Table of Contents

Quick Summary for Homebuyers

Understanding hidden costs is essential for comprehensive home buying budget planning:

- Stamp duty and registration fees add 5-8% to property cost

- GST of 1-5% applies to under-construction properties

- Advance maintenance charges range from ₹30,000-₹1 lakh

- Parking charges cost ₹1-5 lakhs per space

- Brokerage fees typically amount to 1-2% of property value

- Home loan processing fees range from 0.25-1% of loan amount

- Legal verification and interior costs add substantial expenses

- Property insurance and periodic maintenance are ongoing costs

Understanding the Complete Cost of Homeownership

The journey of buying a home extends far beyond the quoted property price. While Hyderabad homebuyers focus on the base cost and home loan EMI calculations, numerous additional expenses significantly impact the total financial commitment. These hidden costs can add 10-20% to your overall property investment, making comprehensive budgeting essential for a smooth homebuying experience.

For families planning to invest in Hyderabad’s growing real estate market, understanding every expense component ensures financial preparedness and prevents unexpected budget constraints. This guide breaks down all hidden costs associated with property purchase, helping you plan comprehensively for your dream home.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

What Are Hidden Costs in Property Purchase?

Hidden costs are expenses beyond the advertised property price that buyers must pay during and after purchase. These mandatory and optional charges accumulate throughout the buying process, from property selection to moving in. Unlike the property cost visible in advertisements and brochures, these expenses often surprise first-time buyers who haven’t factored them into their budget.

The impact of hidden costs becomes particularly significant in Hyderabad’s real estate market where property values range from ₹50 lakhs to several crores. Even a 10-15% additional cost translates to substantial amounts requiring advance financial planning. Understanding these costs helps buyers select properties within their true affordability range rather than facing financial stress after committing to purchase.

Major Hidden Costs: Comprehensive Breakdown

Stamp Duty and Registration Charges

What is Stamp Duty?

Stamp duty is a mandatory government tax levied on property transactions to authenticate legal ownership transfer. This tax provides legal validity to property documents and protects buyers in case of ownership disputes. In Telangana, stamp duty rates vary based on property location, value, and buyer demographics.

Telangana Stamp Duty Rates (2026):

| Property Location | Male Buyers | Female Buyers | Joint Ownership |

| GHMC (Greater Hyderabad) | 4.5% | 3% | 3.75% |

| Other Municipal Areas | 4% | 2.5% | 3.25% |

| Rural Areas | 3% | 2% | 2.5% |

Registration Charges: Registration fees amount to 0.5-1% of property value, separate from stamp duty. This fee covers the cost of recording property ownership with government authorities, providing legal documentation essential for future transactions.

Cost Example: For a ₹1 crore apartment in Gachibowli (GHMC area):

- Stamp duty (male buyer): ₹4.5 lakhs

- Registration charges: ₹50,000-₹1 lakh

- Total: ₹5-5.5 lakhs

Goods and Services Tax (GST)

GST applies exclusively to under-construction properties purchased directly from builders. Ready-to-move-in homes and resale properties are exempt from GST, making them attractive options for buyers seeking to minimize upfront costs.

GST Structure for Residential Properties:

| Property Type | GST Rate | Input Tax Credit |

| Affordable Housing (< ₹45 lakhs, < 60 sqm) | 1% | Not available |

| Non-Affordable Housing | 5% | Not available |

| Ready-to-Move (OC received) | 0% | N/A |

Affordable Housing Criteria:

- Property value below ₹45 lakhs

- Carpet area under 60 square meters (metropolitan cities)

- Carpet area under 90 square meters (non-metropolitan areas)

Cost Example: For a ₹80 lakh under-construction 3BHK apartment:

- GST at 5%: ₹4 lakhs

- This amount is paid during construction-linked payment schedules

Advance Maintenance Charges

Residential societies and apartment complexes collect advance maintenance to establish operational funds before handover. These charges cover security services, common area electricity, water supply, landscaping, elevator maintenance, and amenity upkeep.

Typical Maintenance Structure in Hyderabad:

| Property Type | Monthly Maintenance (per sq ft) | Advance Period | Total Advance Amount |

| Budget Apartments | ₹1.5-2.5 | 12 months | ₹30,000-50,000 |

| Mid-Range Apartments | ₹3-5 | 12-24 months | ₹50,000-1.2 lakhs |

| Premium Apartments | ₹5-8 | 24 months | ₹1.2-2 lakhs |

| Luxury Apartments | ₹8-12 | 24-36 months | ₹2-4 lakhs |

What Maintenance Covers:

- 24/7 security personnel and CCTV monitoring

- Common area electricity and water charges

- Lift maintenance and annual inspections

- Landscaping and garden upkeep

- Swimming pool and gym maintenance

- Waste management services

- Society staff salaries

- Emergency repairs and upkeep

Parking Charges

Parking spaces are typically charged separately from apartment costs, particularly in premium residential complexes. The pricing varies significantly based on parking type (open, covered, stilt), location within the complex, and overall project positioning.

Hyderabad Parking Cost Structure:

| Area Type | Open Parking | Covered Parking | Stilt Parking |

| Budget Projects | ₹50,000-1 lakh | ₹1-1.5 lakhs | ₹1.5-2 lakhs |

| Mid-Range Projects | ₹1-2 lakhs | ₹2-3 lakhs | ₹3-4 lakhs |

| Premium Projects | ₹2-3.5 lakhs | ₹3.5-5 lakhs | ₹5-7 lakhs |

Additional Parking Considerations:

- First parking space sometimes included in base price

- Additional spaces charged at premium rates

- Two-wheeler parking charged separately (₹10,000-50,000)

- Some societies charge annual parking fees

- Electric vehicle charging points incur extra costs

Brokerage and Agent Fees

Real estate brokers facilitate property searches, negotiations, and transaction processes. While their services add value through market expertise and time savings, brokerage fees represent a significant hidden cost often overlooked during initial budgeting.

Brokerage Fee Structure:

| Transaction Type | Typical Fee Range | Calculation Basis |

| New Property Purchase | 1-2% | Property value |

| Resale Property | 1-2% | Property value |

| Rental Transactions | 1 month rent | Annual rent value |

| Premium Properties | 2-3% | Property value |

Cost Example: For a ₹1.5 crore property with 2% brokerage:

- Brokerage fee: ₹3 lakhs

- Split between buyer and seller in some cases

- Negotiable based on market conditions and property type

When to Use Brokers:

- Unfamiliar with specific Hyderabad localities

- Limited time for property search

- Need assistance with documentation

- Seeking off-market property opportunities

- First-time homebuyers requiring guidance

Home Loan Processing Fees

Financial institutions charge processing fees to cover loan application evaluation, credit verification, legal checks, and administrative costs. These fees are paid upfront during loan approval and are non-refundable regardless of whether the loan is ultimately availed.

Loan Processing Fee Structure:

| Loan Amount Range | Typical Processing Fee | Example Cost |

| ₹20-50 lakhs | 0.5-1% | ₹25,000-50,000 |

| ₹50 lakhs-1 crore | 0.25-0.75% | ₹50,000-75,000 |

| Above ₹1 crore | 0.25-0.5% | ₹1-2 lakhs |

Additional Loan-Related Costs:

- Legal and technical valuation: ₹5,000-15,000

- Property insurance (mandatory): ₹5,000-20,000 annually

- Credit report charges: ₹500-1,000

- Documentation charges: ₹2,000-5,000

- Administrative fees: ₹1,000-3,000

Preferred Location and Floor Charges

Builders levy premium charges for specific advantages within the same project. These location-based premiums reflect the added value of certain positions, views, or orientations but aren’t always transparent in initial pricing discussions.

Premium Location Charges:

| Premium Feature | Typical Premium Charge | Percentage of Base Price |

| Corner Apartments | ₹50,000-3 lakhs | 2-5% |

| Park/Garden Facing | ₹1-5 lakhs | 3-8% |

| Higher Floors (10+) | ₹50,000-2 lakhs per floor | 1-3% per floor |

| East Facing (Vastu) | ₹50,000-2 lakhs | 2-4% |

| Poolside Units | ₹2-8 lakhs | 5-10% |

| Penthouse Premiums | ₹10-50 lakhs | 15-30% |

Legal and Documentation Expenses

Comprehensive legal verification protects buyers from ownership disputes, encumbrances, and title defects. Professional legal services ensure all property documents are authentic, free from litigation, and properly registered.

Legal Cost Breakdown:

| Legal Service | Cost Range | Purpose |

| Property Title Verification | ₹5,000-15,000 | Confirm clear ownership |

| Encumbrance Certificate | ₹1,000-3,000 | Check property liens |

| Legal Opinion | ₹10,000-30,000 | Comprehensive document review |

| Sale Deed Drafting | ₹5,000-20,000 | Transaction documentation |

| Registration Assistance | ₹5,000-10,000 | Registration process support |

Documents Requiring Verification:

- Original sale deed chain (minimum 30 years)

- Approved building plans

- Occupancy certificate (OC)

- RERA registration certificate

- Property tax receipts

- No Objection Certificates (NOCs)

- Encumbrance certificate

- Khata certificates

Post-Purchase Hidden Costs

Interior Design and Furnishing

Moving into a new home requires substantial investment in interiors, furnishing, and customization. These costs vary dramatically based on quality preferences, space requirements, and lifestyle choices.

Interior Cost Structure:

| Interior Scope | Basic Budget | Mid-Range Budget | Premium Budget |

| Modular Kitchen | ₹1.5-3 lakhs | ₹3-6 lakhs | ₹6-15 lakhs |

| Wardrobes (3BHK) | ₹1-2 lakhs | ₹2-4 lakhs | ₹4-8 lakhs |

| Flooring | ₹50,000-1 lakh | ₹1-2 lakhs | ₹2-5 lakhs |

| Painting | ₹30,000-60,000 | ₹60,000-1.2 lakhs | ₹1.2-3 lakhs |

| Electrical Fittings | ₹40,000-80,000 | ₹80,000-1.5 lakhs | ₹1.5-3 lakhs |

| Bathroom Fittings | ₹50,000-1 lakh | ₹1-2 lakhs | ₹2-4 lakhs |

| Total (3BHK) | ₹5-10 lakhs | ₹10-20 lakhs | ₹20-40 lakhs |

Moving and Relocation Costs

Professional moving services, temporary accommodation, and utility connections add to immediate post-purchase expenses. Planning these costs prevents last-minute financial stress during the already hectic moving period.

Relocation Expense Breakdown:

- Packers and movers (within Hyderabad): ₹10,000-40,000

- Temporary storage (if needed): ₹5,000-15,000 per month

- Utility connections (electricity, gas, water): ₹5,000-15,000

- Internet and cable setup: ₹3,000-8,000

- Address change documentation: ₹2,000-5,000

- Cleaning and pest control: ₹3,000-8,000

Ongoing Maintenance and Utilities

Home ownership involves continuous financial commitments beyond the one-time purchase costs. Budgeting for these recurring expenses ensures long-term financial stability and property upkeep.

Monthly Recurring Costs (3BHK Apartment):

| Expense Category | Monthly Cost Range |

| Society Maintenance | ₹3,000-15,000 |

| Electricity Bills | ₹2,000-8,000 |

| Water Charges | ₹500-2,000 |

| Property Tax (annualized) | ₹500-3,000 |

| Home Insurance | ₹500-2,000 |

| Repairs and Upkeep | ₹1,000-5,000 |

| Total Monthly | ₹7,500-35,000 |

Property Insurance

Property insurance protects your valuable investment against fire, natural disasters, theft, and structural damage. While optional, insurance provides crucial financial security and peace of mind for homeowners.

Property Insurance Coverage:

| Coverage Type | Annual Premium | Coverage Amount |

| Structure Only | ₹3,000-8,000 | Building value |

| Contents Insurance | ₹2,000-6,000 | ₹5-20 lakhs |

| Comprehensive Coverage | ₹5,000-15,000 | Complete protection |

Complete Cost Estimation: Real Examples

Budget Apartment Purchase (₹50 Lakhs)

| Cost Component | Amount | Percentage |

| Property Cost | ₹50,00,000 | 100% |

| Stamp Duty & Registration (4.5%) | ₹2,25,000 | 4.5% |

| GST (5% if under-construction) | ₹2,50,000 | 5% |

| Loan Processing (0.5%) | ₹25,000 | 0.5% |

| Brokerage (1%) | ₹50,000 | 1% |

| Legal Fees | ₹15,000 | 0.3% |

| Advance Maintenance | ₹40,000 | 0.8% |

| Parking | ₹1,00,000 | 2% |

| Interiors (Basic) | ₹5,00,000 | 10% |

| Total Investment | ₹62,05,000 | 124% |

Premium Apartment Purchase (₹1.5 Crores)

| Cost Component | Amount | Percentage |

| Property Cost | ₹1,50,00,000 | 100% |

| Stamp Duty & Registration (4.5%) | ₹6,75,000 | 4.5% |

| GST (5% if under-construction) | ₹7,50,000 | 5% |

| Loan Processing (0.5%) | ₹75,000 | 0.5% |

| Brokerage (2%) | ₹3,00,000 | 2% |

| Legal Fees | ₹30,000 | 0.2% |

| Advance Maintenance | ₹1,50,000 | 1% |

| Parking (2 spaces) | ₹6,00,000 | 4% |

| Premium Charges | ₹3,00,000 | 2% |

| Interiors (Premium) | ₹25,00,000 | 16.7% |

| Total Investment | ₹2,03,80,000 | 135.9% |

How to Plan for Hidden Costs

Financial Planning Checklist

Before House Hunting:

- Calculate total budget including 15-20% buffer for hidden costs

- Obtain home loan pre-approval to understand financing capacity

- Research area-specific stamp duty rates and charges

- Set aside emergency fund (6 months expenses)

- Evaluate monthly income vs. post-purchase obligations

During Property Selection:

- Request complete cost breakdown from builders

- Clarify all additional charges upfront

- Review maintenance fee structure and escalation clauses

- Understand parking allocation and charges

- Verify GST applicability and calculation method

Before Purchase Finalization:

- Conduct comprehensive legal verification

- Compare loan processing fees across lenders

- Budget for immediate post-purchase expenses

- Plan interior and furnishing costs

- Arrange temporary accommodation if needed

Money-Saving Strategies

Reduce Government Charges:

- Consider purchasing property in wife’s name (lower stamp duty)

- Opt for ready-to-move properties to avoid GST

- Claim home loan tax benefits under Section 80C and 24(b)

Minimize Transaction Costs:

- Negotiate brokerage fees or buy directly from builders

- Compare loan processing fees across multiple lenders

- Bundle legal services for better rates

- Use builder-recommended lenders for preferential terms

Optimize Interior Expenses:

- Phase interior work over 6-12 months

- Source materials directly for cost savings

- Consider semi-furnished apartments

- Negotiate interior packages with builders

- Use modular solutions for flexibility

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

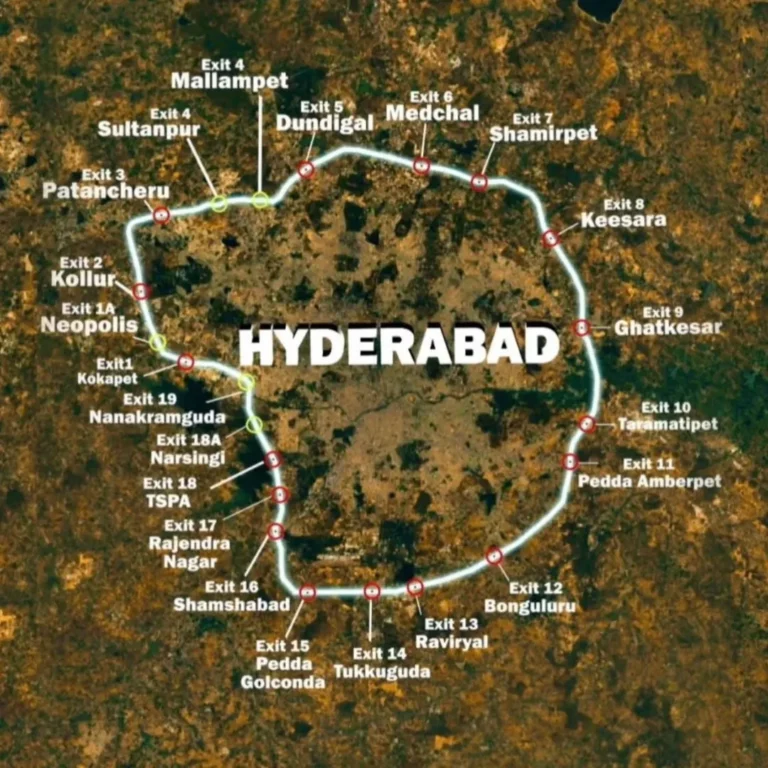

Hyderabad-Specific Considerations

Area-Wise Hidden Cost Variations

Premium Localities (Jubilee Hills, Banjara Hills, Gachibowli):

- Higher stamp duty percentages due to GHMC jurisdiction

- Premium parking charges (₹3-7 lakhs per space)

- Elevated maintenance costs (₹8-12 per sq ft)

- Substantial location premiums for preferred units

Emerging Areas (Mokila, Tellapur, Kondakal):

- Lower stamp duty rates (outside GHMC)

- Affordable parking (₹1-2 lakhs)

- Reasonable maintenance charges (₹2-4 per sq ft)

- Minimal location premiums

RERA Compliance and Transparency

Telangana Real Estate Regulatory Authority (TS-RERA) mandates transparent disclosure of all charges. Verify that your builder provides:

- Complete cost breakdown before booking

- Written confirmation of additional charges

- Maintenance charge structure documentation

- Clear parking allocation agreements

- Amenity access and usage terms

Frequently Asked Questions

What is the total percentage of hidden costs in Hyderabad property purchase?

Hidden costs typically add 15-25% to the base property price in Hyderabad. For a ₹1 crore apartment, expect additional expenses of ₹15-25 lakhs covering stamp duty, registration, GST, maintenance advances, parking, brokerage, loan processing, and legal fees. The exact percentage varies based on property type (under-construction vs ready-to-move), location (GHMC vs outside), and buyer choices (furnished vs unfurnished).

How much is stamp duty for property in Hyderabad in 2026?

Stamp duty in Hyderabad ranges from 2-4.5% based on location and buyer demographics. Within GHMC limits, male buyers pay 4.5%, female buyers pay 3%, and joint ownership attracts 3.75%. Outside GHMC in other municipal areas, rates are 4% (male), 2.5% (female), and 3.25% (joint). Rural areas have the lowest rates at 3% (male), 2% (female), and 2.5% (joint).

Are there ways to reduce stamp duty when buying property?

Yes, purchasing property in a female family member’s name reduces stamp duty by 1-2% in Hyderabad. Joint ownership between spouses also attracts lower rates than sole male ownership. Additionally, stamp duty rates are lower outside GHMC limits, making peripheral areas more affordable. However, never attempt fraudulent practices to evade stamp duty as this can invalidate your property ownership.

What is the difference between GST on affordable and non-affordable housing?

Affordable housing (properties under ₹45 lakhs with carpet area below 60 sqm in metros) attracts 1% GST without input tax credit. Non-affordable housing attracts 5% GST, also without input tax credit. Ready-to-move properties with occupancy certificates are exempt from GST entirely. For a ₹80 lakh under-construction apartment, you’ll pay ₹4 lakhs in GST, adding significantly to the purchase cost.

How much should I budget for interiors in a 3BHK apartment?

Interior budgets for 3BHK apartments in Hyderabad range from ₹5-40 lakhs based on quality preferences. Basic interiors (₹5-10 lakhs) cover essential modular kitchen, wardrobes, and flooring. Mid-range interiors (₹10-20 lakhs) include better quality finishes and comprehensive furnishing. Premium interiors (₹20-40 lakhs) feature luxury materials, designer finishes, and smart home integration. Budget approximately 10-20% of property value for comfortable interiors.

When do I need to pay advance maintenance charges?

Advance maintenance is typically collected during property possession, before you receive the keys. Builders require 12-36 months advance depending on project positioning. Budget apartments ask for 12 months (₹30,000-50,000), mid-range projects need 12-24 months (₹50,000-1.2 lakhs), and premium properties demand 24-36 months (₹1.2-4 lakhs). This amount establishes the society’s operational fund for security, maintenance, and amenity management.

Can I negotiate brokerage fees with real estate agents?

Yes, brokerage fees are negotiable, especially in buyer-favorable market conditions. Standard rates of 1-2% can often be reduced to 0.5-1% through negotiation. Alternatively, buying directly from builders eliminates brokerage entirely. However, experienced brokers provide valuable services including property search, negotiation support, and documentation assistance. Evaluate whether the time saved and expertise gained justify the brokerage cost.

What legal documents should I verify before property purchase?

Essential legal documents include: original sale deed chain (30+ years), approved building plans, RERA registration certificate, occupancy certificate, encumbrance certificate (13-30 years), property tax receipts, Khata certificates, and all necessary NOCs (fire, airport, pollution). Hire a qualified property lawyer (₹15,000-30,000) to conduct comprehensive verification. Never skip legal due diligence to save costs as title disputes can result in complete property loss.

Making Informed Property Decisions in Hyderabad

Understanding hidden costs transforms property purchase from an overwhelming financial commitment into a manageable, well-planned investment. By accounting for stamp duty, GST, maintenance advances, parking, brokerage, loan processing, legal fees, and interior expenses, you can budget accurately and avoid financial stress.

Hyderabad’s dynamic real estate market offers excellent opportunities across budget ranges and localities. Whether you’re purchasing in premium areas like Gachibowli and Kokapet or emerging corridors like Mokila and Tellapur, comprehensive financial planning ensures a smooth homebuying journey.

Remember that transparency and thorough research are your best tools. Work with RERA-compliant builders, conduct complete legal verification, compare financing options, and budget conservatively for both one-time and recurring expenses.

Your Trusted Partner for Transparent Homebuying

Kura Homes brings 49 years of legacy and three generations of real estate expertise to Hyderabad families seeking transparent, quality-driven homeownership. Our commitment to honest dealings means complete cost disclosure from day one—no hidden surprises, no unexpected charges.

When you choose Kura Homes, you receive:

- Complete Cost Transparency: Detailed breakdown of all expenses before booking

- Quality Construction: Proven track record of timely delivery with superior finishes

- Legacy-Driven Values: Trust built through five decades of service

- Customer-First Approach: Comprehensive support throughout your homebuying journey

- RERA Compliance: Full regulatory adherence for your protection

Our diverse portfolio spanning apartments, villas, and plotted developments across strategic Hyderabad locations ensures options suitable for every budget and lifestyle. From Constella’s community-focused apartments to NTANYA’s luxury villas in Tukkuguda, every Kura Homes project reflects our commitment to building homes that understand generations.

Explore Transparent Homebuying with Kura Homes →

Connect with our team to discuss your property requirements and discover how our transparent approach to real estate development can help you plan comprehensively for your dream home. Let five decades of trust and expertise guide your homebuying journey in Hyderabad.

Disclaimer: Cost figures, tax rates, and regulatory information provided are approximate and based on current market conditions as of 2026. Actual costs vary based on specific property, location, and individual circumstances. Stamp duty rates, GST regulations, and other charges are subject to government amendments. Always consult with qualified financial advisors, legal experts, and chartered accountants before making property purchase decisions. Kura Homes provides this information for educational purposes and does not guarantee specific outcomes or financial benefits.