Table of Contents

Quick Summary for Hyderabad Property Investors (2026)

- Hyderabad’s Western Corridor covering Gachibowli, Financial District Hyderabad, Kokapet, and HITEC City accounts for ~25% of the city’s ~50,000 annual apartment sales

- The Financial District leads due to high per-capita office space, robust F&B ecosystem, and mature social infrastructure

- Average prices: Gachibowli at ₹10,996/sq ft; premium rents up to ₹56,978/month

- Employment engine: 600,000+ IT/ITeS professionals across 1,500+ firms, sustaining residential demand

- Connectivity catalysts: Outer Ring Road Hyderabad access and upcoming metro extensions

- Luxury momentum: Registrations for homes ₹1 crore+ up ~58% YoY

- Investor demand: Strong NRI/GCC interest driving premium housing absorption

- Performance benchmarks: 4–5% rental yields and 12–15% annual capital appreciation

- Widely regarded as Hyderabad’s gold standard for luxury living, rentals, and long-term growth

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Defining the Western Corridor

Geographic Boundaries and Key Micro-Markets

Hyderabad’s Western Corridor stretches from Madhapur in the north to Narsingi in the south, encompassing the city’s most economically vibrant micro-markets. This powerhouse region includes HITEC City (the original IT hub established in the late 1990s), Gachibowli (mature residential and commercial zone), Financial District at Nanakramguda (Fortune 500 company headquarters), Kokapet (emerging luxury residential destination), Kondapur (balanced residential neighborhood), Manikonda (family-oriented residential locality), and Narsingi (high-rise residential towers).

The corridor spans approximately 25-30 square kilometers but generates disproportionate economic output, housing Hyderabad’s highest concentration of multinational corporations, premium residential projects, and affluent households.

Employment Engine: IT Sector Domination

| Employment Hub | Key Employers | Workforce | Residential Impact |

| HITEC City | Microsoft, Google, Amazon, TCS, Infosys | 200,000+ | High-income professionals seeking proximity |

| Financial District | Fortune 500 companies, banking, consulting | 150,000+ | Luxury apartment demand |

| Gachibowli Tech Parks | Deloitte, Tech Mahindra, Wipro | 120,000+ | Mid-premium housing clusters |

| Kokapet (Emerging) | Proposed IT parks, WTC development | 50,000+ (projected) | Pre-emptive residential development |

IT/ITeS Sector Statistics

The western corridor employs over 600,000 professionals across 1,500+ IT and ITeS firms, representing approximately 75% of Hyderabad’s total tech employment. This concentration creates unmatched residential demand dynamics—IT professionals earning ₹8-25 lakh annually seek housing within 30-minute commutes, driving apartment absorption rates 40-50% faster than peripheral areas.

Income Profile Impact: The average IT professional household income in the western corridor ranges ₹15-40 lakh annually for dual-income families, enabling property purchases in the ₹1-2.5 crore range. This affluent demographic supports luxury housing developments, premium amenities, and higher price points sustainable long-term.

Infrastructure Excellence: Connectivity Advantage

Outer Ring Road (ORR) Transformation

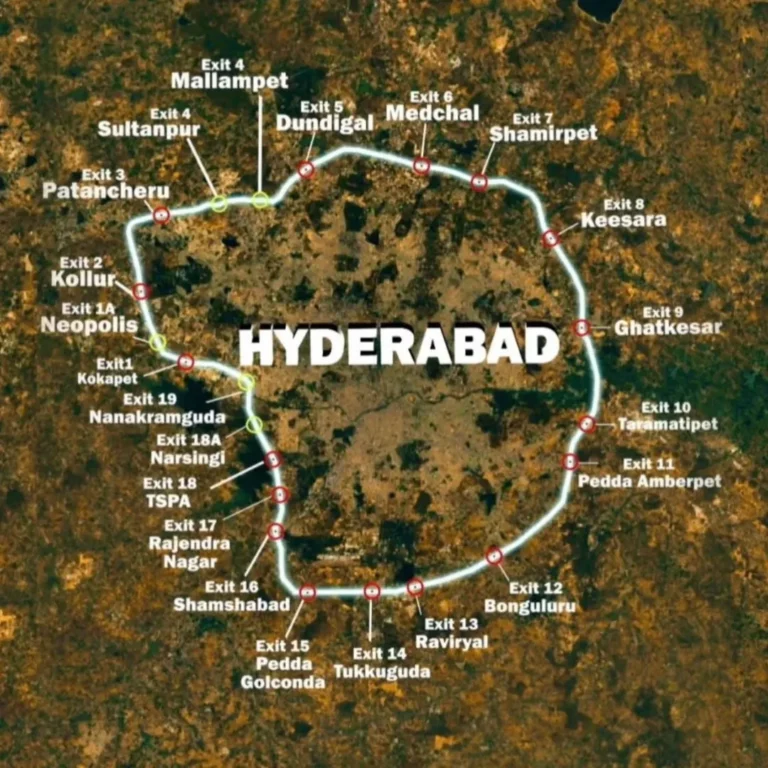

The 158-kilometer Outer Ring Road revolutionized western corridor accessibility, reducing travel times to the airport from 90+ minutes to 35-40 minutes and connecting seamlessly to eastern industrial zones in 45-50 minutes. ORR access points at Gachibowli, Financial District, and Narsingi act as value multipliers properties within 2 kilometers of ORR exits command 15-20% premiums over interior locations.

Real Estate Correlation: Post-ORR completion (2012-2013), property values along the western corridor appreciated 150-200% over the following decade, significantly outpacing city-wide averages of 80-100%.

Metro Connectivity (Current and Future)

Operational Lines:

- Red Line connects Miyapur to LB Nagar, serving western corridor commuters

- Green Line provides HITEC City to Raidurgam connectivity

Upcoming Extensions (2026-2028):

- Raidurg to Shamshabad Airport Express line with Financial District and Nanakramguda stations

- Kokapet-Narsingi connector improving internal corridor mobility

Metro-adjacent properties command 8-12% rental premiums and appreciate 3-5% faster annually compared to non-metro locations. Properties within 1-kilometer radius of proposed metro stations have already experienced 25-35% speculation-driven price increases since announcement.

Road Network and Flyovers

The western corridor benefits from Hyderabad’s best road infrastructure including 100-feet and 200-feet wide arterial roads throughout Financial District, signal-free flyover network reducing commute times, and well-maintained internal roads within gated communities. This infrastructure enables 15-20 minute internal corridor travel during peak hours—unprecedented in Indian metros of comparable size.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

25% Market Share Phenomenon

Financial District Dominance

According to ASBL CEO Ajitesh Korupolu, “The Financial District accounts for almost 25% of the 50,000 apartment sales seen last year in Hyderabad. That’s a staggering figure for a single market pin code.” This concentrated demand reflects unique characteristics including highest per capita office space in India, premium food and beverage ecosystem, exceptional social infrastructure, established resident associations, and luxury developer focus.

Comparative Context: No other single micro-market in Indian metros commands comparable market share. Bangalore’s Whitefield captures approximately 12-15%, Mumbai’s Andheri around 8-10%, and Pune’s Hinjewadi 10-12%. The Financial District’s 25% dominance is unprecedented.

Absorption Rate Analysis

The western corridor demonstrates absorption rates (speed at which inventory sells) 40-50% faster than city averages. Premium projects (₹1.5 crore+ apartments) sell 60-80% inventory within 6-9 months of launch, compared to 12-18 months in emerging corridors. Mid-segment projects (₹80 lakh-1.4 crore) achieve 70-80% sales within 12-15 months.

Investor Takeaway: Faster absorption reduces developer financial stress, ensuring timely delivery and better construction quality—critical factors for homebuyers evaluating project risks.

Property Price Dynamics Across the Corridor

Current Market Pricing (2026)

Gachibowli Core:

- Average: ₹10,996 per sq ft

- Premium Projects: ₹12,000-15,000 per sq ft

- Luxury Villas: ₹15,000-20,000 per sq ft

- Rental Income (3BHK): ₹56,978 monthly average

Financial District:

- Average: ₹11,500-13,000 per sq ft

- Premium High-Rises: ₹14,000-18,000 per sq ft

- 3BHK Apartments: ₹2-2.8 crore

- Rental Yields: 4-4.5%

Kokapet:

- Average: ₹8,500-10,500 per sq ft

- Luxury Townships: ₹9,500-12,000 per sq ft

- Strong Appreciation: 15-18% annually

- Entry Point for Western Corridor Access

Kondapur:

- Average: ₹9,000-11,000 per sq ft

- Balanced Pricing: ₹1.4-2 crore for 3BHK

- Rental Income: ₹45,000-55,000 monthly

- Family-Oriented Demand

Narsingi:

- Average: ₹8,934 per sq ft

- High-Rise Focus: Tallest residential towers in Hyderabad

- Rental Income: ₹43,293 monthly average

- Rapid Appreciation: 12-14% annually

Price Appreciation Trajectory (5-Year Outlook)

Established Zones (Gachibowli, Financial District):

- Projected Appreciation: 55-70% (cumulative)

- Annual Growth: 11-14%

- Drivers: Limited supply, sustained demand, infrastructure maturity

Emerging Zones (Kokapet, Tellapur extension):

- Projected Appreciation: 80-100% (cumulative)

- Annual Growth: 16-20%

- Drivers: New metro connectivity, IT park development, residential expansion

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Lifestyle Infrastructure: Beyond Employment

Food and Beverage Ecosystem

The western corridor has developed into Hyderabad’s premium F&B destination with fine dining restaurants across multiple cuisines, craft breweries and microbreweries, international coffee chains and specialty cafés, rooftop bars and lounges, and family-friendly restaurant chains.

This lifestyle infrastructure attracts high-income professionals who prioritize work-life balance and social experiences. The concentration of premium F&B options creates self-sustaining weekend activity hubs, reducing the need to travel to city center for entertainment.

Real Estate Impact: Areas with dense F&B clusters command 5-8% rental premiums as tenants value walkable leisure options.

Educational Institutions

The corridor hosts some of Hyderabad’s most prestigious schools including CHIREC International School, The Global Edge School, Rockwell International School, Delhi School of Excellence, and International School of Hyderabad (ISH). Additionally, IIIT Hyderabad and ISB (Indian School of Business) proximity enhances intellectual capital.

Family Appeal: Access to quality education eliminates primary parental anxiety, making the western corridor the default choice for families with school-age children willing to pay 15-20% premiums for educational proximity.

Healthcare Facilities

World-class healthcare infrastructure includes Apollo Hospitals, Continental Hospitals, Aware Global Hospital, Kamineni Hospitals, and numerous specialty clinics. The presence of multi-specialty hospitals within 5-10 kilometers provides healthcare security that premium buyers prioritize.

Retail and Entertainment

Comprehensive retail options span Inorbit Mall Hyderabad, Forum Sujana Mall, Asian Lara Devi multiplex, numerous supermarkets and hypermarkets, and brand showrooms across categories. This eliminates lifestyle dependencies on central Hyderabad, creating self-contained urban ecosystem.

Luxury Segment Surge: The ₹1 Crore+ Phenomenon

Registration Data Analysis

Knight Frank India reports a 58% annual increase in apartment registrations priced above ₹1 crore in Hyderabad, with the western corridor accounting for 70-75% of this luxury segment activity. This surge reflects rising affluence among IT professionals (dual-income families earning ₹30-50 lakh annually), NRI and GCC-based investor interest targeting quality assets, demand for larger configurations (3.5BHK, 4BHK) with premium specifications, and preference for branded developers (Prestige, Sobha, Godrej, Brigade).

Luxury Villa Development

Premium villa communities are proliferating across the western corridor including Kolla Luxuria Villas at ₹4-5 crore (Spanish-style, G+2 triplex), Meenakshi Bamboos priced ₹4-20 crore (curated gated community), NSL Orion/Vessella luxury villas, and Rajapushpa Green Dale (upcoming). A June 2025 government auction in Gachibowli fetched ₹2.22 lakh per gaj, indicating sharply rising land prices and robust investor interest in ultra-premium segments.

NRI and Global Investor Interest

International Capital Flows

Dubai-based Driven Properties opened its first India office in Hyderabad (October 2025), specifically targeting western corridor projects. Through Forbes Global Properties network, Driven connects Hyderabad developments with 140 million+ high-net-worth individuals across 25+ countries.

CREDAI Perspective: Gummi Ram Reddy, President Elect of CREDAI Hyderabad, stated “Hyderabad continues to stand tall as one of India’s most trusted real estate markets. The entry of a global leader like Driven Properties signals a new era of collaboration and opportunity.”

NRI Buyer Profile

NRIs and GCC-based investors prioritize airport proximity (western corridor offers 35-40 minute access via ORR), rental yield stability (4-4.5% in established areas), branded developer credibility, property management services, and appreciation aligned with long holding periods (7-10 years).

Western corridor properties particularly appeal to NRIs due to international-standard amenities, English-speaking management, and transparent RERA compliance reducing investment risks for absentee owners.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Developer Landscape and Supply Dynamics

National Players Dominating

Major national developers are concentrating western corridor investments including Prestige Group (multiple luxury projects in Gachibowli and Financial District), Sobha Limited (high-rise developments in Narsingi and Kokapet), Godrej Properties (entering with premium townships), Brigade Group (₹4,500 crore Neopolis investment including WTC), and Aparna Constructions (integrated townships on ORR extension).

Regional Powerhouses

Established Hyderabad developers maintain strong presence including ASBL (four active projects in Financial District—highest concentration by single developer), My Home Constructions (luxury apartments and villas), Raghavendra Constructions (mid-premium segment), and Aliens Group (established communities).

Supply Pipeline Analysis

The western corridor has 80-100 active residential projects in various stages representing 40,000-50,000 units under development. This supply will absorb over 3-5 years given strong demand fundamentals, avoiding oversupply concerns plaguing other metros.

Price Stability Implication: Managed supply aligned with demand prevents price corrections, supporting steady appreciation trajectories.

Comparative Advantage: Western Corridor vs Other Hyderabad Zones

| Factor | Western Corridor | Eastern Hyderabad | Southern Hyderabad | Northern Hyderabad |

| Employment Density | 600,000+ IT/ITeS jobs | 100,000+ manufacturing | 80,000+ logistics/aerospace | 70,000+ mixed sectors |

| Average Price/Sq Ft | ₹9,000-13,000 | ₹5,500-7,500 | ₹5,000-8,000 | ₹5,000-7,000 |

| Appreciation (Annual) | 12-15% | 8-10% | 14-18% (emerging) | 8-10% |

| Infrastructure Maturity | Excellent (10/10) | Good (7/10) | Developing (6/10) | Moderate (6/10) |

| Social Amenities | Best-in-class | Moderate | Limited but growing | Moderate |

| Rental Yields | 4-4.5% | 3.5-4% | 4.5-5.5% | 3.5-4% |

| Liquidity | Highest (2-4 months) | Moderate (6-9 months) | Moderate (4-8 months) | Lower (8-12 months) |

Investment Strategy Implication: Western corridor offers premium pricing justified by infrastructure, employment, and lifestyle advantages. For maximum appreciation, emerging southern corridor offers higher percentage returns but accepts location and amenity trade-offs. Balanced portfolios allocate 60-70% to western corridor for stability and 30-40% to emerging zones for growth.

Challenges and Market Realities

Saturation Concerns

Industry experts acknowledge the western corridor is approaching capacity constraints. ASBL’s Ajitesh Korupolu notes “The west has reached near-saturation.” Land scarcity is driving developers toward vertical expansion (high-rise projects) rather than horizontal sprawl. This saturation manifests through rising land costs (₹2.22 lakh per gaj in recent auctions), limited availability of 10+ acre contiguous parcels, increased competition for prime locations, and developer shift toward mixed-use and redevelopment projects.

Future Outlook: Saturation limits supply growth, supporting price stability and preventing oversupply-driven corrections common in less mature markets.

Premium Pricing Accessibility

The western corridor’s premium pricing (₹9,000-15,000 per sq ft) creates affordability barriers for first-time buyers and mid-income families. A standard 3BHK (1,800 sq ft) in Gachibowli costs ₹1.8-2.2 crore, requiring household incomes of ₹25-35 lakh annually for comfortable EMI servicing.

Market Response: Developers are offering smaller configurations (2BHK, 1,400 sq ft) priced ₹1.1-1.5 crore targeting young professionals, and projects in peripheral western corridor (Tellapur, Mokila) at ₹6,000-8,000 per sq ft providing “western corridor access” at 25-30% discounts.

Environmental and Urban Planning

Rapid real estate expansion has fragmented forest corridors in areas like Gachibowli, Manikonda, and Gandipet, increasing human-wildlife conflict. Ongoing infrastructure projects (e.g., Kancha Gachibowli IT hub proposal) face debates over land-use and environmental compliance.

Responsible Development: Buyers should prioritize IGBC-certified projects, developers with environmental clearances, and communities preserving green buffers and water bodies.

Investment Strategies for the Western Corridor

For End-Users

- Immediate Occupancy: Ready-to-move apartments in Gachibowli or Kondapur eliminate construction wait while securing established neighborhood benefits. Budget ₹1.5-2.5 crore for quality 3BHK with full amenities.

- Family-Oriented Choice: Prioritize locations within 3 kilometers of reputed schools (CHIREC, Global Edge, Rockwell) and multi-specialty hospitals. Manikonda and Kondapur offer optimal balance of education, healthcare, and lifestyle amenities.

- Premium Lifestyle: Financial District high-rises provide luxury specifications, concierge services, and proximity to corporate offices. Suitable for senior professionals earning ₹30 lakh+ annually prioritizing prestige and convenience.

For Investors

- Rental Income Focus: Purchase ready-to-move 2-3BHK apartments in Gachibowli or Kondapur targeting IT professional tenants. Expected yields: 4-4.5% with stable occupancy year-round.

- Capital Appreciation Play: Under-construction luxury projects in Kokapet or Financial District offer 10-15% pre-launch discounts and 15-18% annual appreciation potential. Suitable for 5-7 year investment horizons.

- Villa Investment: Ultra-high-net-worth investors can target luxury villa communities (₹4-8 crore) in Gachibowli for limited supply-driven appreciation. Resale markets developing as more affluent families relocate to western corridor.

For NRIs

- Turnkey Solutions: Engage developers offering property management services (ASBL, Prestige, Sobha) ensuring tenant placement, maintenance coordination, and rent collection remotely.

- Airport Proximity Priority: Western corridor’s 35-40 minute airport access via ORR facilitates convenient property inspections during India visits. Kokapet and Narsingi offer optimal airport-to-property balance.

- Branded Developer Security: Stick to established national/regional developers with proven track records minimizing construction delay and quality risks for absentee investors.

Future Outlook: Western Corridor in 2030

Projected Developments

Infrastructure Completion:

- Full metro network including Airport Express line operational

- Additional flyovers and road widening reducing internal commute times to 10-15 minutes

- Regional Ring Road outer connectivity enhancing broader metropolitan access

Commercial Expansion:

- World Trade Center Hyderabad (15 lakh sq ft) operational in Kokapet

- Additional Grade A office spaces in Financial District and Gachibowli

- Shared workspace penetration reaching 20-25% of total office inventory

Residential Evolution:

- High-rise projects (30-50 floors) becoming standard due to land scarcity

- Smart home technology integration across 60-70% of new supply

- Green building certifications (IGBC/LEED) mandatory for premium segment

Market Predictions

- Pricing: Gachibowli and Financial District will sustain ₹15,000-18,000 per sq ft for premium properties while Kokapet and Narsingi narrow gap to ₹12,000-14,000 per sq ft as infrastructure matures.

- Demand Composition: Luxury segment (₹1.5 crore+) will account for 35-40% of western corridor sales (vs 25-30% currently) reflecting rising affluence and premium buyer concentration.

- Investor Profile: NRI and institutional investor participation will grow from 15-20% currently to 25-30% by 2030, bringing international capital and quality expectations.

Frequently Asked Questions (FAQs)

Why is the Western Corridor expensive?

Because of concentrated IT employment (600,000+ jobs), top-tier infrastructure (ORR, metro, flyovers), premium social amenities, reputed developers, and land scarcity. High household incomes sustain premium pricing.

Is it still a good investment or already saturated?

Yes, if you’re strategic.

- Appreciation: Focus on Kokapet, Tellapur, Narsingi (15–18%)

- Rentals: Gachibowli, Kondapur (4–4.5%)

Saturation limits supply, which actually supports prices.

How do rental yields compare nationally?

Western Corridor yields 4–4.5% better than Mumbai, comparable to Bengaluru & Pune, with lower entry prices and lower vacancy risk.

Minimum budget to enter?

- Entry: ₹1–1.5 cr (2BHK / peripheral west)

- Mid: ₹1.8–3 cr (3BHK core west)

- Premium/Villas: ₹4 cr+

Best balance for first-time investors: ₹1–1.5 cr.

Are home loans easy here?

Yes. Faster approvals, 80–90% LTV, competitive rates, and many pre-approved projects by top developers.

Is this corridor good for NRIs?

Excellent. Airport proximity, strong rental demand, professional property management, and clear RERA compliance make it low-risk for absentee owners.

Best property types to buy?

- Rentals: Ready 2–3BHK in Gachibowli/Kondapur

- Growth: Under-construction luxury in Kokapet/Financial District

- Diversification: Plots near metro

- Ultra-premium: Limited-supply villas

Has the corridor peaked?

No, growth is moderating, not ending. Expect 10–12% sustainable appreciation, lower volatility, and high liquidity like mature global prime markets.

Conclusion: The Indisputable Powerhouse

Hyderabad’s Western Corridor—Financial District Hyderabad, Gachibowli, Kokapet, HITEC City—remains the city’s most reliable real estate engine.

It offers:

- Stable rentals (4–4.5%)

- Consistent appreciation (12–15%)

- Unmatched lifestyle & liquidity

“Saturation” here means scarcity, not stagnation. For homebuyers, investors, and NRIs alike, the Western Corridor continues to be Hyderabad’s gold standard.

Build Your Legacy in Hyderabad’s Premier Corridor

With decades of local expertise, Kura Homes helps you navigate both established prestige zones and emerging micro-markets clearly and strategically.

Explore premium opportunities in Hyderabad’s growth corridors. Connect with Kura Homes today.

Discover Strategic Locations →

Disclaimer: Figures are indicative (2025–26 analysis). Buyers should verify details via RERA and independent due diligence. Past performance does not guarantee future results.