Table of Contents

Hyderabad’s real estate market continues to captivate investors and homebuyers alike as we head toward 2026. The city’s transformation from a historic pearl trading center to India’s technology powerhouse has created unprecedented opportunities in specific micro-markets. Understanding which localities will drive the next wave of growth can help you make informed investment decisions that align with both short-term gains and long-term wealth creation.

Quick Summary: Hyderabad Real Estate 2026 Investment Outlook

- According to Q3 2025 market reports, property prices increased 13–19% year-on-year, signaling robust momentum that experts expect to continue through 2026

- Kokapet leads at ₹9,000 per sq ft premium tech hub status

- Kollur offers highest ROI potential at 12-15% annually with +116% 5-year appreciation

- Tellapur provides mid-segment entry with 12-14% ROI expectations

- Local rental market indicators suggest average monthly rents in Narsingi hover around ₹31,650 due to sustained demand from Financial District professionals.

- Peripheral areas projected to account for 20-25% of new Grade A office supply

- Premium segment (₹1 crore+) now represents 18% of registrations

- Metro Phase II expansion will drive 8-12% appreciation in connected areas

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

The Hyderabad Advantage: Why 2026 Looks Promising

Emerging micro-markets are localities in Hyderabad that are transitioning from peripheral or underdeveloped areas into high-demand residential and commercial zones. These areas benefit from infrastructure development, employment hub proximity, and developer confidence, offering investors higher appreciation potential compared to established neighborhoods.

The fundamentals supporting Hyderabad’s real estate surge remain exceptionally strong. Property prices increased by 13-19% year-on-year in Q3 2025, signaling robust momentum that experts anticipate will continue through 2026. This growth isn’t happening in isolation it’s backed by solid economic drivers including high office leasing activity, rising demand for premium homes, and favorable macroeconomic conditions.

Urban development assessments and long-term city planning data indicate that what sets Hyderabad apart from other Indian metros is its balanced approach to growth. The city’s journey has been shaped by long-term planning, strong civic governance, and expanding employment corridors. The rise of established hubs like HITEC City and Gachibowli has created spillover demand that’s now transforming peripheral areas into tomorrow’s prime locations.

Comparative housing price benchmarks across Indian metros show that Hyderabad’s affordability versus cities like Bengaluru and Mumbai remains a significant draw for both investors and end-users. Even as prices appreciate steadily, Hyderabad still offers better value per square foot, especially in emerging corridors where infrastructure development is rapidly closing the gap with established neighborhoods.

Table: Hyderabad vs Other Indian Metros (2026 Investment Comparison)

| Factor | Hyderabad | Bengaluru | Mumbai | Pune |

| YoY Price Growth (2025) | 13-19% | 8-12% | 5-8% | 10-14% |

| Average Price (per sq ft) | ₹6,000-9,000 | ₹8,000-12,000 | ₹15,000-25,000 | ₹7,000-10,000 |

| Rental Yield | 3-4% | 2-3% | 2-3% | 3-4% |

| IT Sector Growth | Very High | Very High | High | High |

| Infrastructure Development | Excellent | Good | Good | Good |

| Affordability Index | High | Medium | Low | Medium |

| Office Leasing Activity | 2.83M sq ft (Q3 2025) | Strong | Moderate | Moderate |

Emerging Micro-Markets: The New Growth Frontiers

Kokapet: The Premium Powerhouse

Kokapet has emerged as one of Hyderabad’s most compelling micro-markets for 2026. Recent residential pricing trackers indicate that property values in Kokapet have reached approximately ₹9,000 per square foot, reflecting its transformation into a premium residential and commercial hub.

The strategic advantages are clear. Located within 10-15 minutes of the Financial District and Gachibowli, Kokapet offers IT professionals the perfect combination of accessibility and elevated living standards. The development of the Kokapet SEZ and Golden Mile Business District has attracted major developers, resulting in a surge of luxury apartments and gated communities.

New project launch data from leading developers shows that builders such as Prestige, My Home, Godrej, and Poulomi are actively launching projects in Kokapet, highlighting strong developer confidence. The presence of HMDA-approved layouts and well-planned civic amenities provides the infrastructure backbone necessary for sustained appreciation.

Investment potential in Kokapet extends beyond residential properties. Kokapet is being developed as a luxury-tech hub with high-quality commercial spaces, creating opportunities across multiple real estate segments. For investors seeking premium properties with strong rental demand, Kokapet represents an ideal entry point before prices surge further.

Tellapur: The Connectivity Champion

Tellapur has evolved into a premium residential corridor with excellent connectivity to Gachibowli and the Financial District. What makes Tellapur particularly attractive for 2026 is its infrastructure trajectory the area benefits from new link roads, the Nallagandla-Tellapur flyover, and upcoming metro expansion plans.

The micro-market offers diverse housing options, from luxury apartments to expansive villa communities. Based on current transaction trends and investor return estimates, apartment prices in Tellapur range between ₹76.7 lakhs and ₹2.17 crores, with ROI potential of 12–14%, making it accessible to mid-segment buyers while still offering strong appreciation prospects.

Educational infrastructure strengthens Tellapur’s family appeal, with institutions like Samashti International School and Glendale International nearby. This combination of connectivity, amenities, and growth potential positions Tellapur as a micro-market that will mature significantly by 2026.

Tellapur is witnessing a surge in residential projects, with a focus on luxury apartments and villas, and is poised to offer significant returns for early investors. The area’s transformation from a quiet suburb to a sought-after residential destination mirrors the trajectory that Gachibowli experienced a decade ago.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Narsingi: The High-Rise Horizon

Narsingi has carved out a unique identity in Hyderabad’s real estate landscape. The skyline is defined by high-rise residential towers, some of the tallest in the city, with average prices around ₹6,431 per square foot. This vertical development strategy maximizes land use while offering residents impressive city views and modern amenities.

Strategic location drives Narsingi’s appeal. Its position near the Financial District and seamless connectivity via the Outer Ring Road makes it highly attractive to corporate professionals. The presence of leading developers and large-scale townships ensures consistent buyer and tenant demand, Local rental market indicators suggest that Narsingi delivers strong rental yields averaging ₹31,650 per month, driven by proximity to the Financial District.

The micro-market benefits from proximity to both employment hubs and essential services. Top-tier hospitals such as Continental Hospital and Care Hospital are easily accessible, while reputed educational institutions serve families choosing to settle in the area. This comprehensive ecosystem supports both end-users and investors.

Looking ahead to 2026, Narsingi’s development trajectory suggests continued appreciation. The ongoing expansion of commercial zones around the area and upcoming metro connectivity will further enhance its value proposition for premium housing seekers.

Kollur: The Affordable Opportunity

For investors seeking strong appreciation potential at more accessible price points, Kollur represents an exceptional opportunity. The area offers attractive entry points with ROI expectations between 12 and 15% annually, making it ideal for first-time investors and those looking to build a diversified real estate portfolio.

Longitudinal price movement data from residential market trackers shows that property prices in Kollur have risen by 19.8% in one year and 116.1% over the past five years, demonstrating consistent upward momentum that shows no signs of slowing. Current apartment prices hover around ₹6,050 per square foot, offering significant value compared to established western corridor locations.

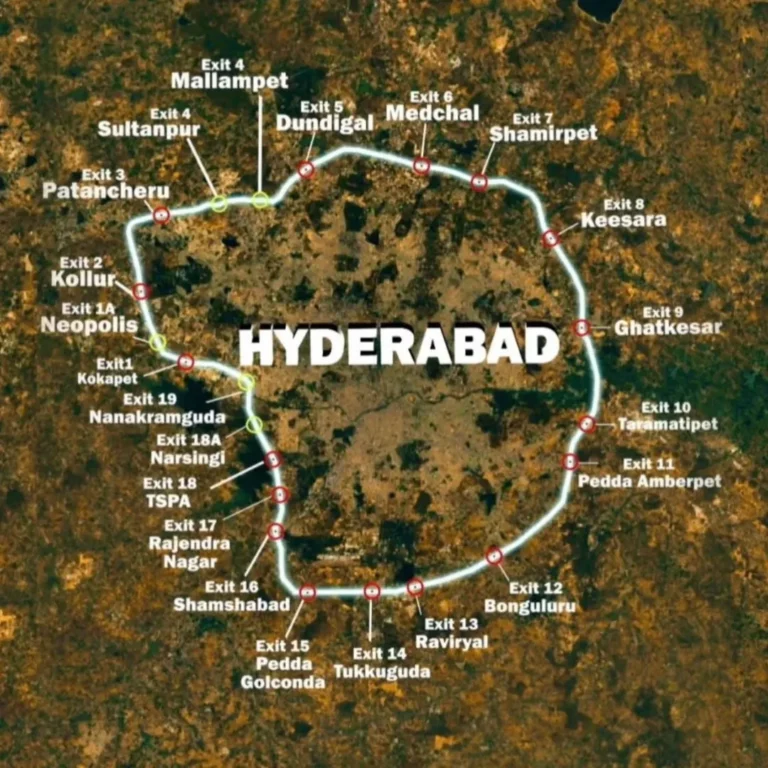

Kollur’s connectivity advantages cannot be overstated. Located along the Outer Ring Road at Exit 2, the area provides quick access to Gachibowli, the Financial District, and HITEC City all within 25-30 minutes. The Rajiv Gandhi International Airport is approximately 45 minutes away, making it convenient for frequent travelers.

The micro-market’s peaceful environment combined with lush greenery offers a quality of life increasingly rare in rapidly developing areas. Future metro expansion plans and improved road infrastructure will further strengthen Kollur’s position as a high-growth investment destination for 2026.

Western Periphery: The Next Wave

Beyond these established emerging markets, Industry leasing forecasts and commercial supply projections suggest that peripheral areas will account for 12–15% of Hyderabad’s Grade A office stock over the next 3–5 years. This shift toward peripheries represents a fundamental change in how Hyderabad’s real estate market is evolving.

The western periphery, in particular, stands to benefit from major infrastructure investments. Peripheral micro markets are likely to account for 20-25% of Hyderabad’s Grade A new supply, significantly up from a current share of less than 5%. This dramatic increase in supply will be met by corresponding demand as companies seek more affordable yet well-connected office spaces.

Property prices in peripheral areas are projected to rise 10-20% over the next 3-5 years, offering early investors substantial appreciation opportunities. Areas benefiting from infrastructure projects like the Metro Phase II extension and the proposed Regional Ring Road will see accelerated development.

Table: Top 4 Hyderabad Micro-Markets for 2026 Investment

| Micro-Market | Price per Sq Ft | ROI Potential | 5-Year Appreciation | Rental Yield | Best For |

| Kokapet | ₹9,000 | 10-12% | 80-100% | 3-4% | Premium investors, IT professionals |

| Tellapur | ₹6,500-7,500 | 12-14% | 90-110% | 3-4% | Mid-segment families, long-term investors |

| Narsingi | ₹6,431 | 10-13% | 75-95% | ₹31,650/month avg | Rental income seekers, corporate professionals |

| Kollur | ₹6,050 | 12-15% | 116% (proven) | 3-4% | First-time investors, high-growth seekers |

Table: Infrastructure Impact on Micro-Market Growth

| Infrastructure Project | Affected Micro-Markets | Expected Appreciation Impact | Completion Timeline |

| Metro Phase II Expansion | Kokapet, Tellapur, Kollur | 8-12% | 2026-2028 |

| Outer Ring Road Enhancement | Narsingi, Kollur, Western Periphery | 5-10% | Ongoing |

| Regional Ring Road | Western Periphery, Tellapur | 15-20% | 2027-2030 |

| Nallagandla-Tellapur Flyover | Tellapur, Gachibowli | 5-8% | Completed |

| Financial District Expansion | Kokapet, Narsingi | 10-15% | Ongoing |

Investment Fundamentals for 2026

The Premium Segment Surge

One of the most significant trends shaping Hyderabad’s 2026 forecast is the shift toward premium housing. As per Telangana property registration data, in February 2025, homes priced above ₹1 crore accounted for nearly 18% of total registrations, demonstrating strong buyer confidence in high-value homes.

This premium segment focus isn’t just about luxury it reflects the evolving profile of Hyderabad’s buyer base. High-earning IT professionals, successful entrepreneurs, and NRI investors are seeking properties that offer more than basic shelter. They want comprehensive amenities, superior construction quality, and locations that reflect their lifestyle aspirations.

A substantial 97% of new supply was added in the premium, luxury, and ultra-luxury segments priced upward of INR 80 lakh, indicating where developers see sustainable demand. For investors, this trend suggests focusing on mid-to-premium properties rather than entry-level units in established micro-markets.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Rental Yields and ROI Considerations

Understanding rental dynamics is crucial for investment planning. Hyderabad saw the highest 32% annual growth in average residential prices among top seven cities, but this capital appreciation must be balanced with rental yield expectations.

Different micro-markets offer varying rental propositions. Areas closer to IT hubs naturally command higher rents due to consistent demand from corporate professionals. Kokapet, Narsingi, and Kondapur benefit from this proximity, offering strong rental yields alongside appreciation potential.

Emerging markets like Kollur and Tellapur may offer slightly lower immediate rental yields but compensate with higher appreciation potential. The key is matching your investment strategy whether cash flow-focused or capital appreciation-focused with the appropriate micro-market.

Infrastructure: The Growth Catalyst

Infrastructure development remains the single most important driver of real estate value in Hyderabad. New infrastructure projects such as the Outer Ring Road and the upcoming Regional Ring Road are opening up previously inaccessible areas, making them attractive for both residential and commercial developments.

The Metro Phase II expansion will transform connectivity across the city. Areas receiving metro stations can expect significant appreciation, as historical data shows property values increase 8-12% in metro-connected localities. For 2026 investments, identifying areas on the metro expansion path offers a clear advantage.

Road infrastructure improvements continue to reduce commute times and enhance accessibility. The signal-free ORR allows smooth movement between micro-markets, effectively shrinking the city and making peripheral areas more viable for daily commuters.

Commercial Real Estate Connection

Understanding commercial real estate trends provides insight into residential market dynamics. Industry leasing data shows that Hyderabad recorded approximately 2.83 million square feet of gross office leasing in Q3 2025, underscoring sustained corporate demand.

Madhapur led leasing with 61% share, followed by Gachibowli at 31%, showing where employment concentration remains highest. Residential micro-markets near these commercial hubs benefit from steady rental demand and appreciation as professionals seek to minimize commute times.

The diversification of commercial spaces beyond traditional IT hubs creates new residential opportunities. As companies establish offices in areas like Kokapet and the Financial District, surrounding residential micro-markets experience increased demand from employees prioritizing work-life balance.

Hyderabad 2026 Investment Checklist

- Identify your investment goal: capital appreciation vs rental income

- Choose micro-market aligned with your budget and timeline

- Verify RERA registration and builder track record

- Check proximity to current/planned metro stations (8-12% appreciation premium)

- Assess connectivity to IT hubs: Gachibowli, Financial District, HITEC City

- Review infrastructure projects impacting the area (ORR, RRR, Metro Phase II)

- Confirm availability of schools, hospitals, and retail amenities

- Calculate total cost: property price + stamp duty + registration + GST

- Evaluate rental demand from IT professionals and corporate tenants

- Compare price per sq ft with neighboring micro-markets

- Review developer’s past project delivery timelines

- Assess potential for commercial development nearby (employment driver)

Investment Strategy for 2026

For First-Time Investors

If you’re entering Hyderabad’s market for the first time, focus on micro-markets offering balanced growth potential with manageable entry costs. Kollur and Tellapur provide this combination, with prices still accessible yet showing strong appreciation trajectories.

Prioritize RERA-registered projects from reputed developers. The regulatory framework in Hyderabad is strong, but due diligence remains essential. Verify all documentation, check project timelines, and assess the builder’s track record before committing funds.

Consider properties near current or planned metro stations. This infrastructure will significantly impact long-term values and provides a hedge against market volatility. Even if possession is a few years away, the metro connectivity premium justifies the wait.

For Experienced Investors

Those with existing portfolios should consider diversifying into emerging micro-markets while maintaining exposure to established areas. The peripheral western corridor offers high appreciation potential that can balance more stable returns from mature localities.

Premium segment properties in Kokapet and Narsingi deserve attention. While entry costs are higher, these micro-markets attract quality tenants willing to pay premium rents, ensuring strong cash flows alongside capital appreciation.

Watch for mixed-use developments that combine residential, commercial, and retail components. These integrated townships create self-contained ecosystems that maintain value even during market corrections and offer multiple revenue streams for investors.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

For NRI Investors

Non-Resident Indians represent a significant portion of Hyderabad’s investor base, attracted by the city’s growth story and transparent regulatory environment. NRIs should look at 2 BHK and 3 BHK apartments, luxury apartments, or estates in high-growth pockets for maximum appreciation.

Gated communities with comprehensive property management services are particularly suitable for NRI investors. These developments offer security, maintenance, and rental management services that address the challenges of owning property from abroad.

The IT sector’s continued expansion ensures steady rental demand. With many multinational corporations establishing or expanding Hyderabad operations, the tenant pool for quality properties remains strong, providing NRI investors with reliable rental income.

Risk Factors to Consider

While Hyderabad’s 2026 outlook is positive, prudent investors should acknowledge potential risks. New supply added approximately 13,890 units in Q3 2024 compared to 24,900 units in Q3 2023, reflecting a 44% yearly decline. This supply moderation could lead to price spikes if demand remains strong, but it also indicates developers are being more cautious.

Market corrections, though less likely in Hyderabad than in overheated markets, remain possible. Overleveraging to acquire property during a growth phase can prove problematic if appreciation slows or rental yields decline. Maintain adequate liquidity and avoid stretching finances beyond comfortable limits.

Regulatory changes at state or national levels can impact real estate dynamics. While Telangana’s government has been pro-development, policy shifts regarding property taxes, stamp duties, or land use regulations could affect returns. Stay informed about policy developments that might influence your investments.

Frequently Asked Questions:

Which micro-markets in Hyderabad offer the best ROI in 2026?

Kollur offers the highest ROI potential at 12-15% annually with proven 5-year appreciation of 116%. Tellapur provides 12-14% ROI with mid-segment pricing, while Kokapet and Narsingi offer 10-13% ROI with premium positioning and strong rental yields.

What is the average property price in Kokapet?

Kokapet property prices have reached approximately ₹9,000 per square foot as of 2026, reflecting its transformation into a premium residential and commercial hub near the Financial District and Gachibowli.

Why is Kollur considered a high-growth investment area?

Kollur has demonstrated +19.8% price growth in one year and +116.1% over five years. Located on the Outer Ring Road with excellent connectivity to IT hubs, it offers affordable entry points (₹6,050 per sq ft) with strong future appreciation potential due to upcoming metro expansion and infrastructure projects.

How does Metro Phase II impact property values?

Historical metro corridor price trend analysis indicates that residential values typically rise by 8–12% in metro-connected localities. Areas like Kokapet, Tellapur, and Kollur on the Metro Phase II expansion path (2026-2028 completion) are expected to see significant appreciation as connectivity improves.

What is driving Hyderabad’s premium housing segment growth?

As per Telangana property registration data, homes priced above ₹1 crore accounted for nearly 18% of total residential registrations in February 2025. The growth is driven by high-earning IT professionals, successful entrepreneurs, and NRI investors seeking comprehensive amenities, superior construction quality, and lifestyle-oriented locations.

Which areas in Hyderabad have the highest rental yields?

Narsingi offers strong rental yields averaging ₹31,650 per month due to proximity to the Financial District and high-rise residential towers. Kokapet also provides 3-4% rental yields with premium tenant demand from IT professionals.

How much have Hyderabad property prices increased recently?

Property prices increased 13-19% year-on-year in Q3 2025, with Hyderabad recording the highest 32% annual growth in average residential prices among India’s top seven cities.

Is Tellapur good for family-oriented investment?

Yes. Tellapur offers excellent educational infrastructure (Samashti International School, Glendale International), diverse housing options from luxury apartments to villas, and strong connectivity via the Nallagandla-Tellapur flyover. Prices range from ₹76.7 lakhs to ₹2.17 crores with 12-14% ROI potential.

What infrastructure projects will impact Hyderabad real estate in 2026?

Key projects include Metro Phase II expansion (8-12% appreciation impact), Regional Ring Road (15-20% impact on western periphery), Outer Ring Road enhancements, and Financial District expansion affecting Kokapet and Narsingi.

Should first-time investors choose emerging or established areas?

First-time investors should focus on emerging micro-markets like Kollur and Tellapur that offer balanced growth potential with manageable entry costs. These areas show strong appreciation trajectories (12-15% ROI) while remaining affordable compared to established neighborhoods.

Making Your Move in 2026

The window to enter Hyderabad’s high-growth micro-markets is narrowing. Areas like Kollur and Tellapur still offer attractive pricing, but appreciation is expected as infrastructure nears completion and development accelerates.

Prioritize locations with strong fundamentals—connectivity, employment access, and social infrastructure—to ensure both livability and resale value. Combine desk research with local, on-ground insights to accurately assess timelines and neighborhood momentum.

Conclusion: Positioning for Success in Hyderabad 2026

Hyderabad’s 2026 real estate story favors investors who act before micro-markets fully mature. Kokapet, Tellapur, Narsingi, and Kollur each present distinct opportunities across premium and value segments.

With sustained IT growth, major infrastructure investments, and relatively affordable pricing, the city offers a compelling long-term case. Infrastructure-led development continues to shift demand toward emerging corridors.

The opportunity is clear. The key decision is where to invest. Choose the micro-market that aligns with your strategy, verify fundamentals, and position yourself early in one of India’s most dynamic real estate cycles.