Table of Contents

Quick Summary for Hyderabad Property Investors (2026)

Shamshabad is emerging as a major industrial and real estate growth corridor driven by the airport ecosystem and logistics hubs

Bharat Future City: India’s first net-zero smart industrial hub spanning 765 sq km, anchoring long-term demand

Price growth (last 4 years):

- Land prices: +118%

- Apartment prices: +74%

- Plot values: +84%

Key developments boosting demand:

- World Trade Center Shamshabad – 15 lakh sq ft

- Tata Aerospace SEZ

- Proximity to Pharma City and large logistics parks

Strong connectivity drivers:

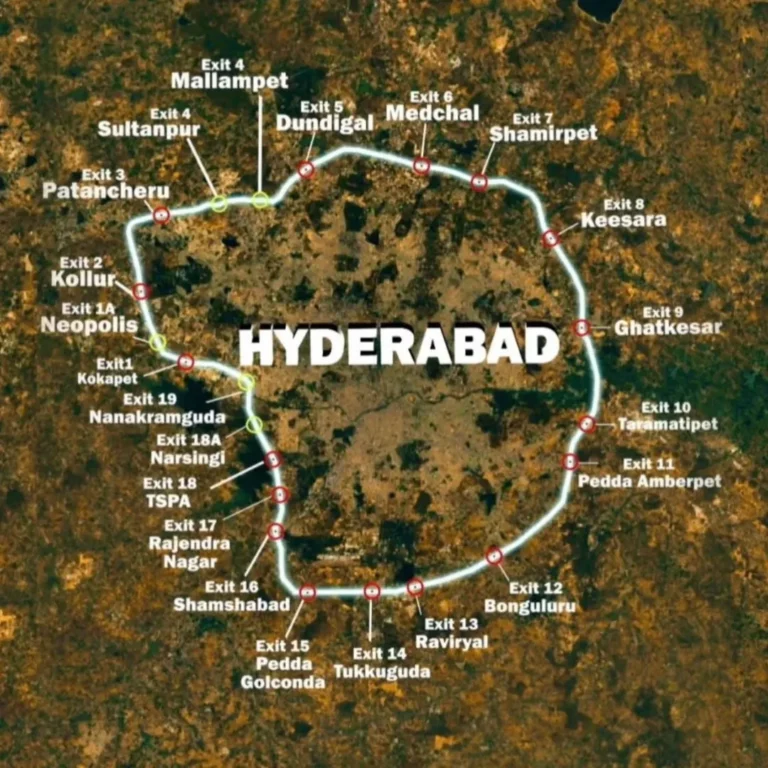

- Outer Ring Road Hyderabad access

- Proposed metro extensions

- Regional Ring Road (RRT) impact

Industrial job creation accelerating housing and rental demand

Lower entry prices compared to western Hyderabad markets

Positioned as a compelling long-term investment destination for 2026 and beyond

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

What Makes Shamshabad Special?

Shamshabad, located in South Hyderabad approximately 25 kilometers from the city center, has evolved from a rural periphery to one of Hyderabad’s most strategic growth corridors. The presence of Rajiv Gandhi International Airport (RGIA)—which serves as India’s sixth-busiest airport—anchors the region’s transformation, but industrial development has become the primary catalyst driving real estate demand.

The corridor extends beyond Shamshabad proper to include neighboring areas like Tukkuguda, Maheshwaram, and Adibatla, forming an integrated industrial-residential ecosystem that mirrors successful models in Bangalore and Pune.

Industrial Growth Drivers Reshaping Shamshabad

| Industrial Sector | Key Projects | Employment Impact | Real Estate Effect |

| Aerospace & Defense | TATA Aerospace SEZ, Aviation Academy | 15,000+ direct jobs | High-income professional housing demand |

| Logistics & Warehousing | DHL, Blue Dart, Amazon fulfillment centers | 25,000+ jobs | Workforce housing, rental demand surge |

| Pharmaceuticals | Pharma City (proximity), API manufacturing | 20,000+ projected jobs | Mid-premium residential townships |

| Information Technology | Proposed IT parks, World Trade Center | 30,000+ potential jobs | Commercial and residential co-location |

| Manufacturing | Electronics City, Hardware Park | 18,000+ manufacturing jobs | Affordable housing clusters |

Bharat Future City: The Game-Changing Development

The Telangana government’s announcement of Bharat Future City represents the single largest industrial catalyst for Shamshabad real estate. Spanning 765 square kilometers across South Hyderabad, this net-zero smart industrial hub will create dedicated clusters for artificial intelligence, electric vehicles, life sciences, entertainment, and advanced manufacturing.

Projected Impact:

- Employment Generation: 500,000+ direct and indirect jobs over 10-15 years

- Infrastructure Investment: ₹50,000+ crore in roads, metro, utilities

- Real Estate Transformation: Shamshabad, Tukkuguda, and Maheshwaram positioned as primary residential zones

- Timeline: First phase development 2026-2030

The project includes internal metro systems and Bus Rapid Transit (BRTS), ensuring seamless connectivity across the industrial hub and to RGIA, making Shamshabad the residential gateway to this futuristic ecosystem.

World Trade Center Shamshabad

Set to become one of India’s largest WTC facilities at 15 lakh square feet, this commercial landmark will attract multinational corporations across IT, logistics, aviation, and pharmaceuticals. The WTC alone is expected to generate 8,000-10,000 jobs, creating immediate housing demand within 5-10 kilometer radius.

Commercial Rental Rates: Expected to range ₹80-120 per sq ft annually, significantly higher than current Shamshabad rates of ₹35-50 per sq ft, indicating rapid market maturation.

TATA Aerospace SEZ

The TATA Advanced Systems Limited facility in neighboring Adibatla manufactures aerospace components and is expanding operations to include defense equipment production. This high-precision manufacturing creates demand for skilled technical professionals earning ₹8-15 lakh annually—a demographic seeking quality housing within commutable distances.

Residential Impact: Gated communities and villa projects in Shamshabad-Adibatla corridor targeting aerospace professionals, with 2-3BHK configurations priced ₹50-70 lakh.

Infrastructure Catalysts Multiplying Real Estate Value

Outer Ring Road (ORR) Transformation

The 158-kilometer Outer Ring Road has fundamentally altered Shamshabad’s accessibility. What was once a 90-minute commute to Gachibowli or Financial District now takes 35-45 minutes via ORR, making Shamshabad viable for IT professionals working in established hubs.

Real Estate Correlation: Properties within 3 kilometers of ORR access points appreciated 25-35% faster than interior locations between 2021-2024.

Regional Ring Road (RRR) Anticipation

The proposed 340-kilometer Regional Ring Road will create an outer connectivity ring linking Shamshabad directly to industrial corridors in Sangareddy, Medchal, and Yadadri. This mega-infrastructure project is expected to reduce travel time from Shamshabad to northern Hyderabad industrial zones from 2+ hours to 60-75 minutes.

Investment Timing: Early investors purchasing before RRR construction commencement (expected 2026-2027) stand to benefit from 30-50% appreciation as the project progresses.

Airport Express Metro

Metro Phase 2 includes an Airport Express corridor connecting Raidurg (HITEC City) to Shamshabad, with intermediate stations at Financial District and Nanakramguda. Once operational (projected 2027-2028), this will reduce commute times to under 40 minutes, making Shamshabad a feasible residential option for thousands of IT professionals.

Current Impact: Speculation around metro stations has already driven land prices 40-60% higher within 1-kilometer radius of proposed station sites.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Real Estate Price Dynamics: The Numbers Tell the Story

Four-Year Growth Trajectory (2021-2025)

- Land Appreciation: 118% increase—the highest among Hyderabad’s peripheral corridors. Plots that sold for ₹8,000-12,000 per sq yd in 2021 now command ₹20,000-28,000 per sq yd in prime Shamshabad locations.

- Apartment Prices: 74% surge, with 2BHK apartments rising from ₹35-40 lakh to ₹60-70 lakh for quality projects with modern amenities.

- Plot Values: 84% growth in plotted development schemes, driven by villa project demand from high-income professionals seeking independent living.

Current Market Pricing (2026)

| Property Type | Price Range | Target Buyer | Appreciation Forecast (5 Years) |

| Residential Plots | ₹18,000-30,000/sq yd | Villa buyers, custom home builders | 60-80% |

| 2BHK Apartments | ₹55-75 lakh | Young professionals, airport employees | 50-65% |

| 3BHK Apartments | ₹85 lakh-1.2 crore | Families, mid-senior professionals | 55-70% |

| 4BHK Villas | ₹1.5-2.5 crore | Senior executives, NRIs | 65-85% |

| Commercial Spaces | ₹8,000-12,000/sq ft | Businesses, investors | 70-90% |

Comparative Advantage

Shamshabad properties remain 40-50% cheaper than equivalent configurations in Gachibowli or Kondapur, while offering similar modern amenities and arguably superior future growth potential. A 3BHK apartment in Gachibowli costs ₹1.5-2 crore; the same configuration in Shamshabad is available for ₹90 lakh-1.2 crore.

Investment Strategy: Price arbitrage between Shamshabad and established western corridors presents value capture opportunity as industrial development narrows the gap over 5-7 years.

Employment Zones Creating Housing Demand

Logistics Hub Concentration

Shamshabad has emerged as South India’s premier logistics destination due to airport proximity and highway connectivity. Major players operating fulfillment centers and distribution hubs include Amazon (1.2 million sq ft facility), Blue Dart Aviation, DHL Express, and Gati-KWE.

Workforce Demographics:

- Entry-level logistics staff (₹3-5 lakh annual income): Demand for affordable 1-2BHK rentals

- Mid-level managers (₹6-10 lakh income): Seek 2-3BHK ownership or rentals

- Senior operations leadership (₹12-20 lakh income): Villa and premium apartment buyers

Housing Requirement: Estimated 40,000-50,000 logistics sector employees within 10-kilometer radius by 2027, translating to 15,000-20,000 residential units.

Pharmaceutical Corridor Development

While Pharma City is located approximately 60 kilometers from Shamshabad in Mucherla mandal, the pharmaceutical manufacturing ecosystem is expanding southward. API manufacturing units and contract research organizations are establishing operations closer to airport and ORR for export convenience.

Professional Profile: Pharma professionals typically earn ₹8-25 lakh annually and prefer gated communities with educational institutions for family-oriented living—exactly what Shamshabad township projects are targeting.

Future IT Parks and Office Complexes

Beyond WTC, multiple developers are planning IT parks and office campuses to capture overflow demand from saturated western Hyderabad. These projects leverage lower land costs (60% cheaper than Gachibowli) and airport connectivity to attract companies seeking cost optimization without sacrificing accessibility.

Projected Timeline: First IT parks expected operational by 2027-2028, creating immediate residential demand for 20,000-30,000 professionals.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Township and Project Types Emerging in Shamshabad

Integrated Residential Townships

Large-scale gated communities spanning 50-200+ acres combining apartments, villas, and plotted developments with comprehensive amenities including schools, hospitals, shopping complexes, and recreational facilities.

Examples:

- Luxury villa communities targeting NRIs and senior executives

- Mid-premium apartment complexes for IT and pharma professionals

- Mixed-configuration townships serving diverse income segments

Pricing: ₹5,000-8,000 per sq ft for quality integrated projects with IGBC certifications.

Affordable Housing Clusters

Government and private developers are creating affordable housing schemes for logistics, manufacturing, and support staff, priced ₹25-45 lakh for 2BHK configurations meeting PMAY (Pradhan Mantri Awas Yojana) eligibility.

Demand Drivers: 60% of industrial workforce falls in affordable housing income brackets, ensuring sustained demand and rental stability.

Premium Villa Projects

Independent villa communities targeting high-income professionals, NRIs, and individuals seeking spacious living near employment zones without city congestion.

Configuration: Typically 3-4BHK villas on 200-300 sq yd plots, priced ₹1.5-3 crore with modern amenities including clubhouses, security systems, and landscaped environments.

Commercial and Mixed-Use Developments

Office spaces, retail complexes, and mixed-use buildings combining commercial ground floors with residential upper levels, creating live-work-shop ecosystems similar to Gachibowli’s established model.

Investment Appeal: Commercial properties in Shamshabad offer 6-8% rental yields compared to 4-5% in saturated markets, attracting investor interest.

Investment Strategies for Shamshabad Real Estate

Long-Term Capital Appreciation Play

Profile: Investors with 7-10 year horizons seeking maximum appreciation.

Strategy:

- Purchase residential plots in approved layouts near proposed metro stations

- Target areas within 2-3 kilometers of Bharat Future City boundaries

- Focus on ORR-adjacent locations ensuring permanent connectivity advantage

- Hold through infrastructure development phases (RRR, metro completion)

Expected Returns: 80-120% appreciation over 7-10 years as industrial employment and infrastructure mature.

Rental Income Generation

Profile: Investors seeking steady cash flow from logistics and manufacturing workforce.

Strategy:

- 2BHK apartments in completed projects near logistics hubs

- Competitive pricing attracting corporate lease agreements

- Property management services handling tenant relations

- Rental yields: 4.5-5.5% annually

Tenant Profile: Logistics managers, manufacturing supervisors, airport employees seeking quality accommodation within budget constraints.

Villa Development for Premium Buyers

Profile: Individuals building custom homes or purchasing builder villas.

Strategy:

- Purchase plots in gated layout schemes with approved plans

- Locations balancing airport accessibility and peaceful environment

- Target growing demographic of NRIs and senior professionals prioritizing space and privacy

- Resale market developing as more families relocate to Shamshabad

Investment Horizon: 5-7 years for villa projects to achieve liquidity and resale potential.

Commercial Property Investment

Profile: Experienced real estate investors diversifying portfolios.

Strategy:

- Office spaces near WTC or proposed IT parks

- Ground-floor retail in high-footfall residential projects

- Warehouse and godown spaces for logistics companies

- Higher risk but superior yields (6-8%) compared to residential

Due Diligence Critical: Commercial success depends on employment zone development timelines—verify developer credentials and phasing plans thoroughly.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Challenges and Risk Mitigation

Infrastructure Delivery Timelines

- Challenge: Metro and RRR construction delays could slow appreciation and rental demand growth.

- Mitigation: Focus on locations already served by ORR ensuring baseline connectivity regardless of future project delays. Verify developer timelines against RERA-approved completion dates.

Water and Civic Amenities

- Challenge: Peripheral areas sometimes face water supply and sewage infrastructure gaps.

- Mitigation: Prioritize gated communities with borewells, water treatment plants, and sewage treatment facilities ensuring self-sufficiency. Verify Panchayat/Municipality infrastructure plans for area.

Distance from Established Social Infrastructure

- Challenge: Limited high-quality schools, hospitals, and shopping initially compared to western Hyderabad.

- Mitigation: Choose integrated townships developing internal social infrastructure. Short-term inconvenience (3-5 years) as commercial ecosystem catches up to residential growth. Budget for occasional travel to established areas during settling-in period.

Market Saturation Risk

- Challenge: Multiple developers launching projects simultaneously could create temporary oversupply.

- Mitigation: Research absorption rates and inventory levels. Diversify across property types (plots, apartments, villas) rather than concentrating in single category. Partner with developers having proven delivery records.

Developer Due Diligence for Shamshabad Projects

Critical Verification Steps

RERA Compliance:

- Confirm project registration on TS-RERA portal

- Review approved layout plans and sanction documents

- Verify possession timeline commitments and penalty clauses

- Check escrow account arrangements protecting 70% of buyer funds

Developer Track Record:

- Inspect 2-3 completed projects assessing construction quality

- Interview existing residents about post-sale support and amenity functionality

- Verify financial stability through bank partnerships and institutional funding

- Research online reviews and complaint resolution history

Legal Due Diligence:

- Encumbrance certificate confirming clear title

- Layout approval from DTCP (Directorate of Town and Country Planning)

- Environmental clearances for large projects

- Occupancy certificate for ready-to-move properties

Infrastructure Verification:

- Visit site during different times assessing road conditions and connectivity

- Verify electricity, water, and sewage arrangements

- Confirm proximity to proposed metro stations against official maps

- Assess neighborhood development status and future plans

Frequently Asked Questions:

Commute to IT hubs

Shamshabad is 35–45 mins from Gachibowli and the Financial District via Outer Ring Road Hyderabad. The proposed Airport Express Metro (2027–28) will make travel faster and predictable. Hybrid work makes the commute practical.

Why Shamshabad over Adibatla or Maheshwaram?

Shamshabad benefits from Rajiv Gandhi International Airport, diversified industries (aerospace, logistics, pharma, IT), and the upcoming Bharat Future City, creating a self-sustaining job–residential ecosystem.

Will prices match Gachibowli?

Not in absolute terms but percentage appreciation will be higher. Over 10–15 years, Shamshabad could grow 80–120%, similar to Gachibowli’s early-stage growth (2005–08).

Best property types now:

Plots near metro/industrial zones → max long-term upside (7–10 yrs)

2BHK apartments near logistics hubs → 4.5–5.5% rental yield

Villas for NRIs/premium buyers → lifestyle + appreciation

Commercial → higher risk, 6–8% yields

Is Bharat Future City execution reliable?

Yes, with caveats. Verify cabinet approvals, budget allocations, land acquisition, and infrastructure work. Timelines may shift, but execution risk is lower for strategic government projects.

Is Shamshabad family-friendly?

Increasingly yes. Townships now offer schools, healthcare, and amenities. Full ecosystem maturity expected 2028–30.

Water availability

Primarily borewell-based today. Quality projects have WTPs, multiple borewells, and backups. Mission Bhagiratha pipeline expansion expected by 2026–27.

Can NRIs invest?

Yes. FEMA-compliant purchase via NRE/NRO accounts, PAN, and PoA. Airport proximity, affordable pricing, and long-term growth make Shamshabad NRI-friendly.

Shamshabad 2035 Snapshot

- Jobs: 2–3 lakh across aerospace, logistics, pharma, IT

- Population: 5–7 lakh residents

- Infrastructure: Metro, RRR, upgraded highways

- Pricing: Premium 3BHKs at ₹2–2.5 cr (from ~₹1 cr today)

- Returns: Early investors (2026–27) could 2–3× portfolios

Bottom Line

Shamshabad’s growth is industrial-led, not speculative. With projects underway but buyer awareness still catching up, 2026–27 is the value window.

Best suited for:

- Long-term investors (plots, 7–10 yrs)

- Value-focused homebuyers (40–50% cheaper than West Hyderabad)

- NRIs seeking airport-led growth corridors

Build in Hyderabad’s Next Growth Engine

With decades of local expertise, Kura Homes identifies corridors before they peak—balancing build quality with long-term appreciation.

Explore Hyderabad’s future-ready locations. Connect with Kura Homes today.

Discover Strategic Locations →

Disclaimer: Projections are based on 2026 market analysis and may change due to government execution, economic conditions, or unforeseen factors. Investors should independently verify project status through official sources and seek professional advice. Past performance does not guarantee future returns.