Table of Contents

Key Takeaways: Millennial Homebuyers (Hyderabad, 2026)

- Millennials dominate demand: 43% of buyers are millennials; 71% aspire to own homes.

- Flexibility over ownership: Preference is shifting from “buy at any cost” to flexible, lifestyle-first housing.

- Co-living is cost-efficient: ₹10,500–17,300/month, offering 25–35% savings vs 1BHK rentals.

- Co-living market booming: Expected to reach ₹200 billion by 2030 (from ₹40 billion in 2025).

- Compact 2BHKs lead choices: Best balance of affordability, space, and resale value.

- Tech-enabled living matters: Demand for smart homes, co-working spaces, and wellness amenities.

- Higher rent tolerance: 51%+ millennials/Gen Z spend 25%+ of income for furnished, community-driven homes.

- Location is critical: Strong preference for IT hubs and metro connectivity (Gachibowli, HITEC City).

- Experience > size: Lifestyle, convenience, and community outweigh larger square footage.

Bottom line: Millennials are redefining Hyderabad housing, flexible, tech-enabled, well-located homes now matter more than traditional ownership or large layouts.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Understanding the Millennial Housing Revolution

Who Are Millennial Homebuyers?

Born between 1981-1996, millennials now aged 30-45 represent India’s largest workforce segment at 440 million (34% of population). In 2026, they’re entering peak earning and family-formation years, creating unprecedented housing demand with distinct preferences from previous generations.

Key Characteristics:

- Digital-native: Expect seamless technology integration in living spaces

- Experience-oriented: Prioritize lifestyle amenities over sheer size

- Value-conscious: Seek maximum utility per rupee spent

- Flexibility-seeking: Prefer adaptable spaces supporting evolving needs

- Community-driven: Value social connectivity and networking opportunities

The Millennial Homeownership Paradox

Despite high homeownership aspiration (71% by 2025), millennials face unique challenges: student debt, delayed family formation, career mobility requirements, and affordability constraints in premium locations. This creates three distinct housing cohorts:

Early Millennials (34-41 years): Established careers, family commitments, seeking permanent homes, 70% intend ownership within 2 years.

Late Millennials (26-33 years): Career growth phase, geographic flexibility needed, split between ownership aspiration and rental practicality.

Millennial-Gen Z Cusp (23-25 years): Just entering workforce, primarily renters, exploring co-living as transitional housing.

Housing Typology 1: Compact Apartments, Smart Design in Smaller Footprints

| Configuration | Typical Size | Price Range (Hyderabad) | Target Millennial | Key Features |

| 1BHK | 600-750 sq ft | ₹35-55 lakh | Singles, young couples | Convertible spaces, smart storage |

| 2BHK | 800-1,100 sq ft | ₹50-80 lakh | Small families, WFH professionals | Dedicated home office, balcony spaces |

| Compact 3BHK | 1,200-1,400 sq ft | ₹70 lakh-1 crore | Growing families | Efficient layouts, modular designs |

Why Compact Apartments Dominate Millennial Preferences

Affordability Without Compromise:

- Hyderabad’s 2BHK apartments (₹50-80 lakh) remain accessible to millennial dual-income households earning ₹15-25 lakh combined

- EMIs of ₹35,000-55,000 monthly constitute manageable 25-35% of income

- Smaller footprints reduce ongoing costs (maintenance ₹1,500-2,500 vs. ₹3,000-5,000 for 3-4BHK)

Location Optimization:

- Compact configurations enable proximity to employment hubs, ₹80 lakh buys 2BHK in Gachibowli versus ₹1.5 crore for 3BHK

- Millennials prioritize short commutes (15-30 minutes) over extra bedrooms rarely used

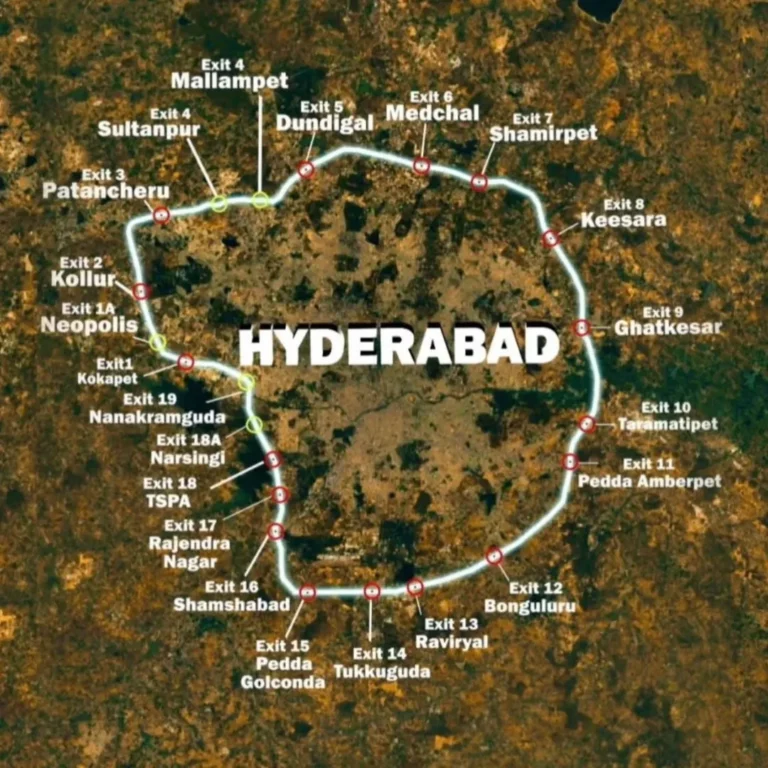

- Metro-connected locations (Miyapur, Uppal, LB Nagar) offer compact options with future appreciation

Design Intelligence:

- Modern compact apartments incorporate space-saving innovations: murphy beds, sliding partitions, vertical storage

- Convertible spaces transform (dining area ↔ home office, guest room ↔ study)

- Balconies and outdoor areas create psychological spaciousness despite smaller interiors

Top Locations for Millennial Compact Living

Bachupally

Why Millennials Choose It:

- Average 2BHK price: ₹55-65 lakh (₹6,694/sq ft)

- Metro proximity (Miyapur terminus 5 km) ensures connectivity

- IT hub access (Gachibowli 12 km via ORR) supports tech professionals

- Established social infrastructure (schools, hospitals, retail)

Millennial Profile: Young IT couples (28-35 years), first-time buyers, dual-income ₹18-28 lakh combined.

Miyapur

Why It’s Popular:

- Metro Red Line terminus, lock-and-leave convenience for frequent travelers

- 2BHK range: ₹45-65 lakh depending on project quality

- Diverse retail, entertainment, dining within walking distance

- Mix of older inventory (affordable) and new launches (smart amenities)

Millennial Profile: Singles and couples prioritizing urban convenience, metro-dependent commuters, lifestyle-focused renters transitioning to ownership.

Kompally

Why It Works:

- Tech park proximity (Infosys, Wipro campuses nearby)

- Affordable 2BHK: ₹48-62 lakh for quality projects

- Quieter, less congested than Gachibowli/HITEC City

- Growing social infrastructure with international schools

Millennial Profile: Families with young children (30-40 years), IT professionals seeking suburban tranquility, value-conscious homebuyers.

Manikonda

Why It Appeals:

- Financial District proximity (3-5 km), walk/bike to work feasible

- 2BHK pricing: ₹60-85 lakh for modern gated communities

- Premium schools (Delhi School of Excellence, Mount Litera Zee) nearby

- Road connectivity to Gachibowli, Jubilee Hills (upcoming flyovers)

Millennial Profile: Banking, finance, consulting professionals (28-38 years), families prioritizing education infrastructure, career-focused couples.

Housing Typology 2: Co-Living, Community-First, Flexible Living

The Co-Living Explosion in Hyderabad

India’s co-living market is projected to reach ₹200 billion by 2030 (from ₹40 billion in 2025), growing at 17% CAGR. Hyderabad specifically shows 25-35% rental savings versus traditional 1BHK apartments, driving rapid adoption.

Market Size Projections:

- Current penetration: 5% of rental demand

- 2030 penetration: 10%+ as organized sector scales

- Bed requirement growth: 6.6 million (2025) → 9.1 million (2030)

- Capital inflows since 2015: >$1 billion USD

Hyderabad Co-Living Economics

Rental Comparison (2026 Data):

| Housing Type | Monthly Cost | What’s Included | Target Demographic |

| Co-Living Single Occupancy | ₹10,500-17,300 | Utilities, Wi-Fi, housekeeping, amenities | Solo professionals, students |

| Co-Living Shared (2-person) | ₹7,000-11,000 per person | Full services, community events | Budget-conscious millennials |

| Traditional 1BHK | ₹14,000-26,500 | Bare apartment only | Couples, established professionals |

Savings Analysis:

- Co-living single occupancy saves ₹3,500-9,200 monthly (25-35%)

- Annual savings: ₹42,000-1,10,400

- Over 3 years: ₹1.26-3.31 lakh, enough for down payment on future home

Who Chooses Co-Living?

The Career-Mobile Professional (Age 23-30, Income ₹6-12 lakh):

- Characteristics: Recently relocated to Hyderabad for job, uncertain about long-term city commitment, values networking opportunities

- Priorities: Flexibility (6-12 month leases), zero hassle (furnished, managed), community (avoiding isolation in new city)

- Duration: Average stay 6-18 months before transitioning to traditional rental or purchase

The Digital Nomad/Hybrid Worker (Age 25-35, Variable Income):

- Characteristics: Works remotely, travels frequently, minimal possessions, prioritizes experiences over ownership

- Priorities: Month-to-month flexibility, co-working spaces, vibrant community, minimal commitment

- Duration: Highly variable (3-24 months), may cycle between cities

The Student/Young Professional (Age 21-27, Income ₹3-8 lakh):

- Characteristics: Early career, limited savings, seeking affordable quality housing

- Priorities: Price consciousness, social connectivity, proximity to workplace/campus

- Duration: 12-36 months until income stabilizes enabling traditional rental/purchase

The Entrepreneur/Startup Founder (Age 26-35, Variable Income):

- Characteristics: Building business, cash-flow conscious, values networking with like-minded individuals

- Priorities: Cost efficiency, business networking, flexibility during growth phase

- Duration: 6-24 months depending on business trajectory

Co-Living Amenities and Services

Included Baseline:

- Fully furnished rooms (bed, wardrobe, desk, chair)

- High-speed Wi-Fi (100+ Mbps dedicated lines)

- Utilities (electricity, water) up to caps

- Housekeeping (common areas daily, rooms weekly/biweekly)

- Shared kitchen with appliances

- Laundry facilities (washers, dryers)

Premium Add-Ons:

- Gym and fitness center

- Co-working lounge with meeting rooms

- Game zones (foosball, TT, PS5)

- Rooftop terraces and outdoor seating

- Community events (movie nights, workshops, networking mixers)

- Meal plans (breakfast/dinner options)

Top Co-Living Operators in Hyderabad

Zolostays:

- Properties: 50+ across Hyderabad (Gachibowli, Kondapur, Madhapur, Hitech City)

- Pricing: ₹8,000-18,000 monthly

- Specialization: Tech professional-focused, premium amenities

Stanza Living:

- Properties: 40+ facilities in IT corridors

- Pricing: ₹9,000-19,000 monthly

- Specialization: Student and young professional housing, strong community culture

CoHo:

- Properties: Boutique facilities in select locations

- Pricing: ₹10,000-20,000 monthly

- Specialization: Premium co-living with hotel-like services

OYO Life/Nestaway:

- Properties: Widespread inventory (100+ properties)

- Pricing: ₹7,500-16,000 monthly

- Specialization: Technology-enabled management, flexible terms

Co-Living vs. Traditional Rental: The Tradeoff Matrix

Co-Living Advantages:

- 25-35% cost savings

- Zero furniture/setup investment (₹1.5-3 lakh saved)

- Utility included (simplifies budgeting)

- Community and networking opportunities

- Flexible lease terms (monthly/quarterly options)

- Hassle-free maintenance

Co-Living Disadvantages:

- Limited privacy (shared common spaces)

- Less personalization (standardized rooms)

- Potential roommate friction in shared units

- Noise and activity levels (young demographic = livelier environment)

- Rules and restrictions (guest policies, quiet hours)

Decision Framework:

- Choose co-living if: Budget-conscious, prioritizing flexibility, new to city, valuing community, short-term stay (< 2 years)

- Choose traditional rental if: Established in city, prioritizing privacy, have partner/family, longer-term commitment (2+ years), possess furniture

Housing Typology 3: Smart Amenities, Technology-Enabled Living

What Millennials Expect in Smart Homes

Over 51% of millennials and Gen Z allocate 25%+ income for accommodations with modern amenities, not traditional luxuries but functional lifestyle enablers.

| Amenity Category | Must-Have Features | Millennial Value Proposition |

| Work-From-Home Infrastructure | Dedicated co-working lounge, high-speed Wi-Fi, soundproof pods | Eliminates external office rental (₹5,000-10,000 saved monthly) |

| Wellness Facilities | Modern gym (24/7), yoga studio, jogging track, outdoor sports | Replaces gym membership (₹2,000-5,000 monthly savings) |

| Smart Home Tech | App-based access control, home automation, energy monitoring | Convenience + security + efficiency |

| Community Spaces | Clubhouse, event halls, rooftop lounges, BBQ areas | Social connectivity, networking, entertainment |

| Sustainability Features | Solar panels, rainwater harvesting, waste management, EV charging | Reduced operational costs + environmental values |

| Convenience Services | Package lockers, concierge, maintenance app, car wash | Time-saving = lifestyle quality improvement |

The Work-From-Home Paradigm Shift

Post-pandemic, 40-60% of IT professionals work hybrid/fully remote. This permanently altered housing requirements:

Home Office Necessities:

- Dedicated workspace (not dining table), compact 2BHK with study/flex room

- High-speed internet (100+ Mbps), non-negotiable for video calls, cloud work

- Ergonomic setup space, desk area with proper lighting, seating

- Acoustic privacy, ability to take calls without disturbing household

Community Co-Working Advantage:

- Eliminates need for spare bedroom as office (saves ₹15-25 lakh in property cost)

- Professional environment when needed (important client calls, focused work)

- Networking with neighbors (potential collaborations, job referrals)

- Separation of work-home (psychological benefit maintaining boundaries)

Projects Offering This: Modern Hyderabad developments now include 1,500-3,000 sq ft co-working lounges with high-speed Wi-Fi, meeting pods, printing facilities, and pantry areas, essentially WeWork within gated community.

Wellness as Non-Negotiable Amenity

Millennials prioritize health and wellness more than previous generations, with fitness infrastructure becoming deciding factor in property selection.

Modern Wellness Facilities:

Comprehensive Gyms:

- 2,000-3,000 sq ft equipped with cardio machines, weights, functional training zones

- 24/7 access (not 6am-10pm restricted hours) enabling flexible workout schedules

- Professional trainers available (included or nominal fee)

- Separate male/female changing rooms with lockers, showers

Mind-Body Spaces:

- Dedicated yoga/meditation studios with natural light, minimalist design

- Outdoor areas for tai chi, breathing exercises, mindfulness practices

- Quiet zones for reading, reflection, mental decompression

Active Recreation:

- Badminton/tennis courts (floodlit for evening play)

- Swimming pools (lap pools for serious swimmers + leisure pools)

- Jogging/cycling tracks (500-1,000 meter circuits)

- Outdoor fitness equipment and calisthenics zones

Economic Justification: Premium gym memberships cost ₹3,000-8,000 monthly (₹36,000-96,000 annually). Over 10-year ownership, that’s ₹3.6-9.6 lakh. If on-site gym eliminates membership, the ₹5-8 lakh premium paid for amenity-rich project pays for itself.

Smart Home Technology Integration

Millennials expect technology integration as baseline, not luxury:

Building-Level Smart Systems:

- App-based entry (eliminate physical keys/cards)

- Visitor management (pre-approve guests, receive notifications)

- Amenity booking (reserve gym, clubhouse, sports facilities via app)

- Maintenance requests (log issues, track resolution digitally)

- Community updates (society circulars, event notifications)

Unit-Level Automation:

- Smart lighting (voice control, scheduling, dimming)

- Climate control (programmable AC, temperature optimization)

- Security (smart locks, video doorbells, motion sensors)

- Energy monitoring (track consumption, identify efficiency opportunities)

- Appliance integration (IoT-enabled refrigerators, washing machines)

Developer Response: Leading Hyderabad projects now pre-wire apartments for smart home integration, include basic automation systems, and offer upgrade packages for full home automation (₹1.5-3 lakh additional investment).

Sustainability Features That Matter

Environmentally conscious millennials increasingly demand green features:

Operational Cost Reducers:

- Solar panels (30-40% electricity generation, ₹1,500-2,500 monthly savings per apartment)

- Rainwater harvesting (25-30% municipal water reduction)

- Wastewater treatment and recycling (landscape irrigation)

- Energy-efficient systems (LED lighting, high-SEER AC units)

Environmental Values Alignment:

- IGBC/LEED certifications validating green claims

- Waste segregation and recycling infrastructure

- EV charging stations (future-proofing for electric vehicle adoption)

- Green spaces (30-40% landscaping promoting biodiversity)

Millennial Willingness to Pay: Studies show 60-65% of millennials pay 10-15% green premiums if demonstrable operational savings and environmental benefits delivered.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Financial Realities: Can Millennials Afford Hyderabad Housing?

Income Profiles and Affordability

Typical Millennial Income Brackets (Hyderabad):

Entry-Level IT Professional (1-3 years experience):

- Income: ₹6-10 lakh annually

- Affordable Housing: ₹35-50 lakh (₹25,000-35,000 EMI)

- Realistic Option: Co-living or 1BHK in peripheral areas (Bachupally, Uppal)

Mid-Level Professional (4-8 years experience):

- Income: ₹12-20 lakh annually

- Affordable Housing: ₹60-1 crore (₹40,000-70,000 EMI)

- Realistic Option: 2BHK in Miyapur, Kompally, Manikonda

Senior Professional/Dual-Income (8+ years, combined income):

- Income: ₹25-40 lakh annually (combined)

- Affordable Housing: ₹1.2-2 crore (₹80,000-1,40,000 EMI)

- Realistic Option: 3BHK in Gachibowli, Kondapur, or 2BHK in premium locations

EMI-to-Rent Decision Framework

The Millennial Calculation:

Scenario A: Rent in Prime Location

- Location: Gachibowli 2BHK

- Monthly Rent: ₹25,000

- Annual Cost: ₹3 lakh

- 5-Year Cost: ₹15 lakh (pure expense)

Scenario B: Buy in Emerging Location

- Location: Bachupally 2BHK

- Property Cost: ₹60 lakh

- Down Payment: ₹12 lakh

- Loan: ₹48 lakh @ 8.5% for 20 years

- EMI: ₹41,700

- 5-Year Payments: ₹25 lakh (₹10L principal + ₹15L interest)

- Property Value (5 years at 9% CAGR): ₹92 lakh

- Net Wealth Creation: ₹20 lakh (₹32L appreciation – ₹12L down payment)

Millennial Preference: 71% prefer EMI over rent in high-cost cities, viewing homeownership as forced savings + wealth creation versus pure expense.

Home Loan Accessibility for Millennials

Banking Sector Response:

- 80-90% LTV (Loan-to-Value) for millennials with stable employment

- 20-30 year tenures reducing EMI burden

- Digital application processes (approval in 48-72 hours)

- Pre-approved loan offers based on salary accounts

Tax Benefits Sweetening Deal:

- Section 24(b): ₹2 lakh interest deduction

- Section 80C: ₹1.5 lakh principal deduction

- Section 80EEA: Additional ₹1.5 lakh for first-time buyers

- Total Potential Savings: ₹1.55 lakh annually (30% tax bracket)

Millennial Preferences: What Matters Most

Location Factors (Ranked by Importance)

- Commute Time to Work (87% priority): Proximity to IT hubs, metro access, manageable traffic

- Metro/Public Transport (76% priority): Sustainability, cost-efficiency, avoiding traffic stress

- Social Infrastructure (71% priority): Schools, hospitals, retail, dining within 2-3 km

- Safety and Security (69% priority): Well-lit streets, police patrolling, gated communities

- Future Appreciation (64% priority): Infrastructure projects, employment hub expansion

- Community/Lifestyle (58% priority): Like-minded neighbors, events, social connectivity

Amenity Priorities (Millennial Survey Data)

Must-Have Amenities:

- High-speed internet (Wi-Fi infrastructure): 92%

- Gym/fitness center: 84%

- Power backup: 81%

- Covered parking: 78%

- 24/7 security: 76%

Nice-to-Have Amenities:

- Swimming pool: 68%

- Clubhouse/community center: 64%

- Co-working spaces: 61%

- Sports facilities (badminton/tennis): 57%

- EV charging stations: 52%

Low Priority (Despite Marketing):

- Golf simulator: 12%

- Bowling alley: 15%

- Movie theater: 23%

Insight: Millennials prioritize functional daily-use amenities over aspirational rarely-used facilities. Developers overinvesting in flashy amenities (golf simulators, bowling) versus essentials (reliable Wi-Fi, functional gyms) misread millennial priorities.

Looking for a Home That Reflects Your Lifestyle?

Discover thoughtfully designed homes by Kura Homes — where timeless architecture, modern comfort, and sustainable living come together.

Challenges Millennials Face in Hyderabad Housing

Down Payment Accumulation

The 20% Barrier:

- ₹60 lakh property requires ₹12 lakh down payment + ₹5 lakh registration/furnishing

- Total upfront: ₹17 lakh

- At ₹50,000 monthly savings rate: 34 months (nearly 3 years) to accumulate

Millennial Strategies:

- Delay purchase until 30-32 years (accumulate savings)

- Parental support (common in Indian context, 60% receive family assistance)

- Sell equity portfolios built during 20s

- Opt for smaller configurations (1BHK) initially, upgrade later

Geographic Flexibility vs. Ownership Commitment

The Millennial Dilemma:

- Career growth often requires geographic mobility (Hyderabad → Bangalore → Mumbai → International)

- Homeownership in one city creates anchoring effect, complicating relocations

- 42% of Indian millennials change cities every 6 months-2 years

Solutions:

- Rental-friendly cities like Hyderabad (strong rental markets ensure tenant availability if relocated)

- Purchase in Tier-2 cities offering better affordability, hold as investment while renting in Tier-1

- Co-living as transitional housing maintaining flexibility until location certainty

Lifestyle Inflation vs. Financial Discipline

The Experience Economy Trap:

- Millennials prioritize travel, dining, entertainment, reducing savings rate

- FOMO (Fear of Missing Out) on experiences delays down payment accumulation

- Average millennial savings rate: 15-20% versus 30-35% for Gen X at same age

Balancing Act:

- Automate savings (SIPs, recurring deposits) before discretionary spending

- Target 25% savings rate for aggressive home purchase timelines

- Recognize homeownership as foundation enabling future experiences (equity unlocking wealth)

Developer Response: How Hyderabad Builders Are Adapting

Compact-Luxury Positioning

Developers recognizing millennials won’t sacrifice amenities for size are creating “compact luxury”, smaller footprints with premium features:

Example Configuration:

- 2BHK: 950 sq ft (versus traditional 1,100 sq ft)

- Saved Area: 150 sq ft

- Cost Reduction: ₹1.2 lakh (₹8,000/sq ft)

- Amenity Reinvestment: Premium gym, co-working lounge, smart home pre-wiring

Result: Same price point, smaller apartment, superior amenities, better value proposition for millennials prioritizing lifestyle over space.

Flexible Payment Plans

Construction-Linked Plans:

- 10% booking, 10% on construction milestones, balance on possession

- Spreads outflow over 2-3 years easing immediate burden

Subvention Schemes:

- Developer pays interest until possession (buyer pays only principal)

- Converts to regular home loan post-handover

- Enables earlier entry despite limited savings

Possession-Linked Plans:

- Nothing until keys handed over

- 100% payment on possession

- Ideal for risk-averse millennials fearing construction delays

Technology-Forward Marketing

Digital-First Engagement:

- Virtual site visits (360° tours, VR walkthroughs)

- Online booking with minimal documentation

- Chatbot assistance and instant query resolution

- Social media engagement (Instagram, YouTube property tours)

Millennial-Friendly Processes:

- End-to-end digital documentation

- E-sign agreements

- Online EMI calculators and financial planning tools

- Mobile apps tracking construction progress

Frequently Asked Questions (FAQs)

1. Is buying better than renting?

Buy if you’ll stay 5+ years, have stable income, and 20% down payment. Rent if you value flexibility and liquidity.

2. Minimum income for a 2BHK in Hyderabad?

For a ₹60L 2BHK, target ₹17–20L annual income to keep EMI ~30% of pay and stay stress-free.

3. Co-living vs buying, what’s better?

Co-living saves money short term and helps build a down payment. Best as a 1–3 year stepping stone, not permanent living.

4. Are smart amenities worth the extra cost?

Only if you’ll use them (gym, co-working, smart energy). Otherwise, skip and save ₹5–8L.

5. Best locations for millennials?

Bachupally: Best overall value

Miyapur: Metro + lifestyle

Kompally: Higher long-term growth

Manikonda: Premium + proximity to Financial District

6. Location or amenities, what matters more?

Location wins 80% of the time. Commute time, resale, and appreciation matter more than fancy amenities.

7. How can millennials buy faster?

Save 30% income, invest bonuses, take side gigs, cut lifestyle waste, and accept family help if available.

8. Common mistakes to avoid?

Overstretching budget, EMIs >40%, draining emergency fund, buying unused space, ignoring location, trusting unknown builders, and rushing due to FOMO.

Future of Millennial Housing in Hyderabad (2026-2030)

Market Evolution Predictions

Co-Living Mainstreaming:

- Organized co-living will capture 15-20% of millennial rental market by 2030 (from 5% in 2026)

- Institutional capital inflows creating professionally managed, hotel-quality co-living

- Hybrid models emerging: co-living + co-working + co-retail in integrated campuses

Compact Apartment Dominance:

- 2BHK will constitute 55-60% of new launches in millennial-focused projects (from 45% currently)

- Developers optimizing layouts: reducing circulation space, maximizing usable area

- Convertible spaces becoming standard (murphy beds, sliding partitions, modular furniture)

Technology Integration:

- Smart home systems will be baseline expectation, not premium feature by 2028

- AI-driven building management (predictive maintenance, energy optimization)

- Blockchain-based society management (transparent accounting, digital voting)

Sustainability Mandates:

- IGBC/LEED certifications becoming mandatory for projects >50 units

- Net-zero energy communities (100% renewable power) emerging in premium segment

- Water-neutral developments (rainwater harvesting + treatment = zero external dependence)

Affordability Outlook

Positive Factors:

- IT salary growth (10-15% annually) outpacing property appreciation (8-12%)

- Dual-income normalization increasing household purchasing power

- Government schemes (PMAY extensions, tax benefits) supporting first-time buyers

- Developer competition maintaining affordability in millennial-focused segments

Challenging Factors:

- Land costs in prime corridors rising 15-20% annually

- Construction material inflation (8-10% yearly) pushing prices higher

- Metro-connected locations commanding 20-30% premiums as connectivity becomes non-negotiable

Net Projection: Affordability will remain challenging but manageable for dual-income millennial households earning ₹15+ lakh combined. Entry-level singles (₹6-10 lakh income) will increasingly rely on co-living, family support, or peripheral locations.

Emerging Millennial Hubs

Next-Generation Millennial Corridors (2027-2030):

Tellapur:

- Metro extension making it accessible

- Affordable 2BHK: ₹55-75 lakh (20-25% below Gachibowli)

- Tech campuses expanding westward creating local employment

- Peaceful, greenfield development attracting lifestyle-focused millennials

Kollur:

- Already emerging but will solidify as millennial hub

- Premium schools creating family-oriented community

- Gachibowli proximity without congestion/pricing

- 2BHK sweet spot: ₹60-85 lakh with quality amenities

Narsingi:

- Financial District proximity appealing to banking millennials

- Scenic surroundings (lesser density, more greenery)

- 2BHK range: ₹65-95 lakh depending on project

- Balanced suburban-urban character

Making the Millennial Housing Choice: Decision Framework

Step 1: Clarify Your Life Stage and Goals

Questions to Answer:

- How certain am I about staying in Hyderabad for 5+ years?

- Do I have stable income (salaried) or variable (entrepreneurial)?

- Am I planning family/children within 3 years (space requirements increase)?

- Do I value flexibility (career mobility) or stability (putting down roots)?

Decision Impact:

- High uncertainty → Co-living or rental

- Moderate certainty (3-5 years) → Compact ownership (1-2BHK)

- High certainty (7+ years) → Strategic purchase (2-3BHK quality location)

Step 2: Calculate True Affordability

Financial Reality Check:

- Monthly Income (post-tax): ₹________

- Essential Expenses (food, utilities, transport): ₹________

- Lifestyle Expenses (dining, entertainment, shopping): ₹________

- Savings/Investments (SIP, insurance): ₹________

- Available for EMI: ₹________ (should be <35% of income)

Down Payment Assessment:

- Current Savings: ₹________

- Expected Family Contribution: ₹________

- Months to Target Down Payment: ________ (minimum ₹10-12L for ₹50-60L property)

- Emergency Fund Status: ________ (must maintain 12 months expenses post-purchase)

Step 3: Prioritize Location vs. Amenities

Location Factors (Rank 1-5):

- Commute time to work: ____

- Metro/public transport access: ____

- Social infrastructure nearby: ____

- Future appreciation potential: ____

- Neighborhood vibe/community: ____

Amenity Factors (Rank 1-5):

- Gym/fitness facilities: ____

- Co-working spaces: ____

- Smart home technology: ____

- Swimming pool: ____

- Community events/clubhouse: ____

Decision Rule:

- If location factors score 20+/25 and amenity factors <15/25 → Prioritize prime location over amenities

- If amenity factors score 18+/25 → Amenity-rich project justified even in secondary location

- If both score high → Premium budget required; consider delayed purchase while accumulating savings

Step 4: Evaluate Co-Living as Transitional Strategy

Co-Living Makes Sense If:

- Age 22-28 in early career phase

- Uncertain about long-term Hyderabad commitment

- Savings <₹5 lakh (insufficient down payment)

- Value community and networking opportunities

- Want to “test” neighborhoods before permanent commitment

Timeline: Use co-living 12-24 months while aggressively saving, researching locations, and building credit history. Then transition to purchase when down payment accumulated and location preferences clarified.

Step 5: Execute with Due Diligence

Pre-Purchase Checklist:

- RERA registration verified on TS-RERA portal

- Developer track record researched (visited 2-3 completed projects)

- Legal due diligence conducted (title verification, encumbrance certificate)

- Loan pre-approval obtained (know exact EMI, affordability)

- Amenities inspected in functioning projects (not just brochures)

- Neighborhood visited 3+ times (different days/times assessing vibe)

- Commute tested during peak hours (not Google Maps estimates)

- Society maintenance costs confirmed (interview existing residents)

- Exit strategy considered (resale potential if relocation needed)

- Financial buffer maintained (12-month emergency fund post-purchase)

Conclusion: The Millennial Housing Revolution

Millennials are fundamentally reshaping Hyderabad’s housing landscape, not through rebellion but through evolved priorities reflecting contemporary realities. They’re choosing compact efficiency over sprawling excess, community connectivity over isolated grandeur, and smart functionality over status-driven luxury.

The 71% homeownership aspiration isn’t naive optimism, it’s pragmatic recognition that in India’s context, real estate remains the most accessible wealth-building tool for middle-class millennials. Unlike previous generations who bought homes purely for shelter, millennials view housing as integrated lifestyle ecosystem combining workspace, wellness infrastructure, social connectivity, and long-term investment.

Developers responding to these preferences, creating compact apartments with premium amenities, co-living spaces balancing affordability and community, and technology-enabled buildings matching digital-native expectations, will capture this massive demographic wave. Those clinging to outdated models (sprawling 3-4BHK as entry configurations, isolated buildings without community features, technology-resistant construction) will struggle.

For millennial homebuyers, success lies in honest self-assessment: understanding your true priorities (location vs. amenities, flexibility vs. ownership, experiences vs. savings), calculating realistic affordability (not stretching to maximum loan amount), and timing strategically (neither rushing due to FOMO nor indefinitely delaying).

The millennial housing journey typically follows this arc:

Ages 23-26: Co-living while accumulating savings, exploring neighborhoods, establishing career Ages 27-30: Strategic rental in desired location, aggressive down payment savings, market research Ages 31-35: First home purchase (compact 2BHK in quality location with growth potential) Ages 36-42: Upgrade to larger configuration or premium location as family/income expands

This patient, phased approach balances immediate lifestyle needs with long-term wealth creation, exactly the thoughtful strategy millennials bring to every financial decision.

Build Your Future with Homes That Understand Modern Living

For nearly five decades, Kura Homes has witnessed Hyderabad’s evolution through multiple generations of homebuyers. Today’s millennials aren’t simply “younger buyers”, they represent fundamentally different housing philosophies prioritizing smart design over sheer size, community over isolation, and flexibility over rigidity.

Legacy-driven development means creating homes that adapt to how people actually live today while maintaining timeless quality standards ensuring value for decades ahead. It’s understanding that millennials don’t need 3,000 square feet, they need 1,000 thoughtfully designed square feet with high-speed internet, flexible workspaces, and vibrant communities.

Whether you’re exploring compact apartments that maximize every square foot, seeking locations balancing affordability with connectivity, or prioritizing smart amenities that enhance daily life, the foundation remains constant: homes built by those who understand generational shifts without abandoning generational wisdom.

Discover homes designed for how millennials actually live, not how developers think they should. Connect with Kura Homes today.

Explore Modern Living Solutions →

Disclaimer: Market statistics, pricing data, co-living costs, and millennial demographic information reflect January 2026 conditions based on industry reports, publicly available data, and market analysis. Individual property values, rental rates, and co-living pricing vary significantly by specific location, project quality, and market dynamics. Millennial housing preferences and affordability thresholds represent statistical trends and should not be interpreted as universal patterns applicable to every individual. Co-living market projections (₹200 billion by 2030) reflect industry forecasts subject to economic conditions, regulatory changes, and evolving consumer preferences. Prospective buyers should conduct independent financial planning with certified advisors, verify all developer claims through RERA portals and site visits, assess personal affordability conservatively, and prioritize financial security before property commitments. This article provides educational framework for millennial housing decisions, not personalized real estate or financial advice.