration.

Maintenance Costs:

Aging properties require higher maintenance. Modern buildings with warranties and builder support reduce unexpected expenses.

Regulatory Changes:

Rental control laws, property tax revisions, or TDS requirements can impact returns. Stay informed through property management services or legal counsel.

2026 Rental Investment Checklist

Phase 1: Market Research

- Identify target locations based on budget and yield expectations

- Research rental demand through broker consultations and online listings

- Calculate potential yields using actual market rental rates

- Assess infrastructure development plans in target areas

Phase 2: Property Selection

- Verify RERA registration for all shortlisted projects

- Check developer credentials and completed project quality

- Inspect sample flat and review specifications

- Confirm possession timeline and penalty clauses

- Review builder-buyer agreement thoroughly

Phase 3: Financial Planning

- Arrange financing with competitive interest rates

- Calculate total investment including registration, taxes, furnishing

- Project rental income and net yield after expenses

- Plan tax optimization strategies

- Set aside contingency fund (10% of investment)

Phase 4: Purchase Execution

- Legal due diligence: title verification, encumbrance certificate

- Review payment schedule and align with construction milestones

- Verify all approvals: layout, building, occupancy (for ready properties)

- Complete registration within 30 days of possession

- Obtain khata and property tax documentation

Phase 5: Rental Preparation

- Complete necessary furnishing as per target tenant profile

- Arrange property insurance covering structure and contents

- List property on rental portals and engage brokers

- Screen tenants: employment verification, credit check, references

- Draft comprehensive rental agreement with legal registration

Frequently Asked Questions:

Is rental yield in HITEC City better than Bangalore or Pune?

Hyderabad is projected to achieve rental yields between 3-5% by 2026, competitive with other major Indian metros. HITEC City specifically offers comparable yields to Bangalore’s IT corridors but with 20-30% lower property prices, making absolute returns attractive. Pune offers similar yields but Hyderabad’s infrastructure development pace provides stronger appreciation potential.

What is the minimum investment required around HITEC City?

Entry points vary by location. Tellapur and Bachupally offer 2BHK apartments from ₹60-75 lakh, while core HITEC City requires ₹1-1.5 crore for similar configurations. Emerging areas provide affordable entry with growth potential, while established zones offer immediate rental stability.

How long does it typically take to find tenants in HITEC City?

Well-located, reasonably priced properties in core HITEC City, Gachibowli, or Financial District typically rent within 2-4 weeks. Emerging areas may take 4-8 weeks. Peak rental seasons (June-August, December-January) see faster absorption due to job relocations and year-end company transfers.

Should I buy under-construction or ready-to-move properties for rentals?

Under-Construction Advantages: 10-15% lower prices, flexible payment plans, customization options, and potential appreciation during construction.

Ready-to-Move Advantages: Immediate rental income, no construction delays, known quality and amenities, verified legal approvals.

Recommendation: For pure rental investors, ready-to-move properties start generating returns immediately. For those with 2-3 year investment horizons, under-construction properties in prime locations offer better total returns through appreciation plus rental income.

How do I calculate accurate rental yield for a property?

Step-by-Step Calculation:

1. Determine total property cost (purchase price + registration + furnishing)

2. Research market rent for comparable properties (check 5-10 similar listings)

3. Calculate annual rent (monthly rent × 12)

4. Subtract annual expenses (tax + maintenance + repairs)

5. Divide net annual income by total property cost

6. Multiply by 100 for percentage yield

Online Resources: Use rental platforms like 99acres, MagicBricks, and NoBroker to verify prevailing rental rates in your target building or locality.

What happens if IT companies reduce office presence due to remote work?

While remote work increased during 2020-2022, IT job openings in Hyderabad increased 41% in six months during FY 2024-25, and companies continue expanding physical infrastructure. Hybrid work models stabilized at 3-4 days office presence, maintaining residential demand. Additionally, Hyderabad’s diversifying economy beyond IT (pharma, finance, manufacturing) provides rental demand resilience.

Are there any hidden costs beyond property price?

One-Time Costs:

Registration & Stamp Duty: 5-7% of property value

Legal Fees: ₹25,000-50,000

GST (new properties): 5% (often included in price)

Furnishing: ₹5-15 lakh depending on scope

Maintenance Deposit: 3-6 months advance to society

Recurring Costs:

Property Tax: 0.15-0.25% of guidance value annually

Society Maintenance: ₹2-5 per sq ft monthly

Repairs/Upkeep: 1-2% of property value annually

Property Manager: 5-8% of rent (if using service)

Budget 25-30% beyond base property price to account for all initial costs.

Can NRIs invest in rental properties around HITEC City?

Yes, NRIs can freely invest in residential properties under FEMA guidelines.

Key considerations:

Investment Process:

Open NRE or NRO account with Indian bank

Power of Attorney to India-based relative/attorney for transactions

PAN card mandatory for property registration

Repatriate rental income through proper banking channels

Taxation: Rental income taxed at slab rates with TDS deducted. File Indian tax returns and claim benefits under DTAA with resident country.

Property Management: Engage professional property managers to handle tenant relations, maintenance, and rent collection remotely.

Making Your Investment Decision

HITEC City and its surrounding corridors represent Hyderabad’s most mature rental market with proven tenant demand, established infrastructure, and consistent appreciation. The 3-5% rental yields, while appearing modest, represent stable, passive income complemented by strong capital appreciation potential.

Ideal Investor Profiles:

Conservative Investors: Core HITEC City or Financial District properties with corporate tenant base, lower yields but minimal vacancy risk.

Balanced Investors: Gachibowli or Kondapur properties offering 4-5% yields with both rental stability and appreciation potential.

Growth-Focused Investors: Kokapet or Tellapur properties with emerging infrastructure, higher yields, and significant appreciation upside over 5-7 years.

The key to maximizing returns lies in thorough research, choosing quality developers, timing your entry during construction phases, and maintaining properties to attract quality tenants consistently.

Start Your Rental Investment Journey with Confidence

Investing in HITEC City’s rental market requires balancing immediate yield expectations with long-term appreciation goals. The locations highlighted in this analysis offer proven rental demand backed by employment concentration, infrastructure development, and demographic trends favoring sustained growth.

Your Next Steps:

- Assess your investment capacity and target yield expectations

- Shortlist 2-3 locations based on budget and return profile

- Visit projects and completed properties to verify quality

- Engage with reputed developers ensuring RERA compliance

- Consult tax advisors for optimized investment structuring

Real estate rewards those who act with informed conviction. Hyderabad’s rental market in 2026 presents compelling opportunities for investors willing to conduct thorough due diligence and commit to quality assets in growth corridors.

Ready to Explore Premium Rental Investment Opportunities?

Kura Homes brings nearly five decades of Hyderabad real estate expertise to help investors identify properties that deliver both rental income and long-term value. Our legacy-driven approach combines proven construction quality with strategic location selection, ensuring your investment stands the test of time.

Discover rental-ready properties in Hyderabad’s prime corridors. Connect with Kura Homes today.

Enquire About Investment Properties →

Disclaimer: Rental yields and property values mentioned are based on 2026 market data and may vary based on specific property features, location micro-factors, and market conditions. Investors should conduct independent due diligence and consult financial advisors before making investment decisions.