Table of Contents

Quick Summary for Property Buyers (2026)

- No one-size-fits-all: The choice between pre-launch vs ready-to-move depends on goals, timeline, and risk tolerance

- Pre-launch — pros:

- 15–30% lower pricing

- Flexible payment plans

- Best unit selection (views, floors, layouts)

- Pre-launch — cons:

- Construction and approval risks

- Possession uncertainty

- Ready-to-move — pros:

- Immediate possession

- Verified build quality

- Faster, more certain bank loans

- Ready-to-move — cons:

- 20–30% price premium

- Full financing upfront

- Hyderabad 2026 insights:

- Pre-launch in Kokapet, Tellapur, Shamshabad can deliver 15–35% appreciation before possession

- Ready-to-move suits end-users avoiding rent + EMI and investors seeking immediate rentals (4–5% yields)

- What should guide your choice:

- RERA registration and approvals

- Developer credibility and track record

- Personal cash flow, urgency, and risk appetite

Bottom line: There’s no “better” option—only the right fit for your situation.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

What Defines Pre-Launch and Ready-to-Move Properties?

Pre-Launch Properties

Pre-launch properties are projects announced by developers before construction commences or regulatory approvals are finalized. At this stage, developers showcase master plans, unit configurations, and pricing to gauge market interest and raise initial capital. Buyers commit based on architectural renders, location potential, and developer reputation rather than physical inspection.

Key Characteristics:

- Announced before RERA registration or construction start

- Pricing typically 20-30% below market rates

- Payment linked to construction milestones

- Possession timelines 2-4 years from booking

- Highest risk-reward ratio in real estate spectrum

Ready-to-Move Properties

Ready-to-move properties are completed projects with occupancy certificates (OC), functional amenities, and immediate possession availability. Buyers can physically inspect units, verify construction quality, and move in within days of purchase completion.

Key Characteristics:

- Occupancy certificate obtained

- All amenities functional and accessible

- Immediate possession (within 1-2 weeks)

- Bank loans processed quickly with full disbursement

- What-you-see-is-what-you-get certainty

Comprehensive Comparison: Pre-Launch vs Ready-to-Move

| Factor | Pre-Launch Properties | Ready-to-Move Properties |

| Pricing | 15-30% below market rates | Market rate or 20-30% premium |

| Payment Structure | Construction-linked (20% down, 80% over 2-3 years) | Full payment or immediate loan disbursement |

| Possession Timeline | 2-4 years from booking | Immediate (1-2 weeks) |

| Unit Selection | Wide choice, premium options available | Limited inventory, popular units sold |

| Customization | Fixtures, fittings, sometimes layout | Minimal or none |

| Construction Quality | Uncertain until completion | Verifiable through inspection |

| Amenities | Promised but unverified | Functional and testable |

| Rental Income | None until possession | Immediate (within 1 month) |

| Appreciation Potential | 15-35% before possession | 8-12% annually post-purchase |

| Bank Loan | Staged disbursement, sometimes challenging | Full disbursement, straightforward |

| Risk Level | High (delays, quality issues, developer default) | Low (known entity) |

| Tax Benefits | Limited until possession | Immediate Section 80C and 24(b) |

| Resale Liquidity | Low until possession | High, immediate market |

| RERA Protection | May lack registration initially | Full RERA compliance mandatory |

Pre-Launch Properties: Deep Dive

Advantages of Pre-Launch Investment

1. Significant Price Advantage (15-30% Savings)

Pre-launch pricing represents the lowest entry point in a property’s lifecycle. Developers offer substantial discounts to generate early capital, gauge demand, and secure project funding. In Hyderabad’s Kokapet corridor, for example, pre-launch 3BHK apartments price at ₹80-90 lakh can appreciate to ₹1.1-1.3 crore by possession—representing 22-44% returns before even moving in.

Real Example: Brigade Gateway’s pre-launch phase (2023) offered units at ₹9,500-10,500 per sq ft. Current pricing (2026) for similar configurations exceeds ₹12,000-13,000 per sq ft—a 26% appreciation in under three years.

2. Flexible Payment Plans

Construction-linked payment schedules ease financial burden. Typical structure: 10-20% booking amount, 10-15% on foundation completion, 15-20% on structure completion, 20-25% on finishing, and 30-35% on possession. This spreads ₹1 crore property cost over 2-3 years instead of requiring immediate full financing.

Financial Impact: Buyers save 2-3 years of home loan interest (₹2-3 lakh annually at 8.5% interest) compared to taking full loan upfront for ready-to-move properties.

3. Prime Unit Selection

Early buyers select corner apartments, park-facing units, higher floors, and specific Vastu-compliant orientations—options unavailable once projects launch officially. In gated communities, premium units facing lakes, gardens, or with superior ventilation sell within days of launch; pre-launch buyers secure these automatically.

4. Customization Opportunities

Many developers allow pre-launch buyers to customize fixtures, kitchen cabinets, bathroom fittings, flooring materials, and sometimes minor layout modifications. This personalization, costing ₹5-10 lakh separately, often comes included or at nominal additional cost during pre-launch.

5. Capital Appreciation Before Possession

Properties appreciate significantly during construction as infrastructure develops, commercial zones activate, and mainstream buyer awareness increases. Investors can flip properties post-launch (when RERA registration completes) or near possession for 20-35% gains without ever occupying the unit.

Disadvantages of Pre-Launch Investment

1. Construction Delays (Most Common Risk)

Hyderabad developers historically average 6-12 month delays beyond promised possession dates. Regulatory approval bottlenecks, funding challenges, labor shortages, and material cost escalations commonly extend timelines. Buyers face extended rent payments or delayed investment returns.

Mitigation: Verify developer’s track record—investigate 3-5 previously completed projects and interview residents about actual possession timelines versus commitments.

2. Regulatory Approval Uncertainty

Pre-launch often precedes RERA registration, DTCP layout approval, or environmental clearances. Projects lacking approvals face severe delays or, in extreme cases, cancellation. Buyers’ capital remains locked without recourse.

Mitigation: Avoid projects without confirmed land title, DTCP layout approval, and developer commitment to RERA registration within 90 days. Verify land encumbrance certificate before booking.

3. Quality and Specification Changes

Without physical inspection, buyers depend on marketing materials. Final construction may deviate from renders—smaller room dimensions, lower-quality materials, or eliminated amenities. Developers sometimes reduce specifications citing cost escalations.

Mitigation: Include detailed specifications in buyer-developer agreement with penalty clauses for deviations. Insist on regular construction milestone inspections.

4. Bank Loan Challenges

Some banks hesitate financing pre-launch projects lacking RERA registration or with unknown developers. Even approved projects face stricter scrutiny, lower loan-to-value ratios (70-75% vs. 80-90%), and slower disbursement.

Mitigation: Choose projects with developer-bank tie-ups ensuring pre-approved financing. Confirm bank’s willingness to finance before booking.

5. No Rental Income During Construction

Investors forego 2-4 years of rental income (worth ₹12-20 lakh cumulatively on ₹1 crore property), reducing total investment returns. Simultaneously, opportunity cost of capital locked in under-construction property reduces portfolio flexibility.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Ready-to-Move Properties: Deep Dive

Advantages of Ready-to-Move Properties

1. Immediate Possession and Rental Income

Move in within 1-2 weeks or lease immediately, generating rental income from month one. For ₹1 crore property yielding 4% annually (₹4 lakh), investors recover ₹16 lakh over four years—partially offsetting the 20% price premium versus pre-launch alternatives.

End-User Benefit: Eliminate rent-plus-EMI double payment burden that costs ₹30,000-50,000 monthly for 2-3 years during under-construction possession wait.

2. Verified Construction Quality

Inspect actual unit conditions—wall finishes, flooring quality, fixture functionality, natural light, ventilation, noise levels, and neighborhood character. Speak with existing residents about developer post-sale support, amenity maintenance, and any construction defects.

Quality Assurance: Ready-to-move properties completed for 1-2 years reveal structural issues or developer negligence before purchase, unlike under-construction projects masking problems until possession.

3. Functional Amenities

Test clubhouse equipment, swim in pools, assess gym facilities, verify security systems, and evaluate landscaping maturity. Under-construction projects promise comprehensive amenities but sometimes deliver reduced versions due to cost overruns.

4. Established Neighborhood

Assess actual social infrastructure—school proximity and quality, hospital accessibility, shopping convenience, and public transport availability. Emerging areas promising future development may take 5-7 years to materialize; ready-to-move properties show current reality.

5. Bank Financing Certainty

Banks readily approve loans for ready-to-move properties with occupancy certificates. Full loan disbursement occurs immediately, and processing completes within 2-3 weeks versus 4-6 weeks for under-construction properties with staged disbursement.

6. Immediate Tax Benefits

Section 80C deductions (₹1.5 lakh principal) and Section 24(b) interest deductions (₹2 lakh) activate from purchase year. Under-construction properties defer tax benefits until possession year—costing ₹50,000-1 lakh annually in higher tax liability.

7. Resale Liquidity

Ready-to-move properties sell 30-40% faster than under-construction units because buyers can inspect physically and lenders approve financing without complications. In emergency situations requiring capital, ready-to-move units liquidate within 60-90 days versus 6-12 months for pre-launch properties.

Disadvantages of Ready-to-Move Properties

1. Higher Purchase Price (20-30% Premium)

Ready-to-move properties command premium pricing reflecting completed construction, verified quality, and immediate possession. In Hyderabad’s Gachibowli, ready-to-move 3BHK apartments price at ₹1.5-1.8 crore versus ₹1.1-1.3 crore for under-construction equivalents—a ₹30-50 lakh difference.

Financial Impact: On ₹40 lakh difference, 20-year home loan costs additional ₹7-8 lakh in interest, significantly increasing total cost of ownership.

2. Limited Unit Selection

Popular configurations (corner units, park-facing, higher floors) sell quickly. Ready-to-move inventory consists of remaining units—often interior-facing, lower floors, or less desirable configurations. Buyers compromise on preferences or pay premium for available inventory.

3. No Customization Options

Accept builder’s standard specifications—fixtures, flooring, paint colors, and layouts. Post-possession modifications cost ₹3-8 lakh and require society approvals, contractor coordination, and resident inconvenience.

4. Lower Appreciation Potential

Ready-to-move properties in established areas appreciate 8-12% annually versus 15-25% for under-construction properties in emerging corridors. While lower risk, conservative returns may underperform diversified portfolios.

Investment Consideration: ₹1 crore ready-to-move property appreciating 10% annually reaches ₹1.61 crore in five years. Same capital in pre-launch property at 18% appreciation reaches ₹2.29 crore—₹68 lakh difference justifying higher risk for long-term investors.

5. Full Financing Requirement

Unlike staged payments in under-construction properties, ready-to-move demands immediate full financing. Buyers must arrange complete ₹80-90 lakh (90% LTV on ₹1 crore property) upfront versus ₹20 lakh down payment for pre-launch equivalents.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Decision Framework: Which Option Suits You?

Choose Pre-Launch If You Are:

Capital Appreciation Investors (5-10 Year Horizon)

- Prioritizing maximum returns over immediate income

- Comfortable with illiquidity during construction

- Financially capable of weathering 12-24 month delays

- Investing in emerging corridors (Kokapet, Tellapur, Shamshabad)

Strategy: Purchase 2-3 pre-launch units in different micro-markets, hold through construction, and exit post-possession when mainstream buyers enter market at premium pricing.

Young Professionals (3-5 Years to Occupancy)

- Currently renting but planning homeownership in 3-4 years

- Building down payment through savings and investments

- Seeking affordable entry into premium locations

- Willing to accept possession uncertainty for cost savings

Strategy: Book pre-launch property now at lower pricing, pay construction-linked installments from salary, and move in when life circumstances align (marriage, children, job stability).

Customization-Focused Buyers

- Specific requirements for layout, fixtures, or finishes

- Willing to wait for personalized space

- Budget allocated for upgrades and modifications

Strategy: Engage with developers during pre-launch offering customization, specify requirements in agreement, and oversee construction milestones ensuring specifications match commitments.

Choose Ready-to-Move If You Are:

Immediate Occupancy End-Users

- Currently paying ₹30,000-50,000 monthly rent

- Financial burden of rent-plus-EMI untenable

- Family circumstances requiring immediate settling (children’s education, elderly parents, job relocation)

Financial Logic: Paying ₹40,000 monthly rent for three years costs ₹14.4 lakh versus ₹20-30 lakh premium for ready-to-move—net difference ₹6-16 lakh, partially justified by immediate possession.

Risk-Averse Investors

- Prioritizing capital preservation over aggressive returns

- Limited tolerance for construction delays or quality issues

- Seeking immediate rental income (4-5% yields)

- Portfolio already contains higher-risk assets

Strategy: Purchase ready-to-move properties in established locations (Gachibowli, Kondapur, Banjara Hills), lease to quality corporate tenants, and earn stable income while appreciating moderately (8-12% annually).

First-Time Homebuyers (Limited Market Knowledge)

- Unfamiliar with developer track records or project evaluation

- Preferring see-before-buy certainty

- Avoiding documentation and approval complexities

- Requiring bank-approved properties for financing

Strategy: Inspect multiple ready-to-move projects, engage real estate consultants for due diligence, verify all legal documents, and purchase completed units eliminating construction uncertainty.

NRIs and Overseas Investors

- Limited ability to monitor construction progress

- Requiring property management from possession

- Seeking immediate rental income for loan EMI servicing

- Preferring verified quality before capital deployment

Strategy: Target ready-to-move properties in gated communities near employment hubs, engage professional property managers, and generate rental income immediately while planning future personal use or resale.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Hyderabad Market Context (2026): Specific Recommendations

Pre-Launch Hotspots Delivering Superior Returns

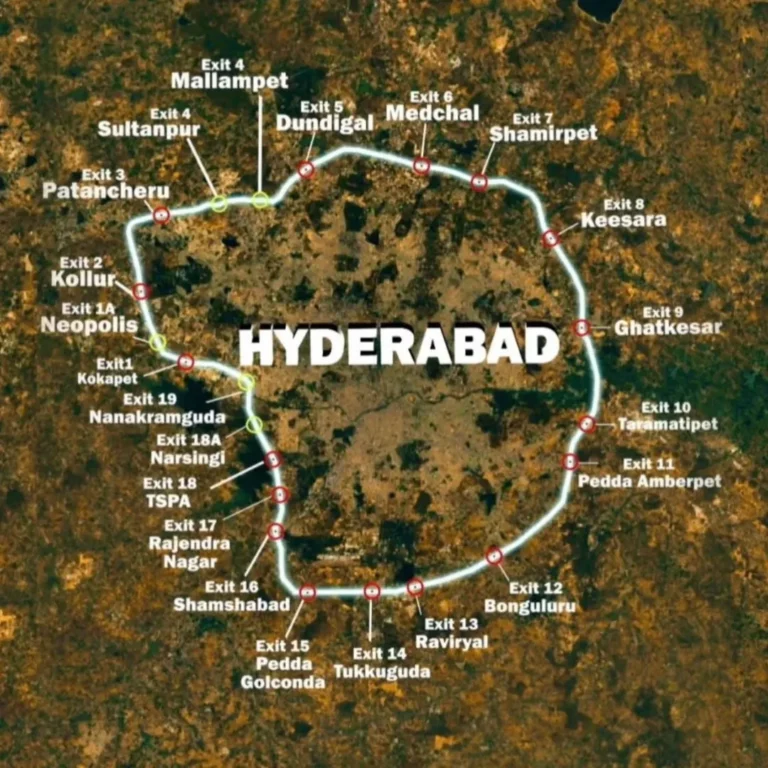

Kokapet (Next Gachibowli):

- Pre-launch pricing: ₹9,000-11,000 per sq ft

- Expected appreciation: 15-18% annually through 2028

- Catalysts: Brigade Gateway WTC, Financial District proximity, proposed metro

- Recommended for: 5-7 year investors, luxury segment buyers

Tellapur (Metro Extension Beneficiary):

- Pre-launch pricing: ₹6,500-8,500 per sq ft

- Expected appreciation: 18-22% annually post-metro (2027-2028)

- Catalysts: Metro Phase 2, social infrastructure, IT corridor proximity

- Recommended for: Family buyers planning 3-5 year occupancy, mid-premium investors

Shamshabad (Airport Corridor Industrial Hub):

- Pre-launch pricing: ₹5,500-7,500 per sq ft

- Expected appreciation: 20-25% annually through Bharat Future City development

- Catalysts: Industrial employment (500,000+ jobs projected), airport proximity, RRR

- Recommended for: Long-term investors (7-10 years), NRIs prioritizing airport access

Ready-to-Move Opportunities for Immediate Value

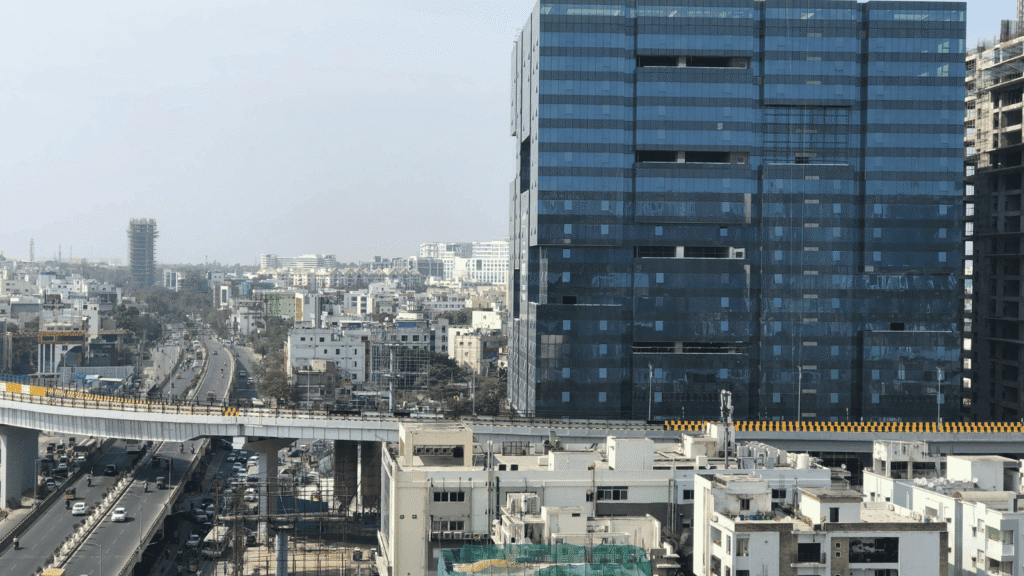

Gachibowli (Established IT Corridor):

- Pricing: ₹10,000-14,000 per sq ft

- Rental yields: 3.5-4.5%

- Advantages: Immediate tenants (IT professionals), verified infrastructure, resale liquidity

- Recommended for: Rental income investors, end-users requiring immediate occupancy

Kondapur (Mid-Premium Balanced Option):

- Pricing: ₹8,000-11,000 per sq ft

- Rental yields: 4-4.5%

- Advantages: IT hub proximity, established social infrastructure, family-friendly

- Recommended for: First-time homebuyers, young families, conservative investors

Uppal (Eastern Corridor Value):

- Pricing: ₹6,000-8,000 per sq ft

- Rental yields: 4.5-5%

- Advantages: Metro connectivity, affordable entry, established neighborhoods

- Recommended for: Budget-conscious families, affordable segment investors

Critical Due Diligence: Protecting Your Investment

Pre-Launch Verification Checklist

Developer Credibility (Non-Negotiable):

- Track record: Minimum 10 years, 5+ completed projects

- Site visits: Inspect 2-3 completed projects assessing quality

- Resident interviews: Speak with existing buyers about post-sale support

- Financial stability: Verify bank partnerships and institutional funding

- Online reputation: Research reviews, complaints, and resolution history

Regulatory Compliance:

- Land title: Clear encumbrance certificate

- DTCP approval: Layout sanction obtained or application filed

- RERA registration: Commitment to register within 90 days of booking

- Environmental clearance: If required for project scale

- Occupancy certificate timeline: Realistic possession schedule with penalty clauses

Agreement Protection:

- Detailed specifications: Unit size, materials, fixtures, amenities in writing

- Construction milestones: Payment linked to verifiable progress (foundation, structure, finishing)

- Delay penalties: Compensation for possession delays beyond committed timeline

- Escrow account: 70% of buyer funds protected per RERA

- Exit clauses: Refund mechanisms if project delays exceed 18-24 months

Ready-to-Move Verification Checklist

Legal Documentation:

- Occupancy certificate: Verify on municipal website

- Sale deed: Confirm seller has clear title

- Encumbrance certificate: No pending loans or legal disputes

- Building approvals: DTCP layout, building sanctions verified

- Property tax receipts: Paid up-to-date

Physical Inspection:

- Structural integrity: Check for cracks, seepage, dampness

- Plumbing and electrical: Test all fixtures, switches, outlets

- Amenities functionality: Visit clubhouse, pool, gym during peak hours

- Neighborhood character: Visit at different times assessing noise, traffic, safety

- Resident feedback: Speak with 3-5 residents about maintenance, developer support

Financial Verification:

- Society maintenance: Confirm monthly charges and payment history

- Pending dues: Ensure no outstanding amounts from previous owner

- Bank loan: Pre-approval confirmation from lender

- Property tax assessment: Current valuation and tax liability

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Financing Strategies and Tax Implications

Pre-Launch Financing

Staged Loan Disbursement:

- Banks release funds matching construction milestones

- Interest paid only on disbursed amount, not total loan

- Pre-EMI (interest-only) payments during construction: ₹15,000-25,000 monthly on ₹80 lakh loan

- Full EMI commences post-possession

Tax Treatment:

- Section 80C deduction: ₹1.5 lakh principal repayment (after possession)

- Section 24(b) deduction: ₹2 lakh interest (after possession)

- Pre-construction interest: Claimed in five equal installments from possession year

Total Tax Savings: ₹1.2-1.5 lakh annually post-possession at 30% tax bracket.

Ready-to-Move Financing

Full Loan Disbursement:

- Entire ₹80-90 lakh sanctioned and disbursed immediately

- Full EMI payments commence from month one: ₹70,000-80,000 monthly on ₹80 lakh loan at 8.5% interest

- Higher initial cash outflow versus staged pre-launch payments

Immediate Tax Benefits:

- Section 80C: ₹1.5 lakh principal deduction from year one

- Section 24(b): ₹2 lakh interest deduction from year one

- Combined: ₹3.5 lakh deductions annually, saving ₹1.05-1.2 lakh taxes at 30% bracket

Rental Income Tax:

- Rental income taxed as “Income from House Property”

- 30% standard deduction on rental income

- Home loan interest fully deductible (no ₹2 lakh cap for rental properties)

- Net tax liability minimal during loan repayment period

Frequently Asked Questions (FAQs)

Can I sell a pre-launch property before possession?

Yes. It’s common and often profitable once RERA is registered and construction hits ~50–60%. Typical gains are 20–35% in 12–18 months. Factor in transfer charges, stamp duty, and capital gains tax. Best exit is 6–12 months before possession.

What if the project is delayed?

RERA allows monthly compensation or refund with interest for long delays, but enforcement takes time. Practically, buyers tolerate 6–12 months delay if work progresses. Always keep a 12–18 month buffer and choose proven developers.

Do ready-to-move homes appreciate slower?

Usually yes (8–12% vs 15–25% for under-construction in emerging areas). But ready homes give immediate rent (4–5%) and stability, making total returns competitive for conservative investors.

How do I check if a pre-launch will finish on time?

Verify past delivery record, insist on RERA registration, check bank tie-ups, and monitor site progress quarterly. Red flags include no construction after 6 months, evasive communication, or delayed RERA.

What should first-time buyers choose?

Generally ready-to-move for peace of mind, quality verification, and no rent-plus-EMI burden. Pre-launch can work only if you have 3–5 years flexibility and do deep due diligence.

How much extra should I budget?

- Pre-launch: +20–25% (GST, stamp duty, registrations, deposits)

- Ready-to-move: +12–15%

Add ₹8–15L for furnishing in both cases.

Can NRIs invest in pre-launch?

Yes, but risks are higher due to monitoring challenges. Use a POA, prefer post-RERA projects, and add 12–18 months buffer. Many NRIs prefer ready-to-move for rental income.

Rent vs waiting for possession—what’s the break-even?

If rent is ₹35k–45k/month and construction is ~3 years, break-even vs ready-to-move happens around a ₹25–30L price gap. Higher rent or longer delays favor ready-to-move.

Hybrid Strategy: Balancing Both Approaches

Sophisticated investors increasingly adopt hybrid portfolios combining pre-launch and ready-to-move properties to optimize risk-return profiles:

Portfolio Allocation Example (₹2 Crore Total Investment):

60% Ready-to-Move (₹1.2 Crore):

- Two properties in established locations (Gachibowli, Kondapur)

- Generating immediate rental income: ₹50,000-60,000 monthly (₹6-7.2 lakh annually)

- Stable 8-10% annual appreciation

- High liquidity for emergencies

- Tax benefits from year one

40% Pre-Launch (₹80 Lakh):

- Two properties in emerging corridors (Kokapet, Tellapur)

- Capital locked for 3-5 years

- Expected 18-25% annual appreciation

- Potential 50-80% gains by possession

- Higher risk justified by conservative core portfolio

Result: Portfolio generates current income (₹6-7.2 lakh annually) while capturing high-growth opportunities. If pre-launch properties succeed, portfolio value increases ₹1.2-1.6 crore over five years. If one pre-launch investment faces delays, ready-to-move properties provide stability and liquidity.

Conclusion: Making Your Decision

Choosing between pre-launch and ready-to-move is not about which is better—it’s about what fits your timeline, risk comfort, and financial goals.

Pre-launch works best if you are:

- An investor with a 5–10 year horizon seeking higher appreciation

- A young professional planning occupancy in 3–5 years

- Comfortable with construction timelines and early-stage risk

- Looking for lower entry pricing in growth corridors

Ready-to-move suits you if you are:

- An end-user needing immediate possession

- A risk-averse buyer prioritizing stability and rental income

- A first-time buyer or NRI who cannot monitor construction

- Someone who values liquidity and resale flexibility

In Hyderabad’s 2026 market, both paths make sense.

Pre-launch opportunities in Kokapet, Tellapur, and Shamshabad reward patience, while ready-to-move homes in Gachibowli, Kondapur, and the Financial District offer certainty and income.

What matters most:

Do your due diligence. Verify developers and approvals, inspect sites, and plan for the full cos ot just the ticket price. When aligned with your personal situation and backed by verified facts, both options can deliver strong long-term outcomes.

Build Your Future with Confidence and Clarity

With decades of local expertise, Kura Homes helps you choose properties that match your life stage and investment approach clearly and confidently.

Explore properties matching your timeline and investment approach. Connect with Kura Homes today.

Discover Your Ideal Property →

Disclaimer: Projections are indicative and based on 2026 market analysis. Buyers should conduct independent due diligence and seek professional advice. Past performance does not guarantee future results.