Table of Contents

Hyderabad continues to rise as one of India’s strongest property investment destinations, especially for Non-Resident Indians (NRIs) seeking long-term stability, rental income, and secured asset growth.

With the city’s robust IT ecosystem, expanding global corporate presence, improved public infrastructure, and a reputation for safety, NRIs are increasingly turning to Hyderabad for residential and commercial real estate purchases.

NRI Quick Checklist: Buying Property in Hyderabad (2026)

Before finalizing any property purchase in Hyderabad, NRIs should run through this quick checklist to avoid legal, financial, or tax-related issues:

- Confirm your NRI / OCI / PIO status under FEMA regulations

- Ensure the property type is legally permitted (residential or commercial only)

- Verify TS-RERA registration number on the official portal

- Check clear land title, encumbrance certificate, and local authority approvals

- Confirm all payments will be routed through NRE / NRO / FCNR accounts

- Obtain a valid PAN card for taxation and registration purposes

- Review sale agreement terms, possession timeline, and penalty clauses

- Check escrow account compliance for under-construction projects

- Evaluate home loan eligibility and EMI affordability if financing

- Appoint a notarized / embassy-attested Power of Attorney if abroad

- Understand rental income tax, TDS, and capital gains implications

- Review repatriation limits and RBI guidelines before exit planning

- Choose a reputed, RERA-compliant developer with a strong delivery record

Tip for NRIs:

Projects from trusted developers like Kura Homes simplify documentation, compliance, and coordination especially when managing the purchase remotely.

Important Disclaimer for NRI Buyers

Disclaimer:

Tax laws, FEMA regulations, TDS rates, and repatriation rules are subject to change based on government policies and amendments. NRIs are strongly advised to consult a qualified tax advisor, chartered accountant, or legal professional before making property investment decisions in India to ensure full compliance with the latest regulations.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

What is NRI Property Investment?

NRI property investment refers to the purchase of residential or commercial real estate in India by Non-Resident Indians, Overseas Citizens of India (OCI), or Persons of Indian Origin (PIO). These investments must comply with FEMA regulations, use legitimate banking channels, and follow specific taxation and repatriation rules.

For NRIs, investing in Indian property requires clarity, legal awareness, financial planning, and a strong understanding of taxation norms. This comprehensive guide breaks down everything an NRI must know—eligibility rules, documentation, loan procedures, taxation policies, FEMA guidelines, and practical steps to ensure a secure investment.

Reliable developers like Kura Homes make the entire experience smoother for NRIs by offering clarity in documentation, timely updates, and legally compliant developments.

Why Hyderabad Is a Prime Destination for NRI Property Investment

Hyderabad has transformed dramatically over the past decade, positioning itself firmly among India’s top real estate markets. What makes it particularly attractive to NRIs is its unique combination of affordability and world-class infrastructure.

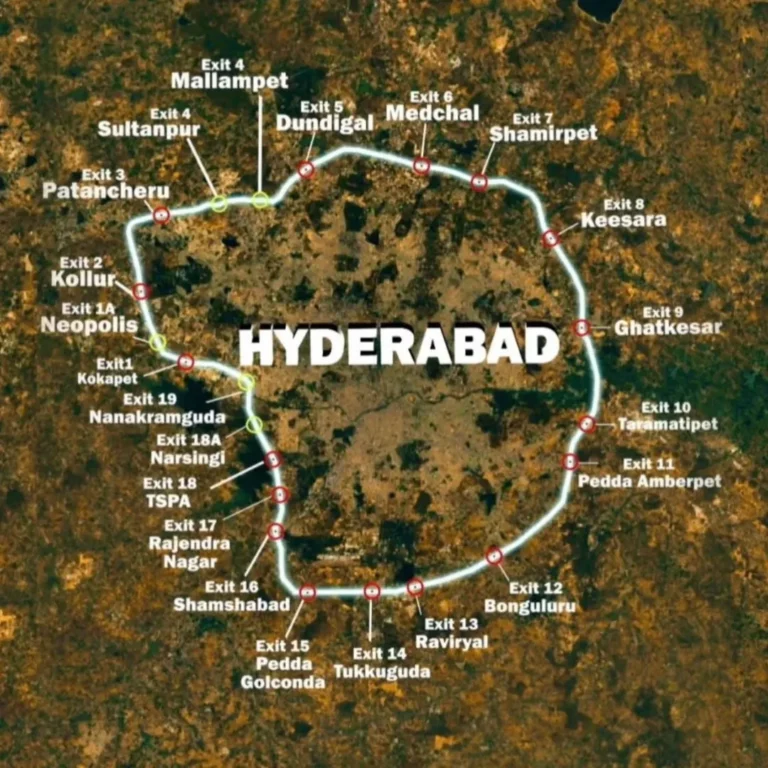

Unlike excessively priced metros, Hyderabad maintains balanced property rates while offering excellent connectivity through the Outer Ring Road, expanding metro lines, and proximity to the international airport.

The rising demand for gated communities, premium 2 & 3 BHK apartments, and villa projects has made it easier for NRIs to find properties that match global living standards. Developers like Kura Homes have contributed significantly to this demand by designing projects that combine luxury, practicality, and strong resale potential.

Table: Why NRIs Choose Hyderabad Over Other Indian Cities

| Factor | Hyderabad | Bangalore | Mumbai | Pune |

| Property Affordability | High | Medium | Low | Medium |

| IT/Corporate Growth | Very High | Very High | High | High |

| Infrastructure Development | Excellent | Good | Good | Good |

| Rental Yield Potential | 3-4% | 2-3% | 2-3% | 3-4% |

| Traffic & Pollution Levels | Low | High | Very High | Medium |

| Safety & Livability | High | Medium | Medium | High |

| Airport Connectivity | Excellent | Good | Excellent | Good |

| RERA Implementation | Strong | Strong | Strong | Strong |

Eligibility & Legal Framework for NRIs Buying Property in India

Understanding Who Qualifies Under FEMA Regulations

India’s real estate laws for NRIs fall under the Foreign Exchange Management Act (FEMA), which defines who qualifies as an NRI, OCI, or PIO. An NRI is someone residing outside India for employment, business, or other reasons indicating an intent to stay abroad for an uncertain period.

OCI cardholders, though residing abroad permanently, retain many rights similar to NRIs, including buying residential property in India. Understanding these classifications is crucial, as documentation and repatriation rules differ slightly between categories.

Types of Properties NRIs Can Legally Buy

FEMA permits NRIs to purchase residential and commercial properties freely. There is no restriction on the number of such properties an NRI can own. However, they are not allowed to buy agricultural land, plantation land, or farmhouses, unless inherited or gifted.

This ensures that NRI investment stays focused on urban and planned development zones.

Key FEMA Compliance Points

All property transactions must follow legitimate banking channels. Payments must be made through NRE, NRO, or FCNR accounts. Cash transactions are prohibited for NRI purchases.

Additionally, NRIs should ensure that the project is registered under RERA, an essential step that provides protection against legal discrepancies, delayed construction, and quality issues. Developers like Kura Homes follow strict RERA compliance, helping NRIs avoid regulatory hurdles and giving confidence in project transparency.

Table: NRI Property Buying Rights Under FEMA (2026)

| Property Type | Can NRIs Buy? | Restrictions/Conditions |

| Residential Apartments | Yes | No limit on number of properties |

| Residential Villas | Yes | Must be in approved layouts |

| Commercial Properties | Yes | Shops, offices, warehouses allowed |

| Agricultural Land | No | Exception: inheritance or gift only |

| Farmhouses | No | Not permitted under FEMA |

| Plantation Property | No | Restricted category |

Documentation Required for NRI Property Purchases

Primary Identification & Residential Proofs

NRIs must provide a valid passport, proof of overseas residency (visa or foreign work permit), and an overseas address proof. Those who hold OCI cards must submit their OCI documentation as part of the verification process.

Indian Financial Documents

A PAN card is mandatory for property transactions in India, as it is required for tax deduction processes, registration, and repatriation. NRIs also need NRE/NRO bank account details to facilitate payment flows.

While Aadhaar is not compulsory for NRIs, it helps simplify verification, especially for taxation and KYC processes.

Builder & Property-Related Documents

Ensuring that the builder provides proper title deeds, RERA details, approved layout plans, municipal clearances, and no-objection certificates is essential. Many reputed developers, including Kura Homes, keep these documents readily available for NRI buyers, reducing the burden of verification.

NRI Property Purchase Checklist (2026)

- Verify your NRI/OCI/PIO status under FEMA regulations

- Confirm the property type is legally allowed for NRIs

- Check RERA registration number and project approval status

- Review builder track record and past project delivery timelines

- Obtain clear title deed verification and encumbrance certificate

- Open NRE/NRO/FCNR bank account for payment transactions

- Ensure PAN card is active and linked to Indian tax records

- Prepare notarized or embassy-attested Power of Attorney (if needed)

- Confirm stamp duty rates and registration charges for the state

- Review taxation implications: rental income, capital gains, TDS

- Understand repatriation limits and RBI compliance requirements

- Inspect property construction quality and possession readiness

Home Loan Options & Banking Requirements for NRIs

Eligible Loan Providers

Almost all major Indian banks, NBFCs, and housing finance companies offer dedicated NRI home loans. Interest rates are competitive, and loan tenures usually extend up to 20–25 years depending on the applicant’s age and employment stability.

Required Documents for Loan Approval

Banks require NRIs to submit employment contracts, salary slips, overseas bank statements, passport copies, and credit history details. They may also request notarized or embassy-attested copies of documents to verify authenticity.

Loan Disbursement & Repayment Rules

Loan amounts are disbursed directly to the builder according to project construction stages. Repayments must be made through NRE or NRO accounts only, ensuring that all transactions comply with RBI guidelines. EMIs cannot be paid using foreign currency directly.

Importance of Power of Attorney (PoA)

Since NRIs live abroad, appointing a trusted PoA holder helps ensure timely signing of documents, completion of registrations, and handling of loan formalities. The PoA must be notarized or attested by the Indian Embassy in the country of residence, ensuring its legal validity in India.

Table: NRI Home Loan Key Details (2026)

| Aspect | Details |

| Loan Amount | Up to 80-85% of property value |

| Interest Rate Range | 8.5% – 10.5% per annum (varies by bank) |

| Loan Tenure | Up to 20-25 years |

| Repayment Method | Through NRE/NRO accounts only |

| Processing Fee | 0.5% – 1% of loan amount |

| Prepayment Charges | Nil for floating rate loans (usually) |

| Required Documents | Passport, visa, salary slips, bank statements, PAN, property documents |

| Disbursement Method | Directly to builder as per construction stages |

Step-by-Step Guide to Buying Property in Hyderabad as an NRI

Step 1: Shortlisting the Property

NRIs should start by examining location advantages, builder history, community offerings, and price appreciation trends. Hyderabad’s emerging hubs like Nallagandla, Tellapur, Bachupally, Kokapet, and Financial District consistently attract NRI investors.

Many NRIs begin with preliminary research on developers like Kura Homes, where clear project information is available.

Step 2: Verifying Legal Approvals

Before booking, NRIs must confirm RERA registration, title clarity, municipality approvals, and construction licenses. This step prevents legal disputes and ensures the project adheres to regional regulations.

Step 3: Agreement Signing & Payment Process

Once the property is selected, NRIs must review the agreement of sale carefully. It outlines construction timelines, payment structures, possession dates, and penalty clauses. Payments should only be made through approved Indian banking routes to maintain financial compliance.

Step 4: Possession, Handover & Registration

During possession, buyers must ensure the property is completed per the agreement. Registration requires payment of stamp duty, registration charges, and submission of identity papers. NRIs may need to provide biometric verification, which can be completed through the PoA if they are abroad.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Taxation Rules for NRIs Buying Property in India

Income Tax on Rental Earnings

Rental income earned in India is taxable for NRIs. However, deductions such as interest on home loans (Section 24(b)) and municipal taxes are allowed. Tenants must deduct TDS before paying rent to NRIs, which can later be adjusted when filing tax returns.

Capital Gains Tax on Property Sale

When NRIs sell property in India, they must pay capital gains tax. Short-term gains apply if the property is held for under two years, while long-term gains apply if held longer. Long-term capital gains benefit from indexation and can be exempted under Section 54 or 54EC.

TDS on Property Transactions

For property sales, the buyer must deduct TDS at source. NRIs must ensure correct PAN and bank documentation to avoid delays or issues.

Repatriation Rules

RBI allows NRIs to repatriate sale proceeds within specific limits, provided documentation such as tax-paid certificates and sales records is submitted. Funds must be routed through NRE or NRO accounts following FEMA guidelines.

Table: NRI Taxation on Property Transactions (2026)

| Transaction Type | Tax Applicable | TDS Rate | Deduction Available |

| Rental Income | As per income tax slab | 30% (by tenant) | Section 24(b) – Home loan interest |

| Short-Term Capital Gains | As per income tax slab | 20% (by buyer on sale) | No indexation benefit |

| Long-Term Capital Gains | 12.5% (after indexation) | 20% (by buyer on sale) | Section 54, 54EC exemptions |

| Property Purchase | No income tax | No TDS | Stamp duty & registration charges apply |

Common Mistakes NRIs Should Avoid

Not Checking Developer Track Record

NRIs must research the developer’s credibility, RERA status, and past project performance. Visiting the developer’s website helps NRIs verify transparency and reliability.

Ignoring Taxation Rules & FEMA Restrictions

Incomplete understanding of tax deductibles, TDS obligations, or repatriation limits can lead to financial penalties. NRIs should consult tax professionals for compliance clarity.

Overlooking Location Growth Potential

Choosing a property based solely on pricing without evaluating the neighborhood’s future development can impact long-term returns. Areas with IT growth and infrastructure expansion offer better appreciation.

Incorrect Documentation or PoA Issues

Improperly attested PoA documents may delay loan approvals, registrations, or legal processes. Ensuring accuracy and embassy validation is crucial.

Why NRIs Prefer Hyderabad Over Other Cities

Hyderabad provides unmatched stability, affordability, and investment potential. The city’s low pollution, low crime rates, and expanding corporate footprint make it ideal for long-term investment.

Its strong infrastructure, IT dominance, and planned urban expansion ensure that property values remain resilient even during market fluctuations. Developers like Kura Homes choose strategic locations aligned with growth trends, offering NRIs homes that appreciate steadily while providing premium living standards.

How Trusted Developers Like Kura Homes Simplify NRI Investments

Reputable developers significantly ease the buying process for NRIs through transparent documentation, RERA compliance, easy communication channels, and structured construction updates.

Kura Homes, known for thoughtful layouts and well-planned communities, offers properties that appeal to both lifestyle and investment-oriented NRIs. Their platform provides complete project information, making long-distance decision-making smooth and reliable.

Frequently Asked Questions:

Can NRIs buy property in India?

Yes. NRIs can freely purchase residential and commercial properties in India under FEMA regulations. However, they cannot buy agricultural land, farmhouses, or plantation properties unless inherited or received as a gift.

What documents do NRIs need to buy property in Hyderabad?

NRIs need a valid passport, overseas residency proof (visa/work permit), PAN card, NRE/NRO bank account details, OCI card (if applicable), and overseas address proof. Additionally, property-related documents like RERA registration, title deed, and sale agreement are required.

Can NRIs get home loans in India?

Yes. Most Indian banks and housing finance companies offer NRI home loans with competitive interest rates ranging from 8.5% to 10.5%. Loan tenure can extend up to 20-25 years, and repayment must be made through NRE or NRO accounts.

How is rental income from Indian property taxed for NRIs?

Rental income is taxable at 30% TDS (deducted by the tenant). NRIs can claim deductions under Section 24(b) for home loan interest and municipal taxes when filing income tax returns in India.

What is the TDS rate on property sale for NRIs?

The buyer must deduct 20% TDS on the sale amount if the property value exceeds ₹50 lakhs. This TDS can be adjusted when the NRI files their capital gains tax return.

Can NRIs repatriate funds after selling property in India?

Yes, but with restrictions. NRIs can repatriate up to USD 1 million per financial year after paying applicable capital gains tax and submitting required documentation to the bank, including tax payment certificates.

Is RERA compliance mandatory for NRI property purchases?

Yes. RERA registration protects buyers from project delays, fund misuse, and construction quality issues. NRIs should always verify the RERA registration number on the state’s RERA website before booking.

Do NRIs need a Power of Attorney to buy property in India?

While not mandatory, a Power of Attorney (PoA) simplifies the buying process significantly. It allows a trusted representative in India to sign documents, complete registrations, and handle banking formalities on the NRI’s behalf. The PoA must be notarized or attested by the Indian Embassy.

Which areas in Hyderabad are best for NRI investment?

Top areas include Gachibowli, Financial District, Kokapet, Tellapur, Nallagandla, Bachupally, and Kompally. These areas offer proximity to IT hubs, excellent infrastructure, and strong rental demand from working professionals.

What are the stamp duty and registration charges in Hyderabad for NRIs?

As of 2026, stamp duty in Telangana is approximately 4-5% of the property value, and registration charges are around 1%. These rates may vary based on property location and type.

Conclusion: Why Hyderabad Is a Smart Investment for NRIs

Hyderabad continues to stand out as one of the most reliable property markets for NRIs combining strong returns, low risk, excellent connectivity, and a development pace that is both sustainable and future-ready.

Understanding legal compliance, taxation rules, and loan procedures ensures that NRIs can invest confidently and enjoy long-term rewards.

Choosing trusted developers like Kura Homes adds an additional layer of security, transparency, and convenience, ensuring that every stage of the buying process from selection to possession remains seamless. NRIs seeking secure, high-quality residential options can explore available projects and begin their investment journey with confidence.