Table of Contents

Key Takeaways , Hyderabad Luxury Real Estate Market (2025)

- Luxury segment booming: Homes priced ₹1.5 crore+ grew 450% from 2021 to 2025.

- Luxury now mainstream: Premium homes account for 29% of total residential sales.

- Strong 2025 momentum: 8,205 luxury units sold in H1 2025, up 17% YoY.

- Rising ticket sizes: Average home prices increased from ₹1.62 crore (2024) to ₹1.84 crore (2025).

- Top-tier pricing city: Hyderabad now ranks among India’s costliest markets after Delhi NCR.

- Who’s buying: Senior IT leaders (₹25L+ income), NRIs, multigenerational families, and high-end investors.

- Large homes preferred: 4BHK and spacious layouts dominate, catering to work-from-home and joint families.

- Prime micro-markets lead:

- HITEC City: ~₹13,000/sq ft

- Jubilee Hills: ₹12,000–15,000/sq ft

- Somajiguda: Premium central pricing

- HITEC City: ~₹13,000/sq ft

- Ultra-luxury price bands: 4BHK homes typically ₹3–5 crore in established corridors.

Bottom line: Hyderabad’s luxury housing has shifted from niche to core demand, driven by high-income professionals, NRIs, and limited prime land, supporting sustained premium pricing.

What Defines Large Format Living in Hyderabad?

Large format apartments in Hyderabad’s context refer to residential units with 4BHK configurations and above, typically spanning 2,500-5,000+ square feet. These homes transcend basic shelter to become lifestyle statements, offering dedicated spaces for home offices, entertainment rooms, multi-generational living, guest accommodation, and premium amenities that smaller configurations cannot provide.

Unlike 2BHK or 3BHK apartments designed for nuclear families, large flats cater to evolved lifestyle needs where space itself becomes a luxury commodity. They feature master bedrooms with walk-in closets, separate powder rooms, expansive balconies with panoramic views, and layouts that ensure privacy even with extended family or guests residing simultaneously.

Luxury Boom: Numbers Tell a Dramatic Story

| Market Metric | 2021 Baseline | 2025 Current | Change |

| Luxury Units (>₹1.5 cr) | 21,000 units | 1.2 lakh units | +450% surge |

| Luxury Share of Total Sales | 21% | 29% | +8 percentage points |

| Affordable Housing (<₹40 lakh) | 37% of sales | 18% of sales | -19 percentage points |

| Hyderabad Luxury Sales (H1 2025) | 7,000 units (2024) | 8,205 units | +17% YoY |

| Average Home Price | ₹1.62 crore (2024) | ₹1.84 crore (2025) | +13.6% |

| Price Per Sq Ft Growth (2 years) | Base | +32% | Matching Bangalore’s pace |

What’s Driving This Transformation?

Income Growth in IT Sector: Hyderabad’s technology professionals saw 15-20% salary increases during 2022-2024, with senior architects, directors, and VPs earning ₹40-80 lakh annually, income levels that comfortably support ₹3-5 crore property purchases.

NRI Investment Surge: Non-Resident Indians viewing Hyderabad as retirement destination or passive income source are purchasing premium properties, often sight-unseen, based on developer reputation and location prestige.

Multigenerational Living Revival: Post-pandemic, families are consolidating rather than fragmenting, with 4BHK apartments enabling parents, children, and grandparents to cohabit comfortably while maintaining individual spaces.

Ultra-Luxury Segment Growth: Homes priced above ₹3 crore are experiencing disproportionate demand from HNIs (High Net-Worth Individuals) seeking exclusivity, privacy, and limited-inventory projects that promise scarcity-driven appreciation.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Buyer Profiles: Who’s Purchasing 4BHK+ Apartments?

Senior IT Professionals and Corporate Executives

Demographics:

- Age: 38-52 years

- Income: ₹25-60 lakh annually (dual-income households: ₹40-90 lakh combined)

- Employers: Microsoft, Google, Amazon, Deloitte, Accenture senior management

- Family Size: Typically 4-5 members including 2 children

Motivations:

- Home office spaces for hybrid work arrangements becoming permanent

- Spacious layouts reflecting career success and social status

- Premium locations reducing commute to Gachibowli, HITEC City, Financial District

- Quality school districts (Jubilee Hills, Banjara Hills) for children’s education

Purchase Behavior: Research-intensive, comparing 8-12 projects before decision. Prioritize developer reputation, construction quality, and resale potential. Typically leverage home loans for 60-70% of property value, with down payments funded through equity portfolios, bonuses, and stock options.

Budget Range: ₹2.5-4.5 crore for 4BHK apartments in Gachibowli, Kondapur, or Kokapet; ₹4-6 crore in Jubilee Hills or Banjara Hills.

Non-Resident Indians (NRIs)

Demographics:

- Geographic Distribution: USA (45%), Middle East (30%), UK/Europe (15%), Southeast Asia (10%)

- Age: 40-60 years

- Income: $100,000-250,000 annually in host countries

- Family Status: Often planning eventual return to India or providing housing for aging parents

Motivations:

- Long-term asset creation in home country

- Retirement planning with intention to relocate within 5-10 years

- Rental income generation from corporate tenants

- Hedge against currency fluctuation and foreign market volatility

Purchase Behavior: Rely heavily on developer brand (SOBHA, Prestige, Brigade), prioritize ready-to-move or near-completion projects to avoid construction delays. Value legal compliance (RERA registration) and prefer turnkey solutions including furnishing and property management services.

Budget Range: ₹3-7 crore, with preference for established locations (Somajiguda, Jubilee Hills, Madhapur) offering prestige addresses and predictable appreciation.

Multigenerational Families

Demographics:

- Structure: Parents (60+), primary earners (35-45), children (5-18)

- Combined Income: ₹50-80 lakh annually

- Cultural Background: Often traditional joint families or newly reforming after pandemic

Motivations:

- Eldercare support without sacrificing independence

- Shared childcare responsibilities enabling both parents to work

- Cost efficiency of consolidated living versus separate households

- Emotional and social benefits of extended family proximity

Purchase Behavior: Prioritize layouts with separation between private wings, master bedrooms on opposite ends, dual living rooms, multiple bathrooms ensuring bathroom-to-bedroom ratios of 1:1 or better. Value ground floor or low-rise options for elderly mobility.

Budget Range: ₹2-3.5 crore, focusing on value-for-space rather than ultra-luxury finishes. Often purchase in emerging corridors (Narsingi, Tellapur, Kompally) where larger configurations remain affordable.

Investors and Asset Diversifiers

Demographics:

- Occupation: Entrepreneurs, doctors, chartered accountants, successful business owners

- Age: 40-55 years

- Portfolio Strategy: Real estate comprising 20-35% of total investment allocation

Motivations:

- Capital appreciation in high-growth luxury segment (8-12% annually)

- Rental yields from corporate executives (₹60,000-1,20,000 monthly for 4BHK)

- Portfolio diversification beyond equities and fixed income

- Tangible asset preference amid stock market volatility

Purchase Behavior: Transaction-oriented, negotiating vigorously on pricing and payment schedules. Analyze micro-market trends, absorption rates, and developer inventory levels. Often purchase pre-launch or during construction for maximum appreciation runway.

Budget Range: ₹3-6 crore, targeting 2-3 properties rather than single ultra-luxury purchase, diversifying across locations and developers.

Ultra-High Net-Worth Individuals (Ultra-HNI)

Demographics:

- Net Worth: ₹25 crore+ in liquid/semi-liquid assets

- Occupation: Successful entrepreneurs, second-generation business owners, C-suite executives at major corporations

- Age: 45-65 years

Motivations:

- Exclusive addresses and limited-inventory projects (only 4-8 apartments per floor)

- Architectural distinction and bespoke design elements

- Privacy, security, and discretion in established elite neighborhoods

- Legacy asset creation for next generation

Purchase Behavior: Brand-agnostic but intensely quality-focused. Conduct extensive due diligence on construction materials, structural engineering, and fire safety systems. Often customize interiors extensively post-purchase, budgeting ₹50 lakh-1.5 crore additional for premium finishes.

Budget Range: ₹6 crore-₹15 crore for ultra-luxury 4BHK+ apartments or penthouses; may extend to ₹20+ crore for marquee projects with lake views or heritage locations.

Prime Locations Commanding Luxury Premiums

HITEC City: The Technology Corridor

Why It Leads: Home to Microsoft, Google, Wipro, Dell, and hundreds of IT companies employing 250,000+ professionals within 5-kilometer radius. Walk-to-work convenience creates unprecedented rental demand.

Price Range: ₹13,000/sq ft average, making 4BHK apartments (2,800-3,500 sq ft) cost ₹3.6-4.5 crore.

Buyer Profile: 65% IT executives, 25% investors targeting corporate rentals, 10% NRIs with tech sector employment history.

Iconic Projects:

- My Home Bhooja: 36-floor towers with biodiversity park views

- 360 Life Enlightened Living: India’s first Vertical Forest Apartments at Shilpa Hills

- Luxury gated communities with 3-4 units per floor ensuring exclusivity

Investment Thesis: Sustained demand from IT sector growth, limited land availability forcing vertical development, and established social infrastructure (international schools, hospitals, premium retail) ensuring long-term desirability.

Jubilee Hills & Banjara Hills: The Prestige Addresses

Why They Command Premiums: Decades-old reputation as Hyderabad’s most affluent neighborhoods, home to celebrities, industrialists, and political elite. Social status and legacy value transcend pure financial considerations.

Price Range: ₹12,000-15,000/sq ft, with lake-view and road-facing properties commanding 20-30% premiums. 4BHK apartments range ₹4.5-7 crore.

Buyer Profile: 40% established business families upgrading within neighborhood, 35% NRIs seeking prestige addresses, 25% newly wealthy IT/pharma executives signaling success.

Market Dynamics: Between January-March 2025, Banjara Hills registered 8% quarterly price appreciation, the highest in Hyderabad. Inventory scarcity due to limited developable land ensures sustained pricing power.

Amenity Ecosystem: International schools (Oakridge, Aga Khan, TISB), multi-specialty hospitals (Apollo, Yashoda), fine dining, luxury retail (Prada, Gucci at Road No. 1), and proximity to Hussain Sagar Lake creating irreplaceable location value.

Gachibowli & Madhapur: The Balanced Choice

Why They’re Popular: Combines IT sector employment density with relatively newer infrastructure compared to HITEC City, offering modern amenities and less congestion.

Price Range: ₹8,000-8,250/sq ft, making 4BHK apartments (2,800-3,200 sq ft) cost ₹2.2-2.6 crore, 30-40% cheaper than HITEC City for similar configurations.

Buyer Profile: 55% young IT professionals (35-45 years) purchasing first large format homes, 30% investors, 15% multigenerational families.

Growth Trajectory: Prices increased 62% during 2021-2024, driven by tech park expansion and metro connectivity. The corridor continues absorbing spillover demand from saturated HITEC City.

Somajiguda: Lakefront Luxury

Why It’s Distinctive: Pristine lake views, central location with 15-minute access to Banjara Hills, HITEC City, and Financial District, and limited high-rise development preserving exclusivity.

Price Range: ₹10,000-12,000/sq ft, with lakefront properties reaching ₹14,000/sq ft. 4BHK configurations (1,948-3,278 sq ft) priced ₹3-5 crore.

Featured Project: SOBHA Waterfront offers 3.5 and 4BHK residences with Vaastu-compliant layouts, 6-story clubhouse, rooftop swimming pool, and 680-meter jogging tracks, setting new benchmarks for lakeside luxury living.

Buyer Profile: 50% NRIs seeking central, prestige addresses, 30% HNI families prioritizing lifestyle amenities, 20% investors recognizing limited lakefront inventory.

Kokapet & Financial District: The New Frontier

Why They’re Emerging: Proximity to Financial District SEZ employing 200,000+ banking, finance, and consulting professionals, plus upcoming Bharat Future City positioning area as long-term growth zone.

Price Range: ₹7,000-9,000/sq ft, making 4BHK apartments (2,900-3,350 sq ft) cost ₹2-2.8 crore, entry point pricing for luxury segment.

Buyer Profile: 60% young professionals (30-40 years) seeking affordable luxury, 25% investors targeting appreciation, 15% early-adopter families willing to trade established infrastructure for value.

Appreciation Potential: Analysts project 15-18% annual growth through 2028 as infrastructure matures (metro extension, Regional Ring Road) and employment density increases.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

What Features Define 4BHK Luxury?

Spatial Design and Layout Intelligence

Room Configuration:

- Master bedrooms: 400-500 sq ft with walk-in wardrobes (80-100 sq ft) and attached bathrooms (100-120 sq ft)

- Secondary bedrooms: 250-300 sq ft each with attached or shared bathrooms

- Dedicated home office: 150-200 sq ft with separate entrance ensuring work-life separation

- Entertainment/multi-purpose room: 200-250 sq ft convertible for gym, home theater, or guest bedroom

- Living and dining: Combined 500-600 sq ft with 11-foot ceiling heights creating airy, spacious feel

- Balconies: Multiple balconies totaling 200-300 sq ft offering outdoor living spaces

Privacy Optimization: Bedrooms positioned on opposite wings of apartment, ensuring parents and children/guests maintain independence. Master bedroom suites often include private foyer, sitting area, and dual walk-in closets for couples.

Premium Construction and Finishes

Structural Excellence:

- 5-layer exterior walls providing thermal insulation and sound dampening

- RCC framed structure with seismic-resistant design

- Vitrified tiles or imported marble flooring in living areas

- Engineered wood or laminate flooring in bedrooms

- False ceilings with concealed lighting in living, dining, and master bedroom

Kitchen and Bathrooms:

- Modular kitchens with granite/quartz countertops and premium brand fittings (Hafele, Hettich)

- Dishwasher and washing machine provision points

- Utility/wash area separate from kitchen for Indian cooking needs

- Bathrooms with Kohler, Grohe, or equivalent sanitary fittings

- Premium tiles, wall-mounted WCs, and rain showers in master bathroom

Smart Home Integration:

- Home automation systems controlling lighting, climate, and security

- Video door phones and smart locks

- Centralized electrical points for Wi-Fi routers ensuring seamless connectivity

- Provision for solar water heaters and inverter backup for essential loads

Amenities Justifying Premium Pricing

Community Infrastructure:

- Clubhouses: 15,000-20,000 sq ft with multi-purpose halls, library, co-working spaces

- Swimming pools: Rooftop infinity pools with city/lake views, separate kids’ pools

- Fitness facilities: Fully equipped gyms (2,000+ sq ft), yoga studios, aerobics rooms

- Sports facilities: Tennis courts, badminton courts, basketball courts, cricket practice nets

- Recreational zones: Jogging tracks (500-800 meters), cycling paths, landscaped gardens comprising 30-40% of project area

Lifestyle Services:

- 24/7 security with CCTV surveillance, biometric access, and manned gates

- Concierge services for package delivery, visitor management, and maintenance requests

- Property management handling common area upkeep, society administration

- EV charging stations (2-4 per tower) for electric vehicle owners

- Pet-friendly policies with dedicated walking areas

Financial Considerations: True Cost of Large Format Living

Purchase Price Breakdown

Base Property Cost (4BHK, 3,000 sq ft in Gachibowli at ₹8,000/sq ft):

- Property Price: ₹2.4 crore

- Stamp Duty (6% in Telangana): ₹14.4 lakh

- Registration Charges (1%): ₹2.4 lakh

- GST (5% on under-construction, if applicable): ₹12 lakh

- Legal Fees: ₹50,000-1 lakh

- Total Acquisition Cost: ₹2.70 crore

Ongoing Costs:

- Monthly Maintenance: ₹12,000-18,000 (₹4-6 per sq ft)

- Annual Property Tax: ₹30,000-50,000 (0.15-0.25% of guidance value)

- Home Insurance: ₹15,000-25,000 annually

- Furnishing and Interiors: ₹15-40 lakh depending on customization level

Financing and Tax Benefits

Home Loan Structure (₹1.8 crore loan at 8.5% for 20 years):

- EMI: ₹1,56,000 monthly

- Total Interest Payable: ₹1.94 crore over loan tenure

- Affordability Threshold: Monthly household income ≥ ₹4.5-5 lakh (EMI < 35% of income)

Tax Advantages:

- Principal Repayment: Up to ₹1.5 lakh deduction under Section 80C

- Interest Deduction: Up to ₹2 lakh under Section 24(b) for self-occupied property

- Additional ₹1.5 lakh interest deduction under Section 80EEA for first-time homebuyers (if eligible)

- Total Potential Tax Savings: ₹1.75 lakh annually (₹5 lakh deductions at 30% tax slab = ₹1.5 lakh + ₹25,000)

Investment Returns and Appreciation

Rental Yields:

- 4BHK apartments in HITEC City/Gachibowli: ₹60,000-80,000 monthly

- Annual Rental Income: ₹7.2-9.6 lakh

- Rental Yield: 3-3.5% (₹7.8 lakh ÷ ₹2.4 crore property cost)

Capital Appreciation (Historical 2021-2025):

- HITEC City/Gachibowli: 12-15% CAGR

- Jubilee Hills/Banjara Hills: 8-10% CAGR (mature market, lower volatility)

- Kokapet/Financial District: 15-18% CAGR (emerging market, higher growth)

10-Year Projection Example (₹2.4 crore property at 12% CAGR):

- Year 5 Value: ₹4.23 crore (appreciation: ₹1.83 crore)

- Year 10 Value: ₹7.45 crore (appreciation: ₹5.05 crore)

- Cumulative Rental Income (assuming 5% annual growth): ₹1.1 crore

- Total Returns: ₹6.15 crore (256% over 10 years)

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Challenges and Considerations for Large Flat Buyers

Higher Upfront Capital Requirements

Challenge: 4BHK apartments require down payments of ₹60-80 lakh (25-30% of property value), which many aspirational buyers struggle to accumulate despite healthy incomes.

Mitigation: Developers offering construction-linked payment plans spread over 3-4 years reduce immediate burden. Buyers can time payments with bonus cycles, stock option vesting, or staggered liquidation of equity portfolios.

Maintenance Cost Sustainability

Challenge: Monthly maintenance of ₹12,000-18,000 adds ₹1.44-2.16 lakh annually, a significant ongoing expense that can strain budgets during income disruptions.

Mitigation: Build contingency fund covering 12-18 months of maintenance costs. Prioritize projects with transparent accounting and efficient society management to avoid maintenance hikes exceeding inflation.

Resale Liquidity Concerns

Challenge: 4BHK apartments have narrower buyer pools than 2-3BHK, potentially extending resale timelines to 6-12 months versus 2-4 months for smaller configurations.

Mitigation: Purchase in prime locations (HITEC City, Jubilee Hills) where HNI buyer pools remain active. Maintain property meticulously and consider minor upgrades (fresh paint, modern fixtures) before listing to justify asking price.

Lifestyle Inflation and Overstretching

Challenge: Aspirational buyers purchasing maximum affordable property may sacrifice emergency funds, retirement savings, or children’s education corpus.

Mitigation: Follow 30-35% debt-to-income ratio cap, if EMI exceeds 35% of monthly income, consider smaller configuration or cheaper location. Prioritize financial security over spaciousness.

Future Outlook: Where Is the 4BHK Market Heading?

Continued Premiumization

Hyderabad’s luxury segment will likely grow from 29% to 35-40% of total sales by 2028 as IT sector maturity pushes more professionals into ₹30+ lakh annual income brackets. Developers will respond with increased luxury inventory, particularly in emerging corridors like Tellapur and Narsingi.

Sustainability Integration

Future 4BHK projects will incorporate net-zero energy systems, comprehensive water recycling, and IGBC Platinum certifications as baseline rather than premium features. Buyers increasingly view sustainability not just environmentally but as operating cost reduction (lower electricity bills through solar, reduced water costs via recycling).

Customization and Flexibility

Developers will offer white-box delivery options allowing buyers complete interior customization, plus modular layouts with movable walls enabling room reconfigurations as family needs evolve (converting office to nursery, combining bedrooms for elderly care).

Smart Home Standardization

Current “luxury” smart home features (automation, energy monitoring, IoT integration) will become standard in all 4BHK projects within 3-5 years. Next-generation features like AI-driven energy optimization, blockchain-based society management, and predictive maintenance will differentiate ultra-luxury offerings.

Frequently Asked Questions (FAQs)

1. Are 4BHKs better investments than 2–3BHKs?

4BHK: Higher appreciation (12–15%), lower rent & resale liquidity.

2–3BHK: Better rental yields (4–5%) and faster exits.

Choose 4BHK for long-term ownership, 2–3BHK for income-focused investing.

2. What income supports a ₹3–4 crore purchase?

Monthly household income of ₹7.5–10 lakh (₹90L–1.2Cr annually) to stay financially comfortable.

3. Hyderabad vs Bangalore/Pune for 4BHKs?

Hyderabad is 20–30% cheaper than Bangalore with similar appreciation. Bangalore offers higher rents; Hyderabad wins on value.

4. Established areas or emerging corridors?

Established: Lower risk, steady returns.

Emerging: Lower entry price, higher upside, more risk.

Best balance: adjacent emerging zones like Kokapet.

5. Can NRIs manage 4BHKs remotely?

Yes. Property managers charge 6–8% of rent and handle end-to-end operations.

6. Typical age of 4BHK buyers?

Mostly 38–50 years, with senior professionals and multigenerational families.

7. Is Vaastu important?

Yes for 40–50% of buyers. Non-Vaastu units may sell at 3–5% discount.

8. Are 4BHKs sustainable?

Modern projects with solar, rainwater harvesting, STPs, and green certification can be efficient when occupied by larger families.

Making the 4BHK Decision: A Framework

Assess Your True Space Needs

Conduct Honest Lifestyle Evaluation:

- How often do you host guests overnight (weekly/monthly/rarely)?

- Do family members require separate work-from-home spaces?

- Are aging parents likely to move in within 5 years?

- Will children require separate rooms through college years?

- Do hobbies/interests need dedicated spaces (home gym, music room, workshop)?

Reality Check: Many 4BHK buyers utilize only 60-70% of space regularly, with guest rooms occupied <10 days annually. If honest assessment reveals 3BHK meets 90% of needs, purchasing larger configuration for occasional use may not justify 40-50% price premium.

Run Comprehensive Financial Stress Tests

Scenario Planning:

- Can you comfortably afford EMI if one income source disappears?

- Do you maintain 12-month emergency fund post down payment?

- Have you budgeted furnishing costs (₹15-40 lakh realistically needed)?

- Can you absorb 6-month tenant vacancy without financial strain?

- Are you sacrificing retirement contributions to maximize home loan?

Decision Rule: If answering “no” to 2+ questions, consider smaller configuration or extending accumulation period for larger down payment reducing loan dependence.

Location vs. Size Trade-Off

Optimization Question: Is 4BHK in Narsingi (₹2.2 crore) preferable to 3BHK in Gachibowli (₹2 crore)?

Analysis Factors:

- Daily commute impact on quality of life

- School/hospital proximity for family needs

- Resale liquidity in established vs. emerging location

- Appreciation potential differential

- Space utilization likelihood

General Guidance: For end-users, location trumps size, better to maximize usage of well-located 3BHK than underutilize peripheral 4BHK. For investors with longer horizons, size in emerging location captures more appreciation.

Developer and Project Selection

Non-Negotiable Criteria:

- RERA registration with transparent project timelines

- Track record of timely delivery in 3+ previous projects

- Financial stability (bank partnerships, institutional funding)

- Construction quality verification through site visits to completed projects

- Amenity functionality validation through existing resident interviews

Red Flags:

- Vague possession timelines or frequent deadline revisions

- Developer unwilling to share approval documents

- Complaints on consumer forums about hidden charges

- Significant gap between advertised and actual amenity quality

Conclusion: The New Definition of Home

The surge in 4BHK demand reflects fundamental shifts in how urban Indians conceptualize home. Space is no longer mere shelter, it’s workspace, fitness center, entertainment venue, and multi-generational gathering place simultaneously. The 450% growth in luxury segment isn’t speculative bubble; it’s structural transformation driven by income growth, lifestyle evolution, and pandemic-accelerated preference for spacious, self-sufficient living environments.

For buyers navigating this market, success lies in honest self-assessment. Purchase 4BHK because it genuinely serves your family’s needs and fits comfortably within your financial capacity, not because neighbors upgraded or it signals success. The most satisfied 4BHK owners are those who utilize space thoughtfully, maintain financial flexibility, and view their home as long-term lifestyle investment rather than short-term status symbol.

Three buyer personas thrive in large format living:

Career-Established Professionals: Senior IT executives, corporate leaders, and successful entrepreneurs who’ve reached income stability (₹40+ lakh annually) and seek homes reflecting their professional achievements while accommodating hybrid work arrangements.

Multigenerational Families: Households consolidating aging parents, working professionals, and children into single residences that balance togetherness with privacy, leveraging multiple bedrooms and living areas for harmonious cohabitation.

Forward-Looking Investors: Real estate investors recognizing that luxury segment appreciation (12-15% annually) outpaces mid-market returns (8-10%), with limited supply of quality 4BHK inventory ensuring sustained demand from growing HNI population.

The Hyderabad market in 2025 offers unprecedented variety, from ₹2.2 crore entry-luxury in Kokapet to ₹7 crore ultra-premium in Jubilee Hills, ensuring options across budget spectrums while maintaining quality standards that previous generations could only dream of. The key is matching aspiration with affordability, ensuring your large format home enhances rather than constrains your lifestyle.

Developer Spotlight: Who’s Building Hyderabad’s Premium Homes?

National Luxury Brands

SOBHA Limited: Known for backward integration (in-house material production), SOBHA projects like SOBHA Waterfront in Somajiguda set benchmarks for lakefront luxury. Their 4BHK configurations (1,948-3,278 sq ft) feature Vaastu compliance, premium Grohe fittings, and 6-story clubhouses with rooftop infinity pools. SOBHA’s quality reputation commands 10-15% price premiums over comparable developers.

Prestige Group: Bangalore-based developer expanding aggressively in Hyderabad with projects in Gachibowli and Financial District. Prestige emphasizes large floor plates (4 apartments per floor maximum) ensuring exclusivity and privacy. Their 4BHK units typically feature home automation, video door phones, and modular kitchens as standard.

Brigade Group: Post their ₹4,500 crore Brigade Gateway success in Neopolis, Brigade is recognized for integrated township expertise. Their 4BHK offerings combine residential excellence with on-site commercial infrastructure, creating live-work ecosystems appealing to professionals seeking convenience.

Regional Powerhouses

My Home Group: One of Hyderabad’s most prolific luxury developers with 4BHK projects across Gachibowli, Kokapet, and HITEC City. My Home Bhooja’s 36-floor towers with biodiversity park views exemplify their focus on green spaces and environmental integration. Known for timely delivery and transparent pricing.

Aparna Constructions: Specializes in premium gated communities with comprehensive amenities. Their 4BHK projects emphasize family-oriented design, playgrounds, senior citizen zones, pet parks, creating community ecosystems rather than mere residential buildings.

Boutique Developers with Legacy

Builders like Kura Homes, with nearly five decades of Hyderabad experience, bring generational wisdom to luxury development. Their approach emphasizes timeless design over trendy gimmicks, construction quality that outlasts warranty periods, and understanding that true luxury isn’t ostentation but thoughtful spaces that enhance daily living across decades. Legacy developers often provide better post-sale support and society management guidance, critical for 4BHK buyers planning 15-20 year ownership.

Psychology of Large Format Buying

Status Signaling vs. Genuine Need

The Status Trap: Many buyers purchase 4BHK apartments to signal career success to peers, family, or society, driving decisions based on external validation rather than internal needs. This often leads to buyer’s remorse when reality of higher EMIs, maintenance costs, and underutilized spaces sets in.

Genuine Need Indicators:

- Frequently hosting elderly parents or relatives for extended stays (months, not days)

- Both spouses requiring dedicated home offices for full-time remote work

- Children of different genders requiring separate bedrooms throughout teenage years

- Hobbies or side businesses needing dedicated space (home studio, workshop, consulting room)

- Planning to age-in-place, requiring future-ready accessibility features

Self-Assessment Exercise: List every room in prospective 4BHK and define its specific, weekly use. If any room lacks clear weekly utility beyond “someday we might need it,” that space carries significant opportunity cost.

The “Right-Sizing” Movement

Interestingly, a counter-trend is emerging among environmentally conscious buyers and minimalists who deliberately choose 3BHK despite affording 4BHK. These buyers prioritize lower carbon footprints, reduced maintenance burdens, and forced discipline in possessions. While currently <10% of luxury buyers, this segment is growing, particularly among younger professionals (30-35 years) with Scandinavian lifestyle influences.

Rental Market Dynamics for 4BHK Apartments

Corporate Lease Opportunities

Target Tenants:

- Expatriate executives on 2-3 year assignments (oil & gas, consulting, pharma MNCs)

- Senior Indian professionals relocating to Hyderabad for director/VP roles

- Company guest houses for rotating senior management visits

- Diplomatic and consular housing for international missions

Rental Rates by Location (2025):

- HITEC City/Gachibowli: ₹70,000-90,000 monthly

- Jubilee Hills/Banjara Hills: ₹80,000-1,20,000 monthly

- Somajiguda/Madhapur: ₹65,000-85,000 monthly

- Kokapet/Financial District: ₹55,000-75,000 monthly

Lease Characteristics:

- Duration: 11-month standard, 24-36 month corporate leases common

- Furnishing: 90% of corporate tenants require fully furnished apartments

- Escalation: 5-8% annual rent increases standard in contracts

- Maintenance: Tenants typically cover maintenance charges beyond rent

Investor Consideration: Fully furnishing 4BHK apartment costs ₹15-25 lakh but commands ₹15,000-25,000 monthly premium over unfurnished. ROI on furnishing investment: 12-18 months, after which it’s pure yield enhancement.

Vacancy Risk Management

4BHK apartments face 2-3x longer vacancy periods than 2-3BHK due to narrower tenant pool. Strategies to minimize downtime:

Competitive Pricing: Price 5-10% below market average for quick absorption rather than holding out for maximum rent.

Professional Photography: High-quality photos highlighting space, views, and amenities significantly improve listing response rates.

Flexible Lease Terms: Offering 24-month leases attracts corporate tenants seeking stability, while 6-month lock-in protects against early exits.

Property Management: Professional managers with corporate client networks fill vacancies 40-50% faster than owner-managed listings.

Realistic Budgeting: Assume 1-2 months vacancy annually when projecting rental yields. A 4BHK renting for ₹80,000/month with 1 month vacancy yields ₹8.8 lakh annually, not ₹9.6 lakh.

Tax Optimization for 4BHK Owners

For Self-Occupied Properties

Deductions Available:

- Home loan interest: ₹2 lakh annually under Section 24(b)

- Principal repayment: ₹1.5 lakh under Section 80C (combined with other 80C investments)

- Additional interest: ₹1.5 lakh under Section 80EEA for first-time buyers (properties ≤ ₹45 lakh stamp value, typically not applicable to 4BHK)

Total Tax Benefit Example:

- ₹3.5 lakh deductions (₹2L interest + ₹1.5L principal)

- Tax bracket: 30%

- Annual tax savings: ₹1.05 lakh

- 20-year cumulative savings: ₹21 lakh (significant wealth preservation)

For Rental Properties

Taxation Structure:

- Rental income taxed as “Income from House Property”

- 30% standard deduction allowed on gross rental income

- Entire home loan interest deductible (no ₹2 lakh cap for rental properties)

- Property tax paid is deductible

Worked Example (₹2.4 crore property renting for ₹70,000/month):

- Annual Rent: ₹8.4 lakh

- Less: Standard Deduction (30%): ₹2.52 lakh

- Less: Home Loan Interest: ₹16 lakh (year 1 of ₹1.8 crore loan)

- Less: Property Tax: ₹40,000

- Net Taxable Income: -₹10.52 lakh (loss set off against other income)

During initial loan years, high interest payments often create tax losses that offset other income. As loan amortizes and interest reduces, taxable rental income increases, optimal to refinance or prepay strategically.

Capital Gains Strategy

Long-Term Holding (>24 months):

- Capital gains taxed at 20% with indexation benefit

- ₹2.4 crore purchase in 2025, sold for ₹5 crore in 2035

- Indexed cost (assuming 5% inflation): ₹3.91 crore

- Taxable gain: ₹1.09 crore

- Tax liability: ₹21.8 lakh (20% of ₹1.09 crore)

Tax-Saving Reinvestment:

- Invest proceeds in another residential property (Section 54) within 2 years, zero tax

- Invest ₹50 lakh in capital gains bonds (Section 54EC), save tax on ₹50 lakh gain

- Strategic timing of sale during low-income year reduces effective tax rate

10-Year Market Forecast: Where Will 4BHK Segment Be?

Supply-Demand Dynamics

Demand Drivers Remaining Strong:

- IT sector projected to employ 1.2 million by 2030 (vs. 800,000 in 2025)

- 60,000+ professionals will enter ₹30+ lakh income bracket annually

- NRI remittances to Hyderabad expected to grow 12-15% annually

- Nuclear-to-multigenerational family reversal continuing post-pandemic

Supply Constraints:

- Land scarcity in prime corridors limiting luxury inventory growth

- Regulatory environment (RERA, environmental clearances) slowing approvals

- Construction cost inflation (8-10% annually) pushing prices higher

- Developers focusing on fewer, higher-quality projects versus volume

Projection: Luxury segment (>₹1.5 crore) will constitute 40-45% of Hyderabad sales by 2030, with 4BHK configurations representing 15-18% of total residential inventory (vs. 12% today).

Price Trajectory Forecasts

Conservative Scenario (8% CAGR):

- Current: ₹2.4 crore (Gachibowli 4BHK)

- 2030: ₹3.8 crore

- 2035: ₹5.6 crore

Base Case Scenario (12% CAGR):

- Current: ₹2.4 crore

- 2030: ₹4.2 crore

- 2035: ₹7.4 crore

Optimistic Scenario (15% CAGR):

- Current: ₹2.4 crore

- 2030: ₹4.8 crore

- 2035: ₹9.7 crore

Key Variables: Infrastructure delivery (metro Phase 3, Regional Ring Road), IT sector growth sustaining 15-18% annually, no major economic disruptions, and continued government support for real estate sector.

Emerging Micro-Markets

Next-Generation Luxury Hubs (2028-2035):

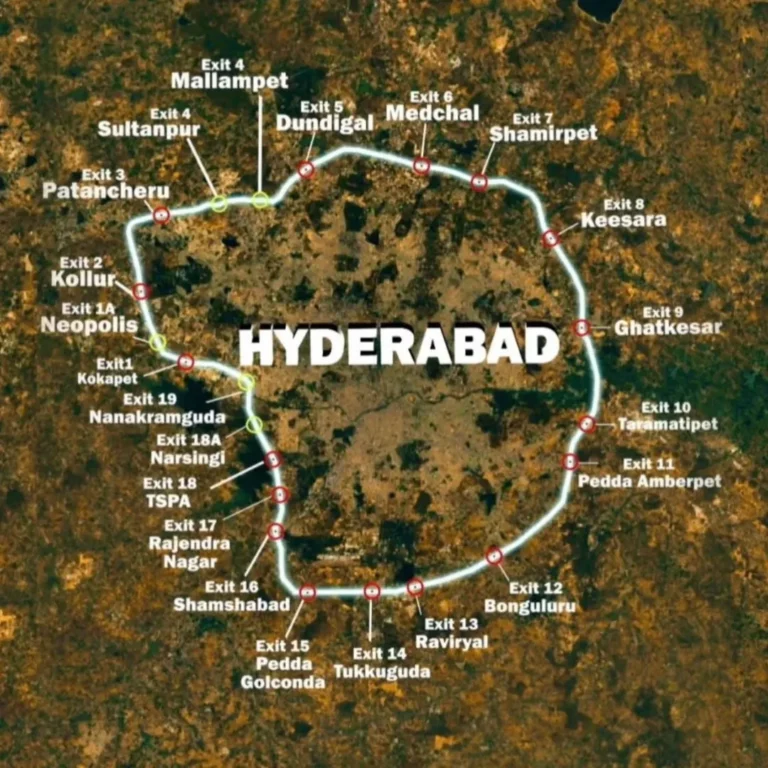

- Tellapur: Metro extension + ORR access will mature this corridor into premium residential zone

- Narsingi: Financial District proximity + lifestyle amenities will drive luxury township development

- Airport Corridor (Shamshabad): Bharat Future City employment generation will create demand for 50,000+ premium homes

- Northern Growth Corridor (Kompally-Gundlapochampally): Pharma sector expansion + future infrastructure will unlock luxury segment

Investment Strategy: Early investors purchasing 4BHK in these emerging corridors at ₹2-2.5 crore today could see ₹5-7 crore valuations by 2033-2035 as infrastructure matures and employment density increases, potentially outperforming established corridors by 20-30%.

Build Your Generational Home with Wisdom and Experience

Choosing a 4BHK apartment represents one of life’s most significant decisions, financially, emotionally, and practically. It’s not merely acquiring 3,000 square feet of constructed space; it’s creating the backdrop against which your family’s most important moments will unfold over decades.

The luxury boom in Hyderabad offers unprecedented options, but also demands thoughtful navigation. The right 4BHK in the appropriate location at a sustainable price point can enhance your family’s quality of life immeasurably while building substantial wealth. The wrong purchase, driven by status anxiety, FOMO, or inadequate financial planning, can burden you with debt stress and underutilized space for years.

Kura Homes understands that legacy-driven development means creating homes that serve not just today’s needs but future generations. With nearly five decades of experience in Hyderabad’s real estate landscape, we’ve witnessed firsthand how thoughtful design, quality construction, and strategic location selection create properties that appreciate in value while remaining deeply functional across evolving family needs.

True luxury isn’t about the most expensive finishes or tallest towers, it’s about homes that understand how you live, work, and grow over time.

Explore 4BHK opportunities designed for generational living. Connect with Kura Homes today.

Discover Homes That Understand You →

Disclaimer: Market statistics, pricing data, and appreciation forecasts reflect January 2025 conditions and publicly available industry reports. Individual property values vary based on specific locations, developer reputation, construction quality, and market dynamics. Prospective buyers should conduct independent financial analysis, verify all claims through multiple sources, and consult certified financial planners before purchase decisions. Past appreciation rates do not guarantee future returns. This article provides educational information, not investment advice.