Table of Contents

Quick Summary for Real Estate Investors (2026)

- India office leasing crossed 90+ million sq ft (2025), directly boosting residential demand via job creation, income growth, and location clustering

- Hyderabad leads this linkage: 4 million sq ft office absorption in Q1 2025 (+30%) aligned with 13–19% residential price growth in Q3 2025

- Western Corridor dominance: ~25% of ~50,000 annual apartment sales, powered by 600,000+ IT professionals

- Key employment hubs: HITEC City, Gachibowli, Financial District Hyderabad

- GCCs leased 25.7 million sq ft nationally (+41% YoY), driving demand from high-income households (₹15–40L/year) buying ₹1.5–2.5 cr homes

- Rental performance: 4–4.5% yields near employment hubs vs 3–3.5% in peripheral areas

- Three drivers of the office→housing flywheel:

- Direct housing demand from new jobs

- Infrastructure investment triggered by commercial growth

- Investor confidence spillover from offices to residential markets

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Understanding the Commercial-Residential Nexus

What Defines the Leasing Boom?

Office leasing refers to companies renting commercial space for operations, measured in gross leasing volume (all leasing activity including fresh take-up, renewals, and pre-commitments) and net absorption (actual occupied space increase). India’s office market crossed 1 billion sq ft total stock in Q3 2025, with 2025 projected to deliver 90+ million sq ft gross leasing—the highest ever recorded.

This unprecedented volume reflects structural economic shifts including Global Capability Centre (GCC) expansion, domestic firm growth accounting for 42% of leasing, technology sector diversification beyond IT to engineering and manufacturing, flex space adoption rising to 19-23% of quarterly transactions, and green building preference with 70-80% of leasing in certified spaces.

The Direct Employment-Housing Connection

Every square foot of leased office space translates to employment, which creates housing demand. Industry standards indicate 1,000 sq ft of office space typically accommodates 7-10 employees depending on density (traditional cubicles vs open plans vs hot-desking). Therefore, 90 million sq ft of annual leasing generates 630,000-900,000 new jobs requiring residential accommodation.

Geographic Concentration Matters: Leasing isn’t evenly distributed—it concentrates in specific micro-markets (Bengaluru’s Whitefield, Hyderabad’s Financial District, Mumbai’s BKC), creating localized residential demand spikes rather than city-wide diffusion.

India’s Office Leasing Boom: The Numbers

| Metric | 2024 Performance | 2025 Projection | Growth |

| Gross Leasing Volume | 89 million sq ft | 90+ million sq ft | 15% YoY (Jan-Sep) |

| Net Absorption | 66.4 million sq ft | 70+ million sq ft | 14% YoY |

| GCC Leasing | 25.7 million sq ft | 30+ million sq ft | 41% YoY |

| Total Office Stock | 980 million sq ft | 1.05 billion sq ft | Crossed 1 billion in Q3 2025 |

| Green Building Share | 70% of leasing | 80-85% projected | Sustainability preference |

| Flex Space Share | 15% of transactions | 19-23% quarterly | Workplace evolution |

| Rental Growth (YoY) | 8% average | 10-12% in tight markets | Supply-demand gap |

Sectoral Demand Drivers

Technology & IT-BPM: 28-34% of leasing share despite declining from historical 40-50% dominance. Remains largest single sector creating residential demand for IT professionals earning ₹6-25 lakh annually.

Global Capability Centres (GCCs): 35.5% of Jan-Sep 2025 leasing (20 million sq ft), concentrated in Bengaluru (47% of GCC activity) and Pune. GCC professionals typically earn ₹12-35 lakh annually, targeting mid-premium housing (₹1-2 crore apartments).

BFSI (Banking, Financial Services, Insurance): 14-16% of leasing, primarily in Mumbai, Delhi NCR, and Hyderabad’s Financial District. High-income professionals (₹15-50 lakh annually) drive luxury housing demand.

Engineering & Manufacturing: 21% of leasing as companies establish R&D centers and operational hubs. These professionals seek family-oriented housing near schools and hospitals.

Flex Spaces: 19-23% of quarterly leasing, serving startups, freelancers, and hybrid work arrangements. Creates demand for co-living and compact apartments (1-2BHK).

City-Specific Analysis: Leasing and Residential Correlation

Hyderabad: The Perfect Case Study

Office Leasing Performance:

- Q1 2025: 4 million sq ft absorbed (30% surge YoY, highest in 5 years)

- 2024: 12.1 million sq ft total (52% growth from 2023’s 8 million sq ft)

- Total Stock: 140+ million sq ft, projected 150+ million by year-end 2025

- Rental Growth: 18.7% YoY (Q3 2025 vs Q3 2024)—highest among all Indian metros

Residential Market Response:

- Property Prices: 13-19% YoY increase (Q3 2025), led by premium segment

- Western Corridor: 25% of city’s 50,000 annual apartment sales from Financial District alone

- Gachibowli Pricing: ₹10,996 per sq ft average, with rentals at ₹56,978 monthly (3BHK)

- Luxury Segment: 58% annual growth in ₹1 crore+ apartment registrations

Causation Mechanism:

- Direct Employment: 600,000+ IT/ITeS professionals in western corridor create captive housing demand

- Income Support: IT household incomes (₹15-40 lakh annually for dual-income families) sustain premium pricing

- Rental Demand: Corporate relocations and new hires fill rental inventory at 4-4.5% yields

Bengaluru: The Leasing Leader

Office Performance:

- Q3 2025: 4.2 million sq ft leased (highest among all cities)

- 2024: 21.7 million sq ft absorbed (highest-ever annual figure)

- GCC Concentration: 47% of national GCC leasing activity (₹12 million sq ft in 2024)

Residential Impact:

- Whitefield, Sarjapur, and ORR corridors experiencing 12-18% annual residential appreciation

- 2-3BHK apartments priced ₹1.2-2 crore absorbing fast due to IT employee demand

- Rental yields: 4-5% in employment-adjacent areas vs 3-3.5% in peripheral zones

Lesson for Investors: Proximity to office concentrations (within 5-10 km) commands 15-20% price premiums and superior rental yields.

Delhi NCR: The Emerging Powerhouse

Office Momentum:

- Q2 2025: 4.6 million sq ft leased (68% QoQ increase)

- Gurugram Dominance: 70% of NCR leasing, driven by GCCs and domestic enterprises

- Infrastructure: Metro expansion and expressways reducing commute times

Residential Correlation:

- Gurugram Sectors 104-115: 14-16% annual appreciation aligned with Cyber Hub office expansion

- Noida and Greater Noida: Emerging residential demand as companies establish satellite offices

- DLF and Huda City Centre: Premium apartments (₹12,000-18,000 per sq ft) absorbing due to BFSI professional demand

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Three Pillars of Commercial-Residential Linkage

Pillar 1: Direct Employment Generation

Quantifying the Impact:

- 90 million sq ft annual leasing = 630,000-900,000 new jobs

- Assuming 60% are relocations (need housing): 378,000-540,000 residential units demanded annually

- Average household size: 2.5 persons per unit

- Total population needing accommodation: 945,000-1.35 million people

Housing Configuration Preference:

- Single professionals (30% of workforce): 1BHK or co-living (₹30-60 lakh budget)

- Young couples (35% of workforce): 2BHK apartments (₹70 lakh-1.2 crore)

- Families with children (25% of workforce): 3BHK apartments (₹1.2-2 crore)

- Senior executives (10% of workforce): 3.5-4BHK or villas (₹2-5 crore)

Geographic Concentration: IT hubs (Bengaluru, Hyderabad, Pune) absorb 65-70% of new tech employees, creating micro-market residential spikes rather than city-wide diffusion.

Pillar 2: Infrastructure Investment Catalysis

Commercial development triggers infrastructure upgrades that enhance residential attractiveness including metro extensions connecting office hubs to residential zones, road widening and flyovers reducing commute times, civic amenity development (water supply, sewage, electricity upgrades), and retail and F&B ecosystem establishment serving both office workers and residents.

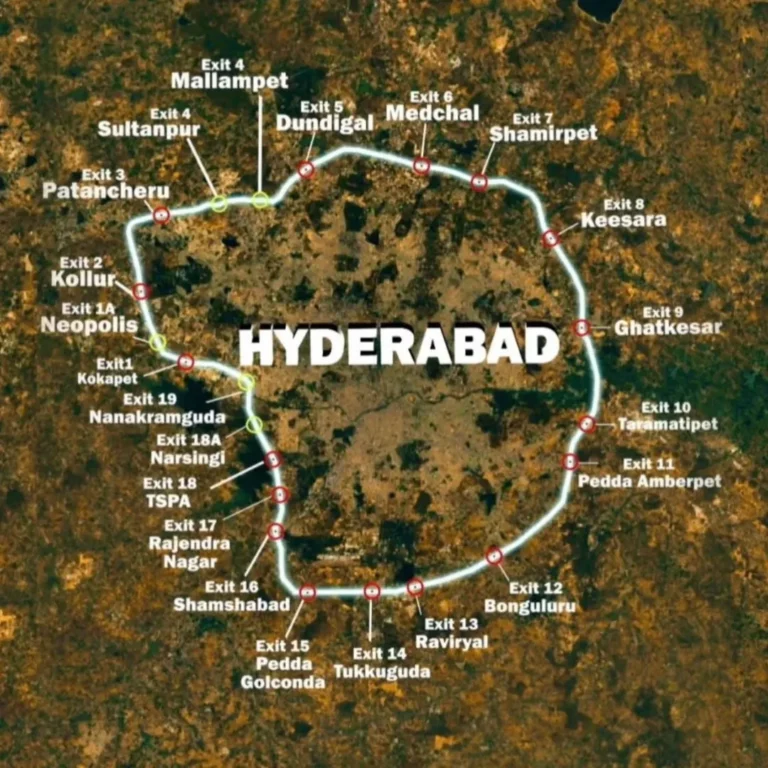

Example: Hyderabad’s Western Corridor

- Initial IT park development (1990s-2000s): HITEC City and Gachibowli

- Infrastructure response: Outer Ring Road, metro lines, road network improvements

- Residential consequence: Property values appreciated 150-200% (2012-2022) post-ORR completion

- Current status: Self-sustaining ecosystem with schools, hospitals, malls supporting 600,000+ residents

Investment Insight: Buy residential properties near announced (not yet completed) office developments. Infrastructure follows employment, not vice versa. Early entrants capture maximum appreciation as infrastructure materializes.

Pillar 3: Investor Confidence Spillover

Strong office leasing signals economic vitality, encouraging residential investment through developers allocating capital to residential projects near employment zones, homebuyers willing to pay premiums for proximity to work, investors recognizing stable rental demand from corporate tenants, and financial institutions offering favorable financing for employment-adjacent properties.

Data Correlation:

- Cities with 10+ million sq ft annual office leasing: 12-18% residential appreciation

- Cities with 5-10 million sq ft leasing: 8-12% residential appreciation

- Cities with under 5 million sq ft leasing: 6-8% residential appreciation

The confidence multiplier operates bidirectionally—office leasing boom validates residential investment, while residential development attracts more companies seeking employee housing access.

Rental Market Dynamics: The Immediate Impact

Rental Yield Premium in Employment Zones

| City & Location | Proximity to Office Hub | Property Price | Monthly Rent | Gross Rental Yield |

| Hyderabad – Gachibowli | Within 2 km of HITEC City | ₹1.5 crore (3BHK) | ₹60,000 | 4.8% |

| Hyderabad – Kondapur | 3-5 km from Financial District | ₹1.3 crore (3BHK) | ₹50,000 | 4.6% |

| Hyderabad – Manikonda | 5-7 km from Gachibowli | ₹1.1 crore (3BHK) | ₹40,000 | 4.4% |

| Hyderabad – Miyapur | 10+ km from western corridor | ₹90 lakh (3BHK) | ₹28,000 | 3.7% |

| Bengaluru – Whitefield | Adjacent to tech parks | ₹1.8 crore (3BHK) | ₹70,000 | 4.7% |

| Bengaluru – Sarjapur | Within 5 km of ORR offices | ₹1.4 crore (3BHK) | ₹55,000 | 4.7% |

Key Insight: Every kilometer away from major office concentrations reduces rental yields by 0.1-0.15 percentage points and absolute rental income by ₹3,000-5,000 monthly.

Tenant Profile and Lease Stability

Corporate Relocations:

- Companies offering housing allowances (₹15,000-50,000 monthly depending on role)

- Multi-year assignments ensuring 2-3 year lease stability

- Professional property management through corporate housing divisions

Individual Tech Professionals:

- Dual-income IT couples (combined ₹15-35 lakh annually) seeking 2-3BHK

- Preference for gated communities with amenities eliminating need for external club memberships

- Willingness to pay 10-15% premiums for 15-20 minute commutes

Flex Space Workers:

- Freelancers, startup employees, remote workers

- Demand for 1-2BHK or co-living near co-working hubs

- Shorter lease terms (6-12 months) but consistently high demand

Investment Recommendation: Target 2-3BHK apartments in established gated communities within 5 km of major office clusters. Yields of 4.5-5% with tenant stability and annual rent escalations of 5-7%.

Future Outlook: 2026 and Beyond

Projected Office Leasing Trajectory

2026 Forecast:

- Gross Leasing: 95-100 million sq ft (continuing upward trend)

- New Supply: 60-65 million sq ft Grade A space

- Vacancy Rates: Declining to 15-16% (from current 16.2%)

- Rental Growth: 10-12% in tight markets (Bengaluru, Pune, Mumbai, Hyderabad)

- GCC Expansion: 33-35 million sq ft (sustained growth as India becomes global innovation hub)

Sectoral Evolution:

- Technology maintaining 25-28% share (absolute growth despite declining percentage)

- Engineering & Manufacturing growing to 23-25% (domestic manufacturing push)

- BFSI stabilizing at 15-16% (digital banking expansion)

- Flex spaces reaching 20-22% (hybrid work normalization)

Residential Demand Implications

Employment-Driven Housing Need:

- 95 million sq ft = 665,000-950,000 new jobs

- Assuming 55% need new housing: 365,000-523,000 residential units required annually

- Geographic concentration: Tier I cities (Bengaluru, Hyderabad, Pune, NCR, Mumbai) absorbing 75-80%

Price Appreciation Forecast (2026-2030):

- Employment-adjacent zones (Gachibowli, Whitefield, Gurugram Cyber Hub): 12-15% annual appreciation

- Secondary employment zones (Kondapur, Sarjapur, Noida): 10-13% annual appreciation

- Emerging corridors (Kokapet, Narsingi, Greater Noida): 14-18% annual appreciation as office development materializes

Investor Strategy:

- Immediate Returns: Purchase ready-to-move apartments in established employment zones for 4-5% rental yields

- Medium-Term Appreciation: Buy under-construction properties near announced office parks for 12-15% annual gains

- Long-Term Growth: Invest in emerging corridors where office development is planned but not yet commenced for 16-20% appreciation as infrastructure catches up

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Risk Factors and Mitigation

Potential Headwinds

Global Economic Uncertainty:

- Trade tensions and geopolitical conflicts could slow GCC expansion

- Technology layoffs impacting residential demand in IT-heavy cities

- Mitigation: Diversify across sectors—target areas with mixed employment (IT + BFSI + engineering) rather than single-sector dependency

Work-From-Home Normalization:

- Sustained remote work reducing office space per employee

- Professionals relocating to tier-2 cities or hometowns

- Reality Check: Despite remote work fears, office leasing has grown 14-15% annually since 2023, indicating hybrid models still require significant office presence. Tier I cities retain talent attraction advantages.

Oversupply in Select Micro-Markets:

- Rapid residential construction in speculative areas without matching employment growth

- Example: Gachibowli’s potential oversupply capping rent growth

- Mitigation: Verify employment density through office leasing data before purchasing. Avoid areas with 5+ years of residential supply pipeline exceeding historical absorption rates.

Infrastructure Delivery Delays:

- Delayed metro extensions or road projects reducing location attractiveness

- Mitigation: Prioritize areas with completed or under-construction (not just announced) infrastructure. Verify project timelines through government portals.

Investment Checklist: Capitalizing on the Leasing-Residential Link

Phase 1: Market Selection

- Identify cities with 10+ million sq ft annual office leasing (Bengaluru, Hyderabad, Pune, NCR)

- Research sectoral composition (diversified better than single-sector dependent)

- Verify 3-5 year office supply pipeline indicating sustained employment growth

- Check infrastructure development plans (metro, roads, civic amenities)

Phase 2: Micro-Market Analysis

- Map office concentrations (HITEC City, Whitefield, Cyber Hub, etc.)

- Identify 5-10 km radius residential catchment areas

- Analyze current rental rates and yields for comparable properties

- Assess residential supply pipeline (avoid oversupplied micro-markets)

- Visit area during different times (morning commute, evening, weekend) evaluating traffic, amenities, livability

Phase 3: Property Selection

- Target 2-3BHK configurations (highest tenant demand from IT professionals)

- Prioritize gated communities with amenities (swimming pools, gyms, clubhouses)

- Verify proximity to schools and hospitals (family-oriented tenants prioritize these)

- Confirm metro/bus connectivity (commute ease critical for renters)

- Check developer reputation and RERA compliance (quality and timely delivery)

Phase 4: Financial Analysis

- Calculate total investment (property + registration + furnishing)

- Project rental income based on comparable properties (verify with 3-5 listings)

- Estimate net rental yield after maintenance, taxes, and vacancy periods

- Model 5-year appreciation using historical data for the micro-market

- Assess total returns (rental income + capital appreciation)

Phase 5: Execution

- Arrange home loan pre-approval (80-90% LTV available for employment-adjacent properties)

- Conduct legal due diligence (title verification, encumbrance certificate, society NOCs)

- Negotiate pricing (resale properties offer 5-10% negotiation room)

- Plan furnishing strategy (semi-furnished earns 15-20% rental premium with lower depreciation than fully furnished)

- Engage property management services for tenant placement and maintenance

Frequently Asked Questions (FAQs)

How fast does housing demand respond?

- 0–12 months: Rentals tighten; yields rise 0.3–0.5%

- 1–3 years: Buyer demand picks up; prices grow 8–12%

- 3–5 years: Infrastructure + developer activity; 35–50% cumulative growth

- 5–10 years: Mature ecosystems; prices stabilize 80–120% above pre-growth levels

Do all office jobs impact housing equally?

No.

- IT/ITeS: Core demand for 2–3BHKs near offices

- GCCs & BFSI: Disproportionate demand for ₹1.5–3 cr premium homes

- Manufacturing/Engineering: Family housing near schools

- Flex/startups: Affordable homes & co-living

Can investors use office leasing data?

Yes—it’s a 12–24 month leading indicator. Pair leasing data with supply pipeline checks, infra timelines, and developer quality before buying.

Ideal distance from office hubs?

- 2–5 km: Max rents, lower upside

- 5–10 km (sweet spot): Best balance—12–15% appreciation + strong rentals

- 10–15 km: Higher upside, higher risk

- 15 km+: Speculative unless infra is guaranteed

Upcoming offices or established hubs?

- Upcoming: Higher upside (18–25%), higher risk (best for 7–10 yrs)

- Established: Immediate income (4–5% yields), lower volatility

- Best strategy: 60–70% established + 30–40% emerging

Impact of hybrid work?

Hybrid hasn’t reduced demand—office leasing hit 90+ mn sq ft in 2025. Companies lease better, not less, sustaining nearby housing demand.

Is this NRI-friendly?

Yes. Office-hub housing offers stable tenants, professional property management, 4–4.5% yields, and 10–13% appreciation—ideal for long-term NRI portfolios.

Conclusion: The Inseparable Link

Office leasing growth is the foundation of residential demand. Track where jobs concentrate, verify infra delivery, and invest before prices adjust.

Markets like Hyderabad (Western Corridor), Whitefield (Bengaluru), and Cyber Hub (Gurugram) prove the rule:

Employment creates housing demand—predictably and profitably.

Build Your Portfolio with Employment-Driven Intelligence

With decades of local expertise, Kura Homes helps investors align property choices with real economic drivers not hype.

Explore residential opportunities in Hyderabad’s employment-rich corridors. Connect with Kura Homes today.

Discover Strategic Properties →

Disclaimer: Insights are based on 2025–26 industry reports (JLL, Colliers, Cushman & Wakefield, Knight Frank). Outcomes may vary due to market, policy, or location factors. Investors should conduct independent due diligence and seek professional advice. Past performance does not guarantee future returns.